Outrageous Predictions

Executive Summary: Outrageous Predictions 2026

Saxo Group

Head of Commodity Strategy

The waiting/guessing game is almost over after President Trump yesterday tweeted that a decision on the Iran nuclear deal will be made today from the White House at 18:00 GMT. Since the president back in January said he was putting the “worst deal ever” on notice, a geopolitical/non-fundamental risk premium has been built into the price of oil.

Crude oil has rallied by 20% from the February low on a combination of geopolitical focus, strong global demand, an ongoing collapse in Venezuelan production together with strong production cut discipline led by Russia and Saudi Arabia. Over the coming days, however, the outcome of Trump's decision will provide us with an idea about whether the built up risk premium has been justified. On that basis tonight’s announcement could potentially be the biggest event since the December 2016 Opec/Russia agreement to curb oil production in order to support the price.

A potential binary market reaction awaits the market today as the outcome of Trump’s decision on Iran risks sending the market even higher or triggering a correction, initially to $71/b on Brent crude oil:

Source: Saxo Bank

Source: Saxo Bank

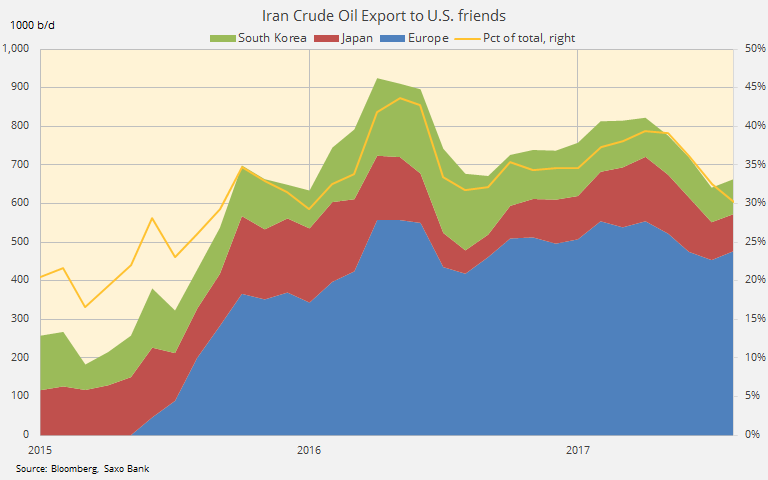

At stake is the June 14, 2015 deal between Tehran and six world powers that lifted sanctions against the Islamic Republic in exchange for limits on the Iranian nuclear programme. If Trump abandons the deal, he risks a spike in global oil prices that could end up being counterproductive given the impact on global growth and inflation. While the other members of the deal remain in favour of its continuation, the reintroduction of US sanctions would hurt Iran's ability to transact in dollars. Even though Iran does not export any oil to the US, it could on that basis reduce, or potentially completely remove, or at best reduce demand from US allies in Europe, Japan and South Korea – just like we saw between 2012 and 2015, when Iran was sanctioned.

The US, Israel and Saudi Arabia view the deal as flawed as it allows Iran to build nuclear weapons following a 10-year moratorium while at the same time giving Tehran the economic power to fund terrorist organisations in Syria, Lebanon and Yemen. The lifting of sanctions at the beginning of 2016 helped trigger a one million barrels/day increase in Iranian oil production to 3.8 million b/d. A reintroduction of sanctions without seeing other Opec members increase production could remove an estimated 300-500,000 barrels/day of Iranian barrels.

There are multiple options available to President Trump which makes this such a binary event where the price could move sharply in either direction. The three most likely options currently being mentioned are:

1) Waiver the sanctions again while allowing time to renegotiate the deal

2) A soft exit being the refusal to waive sanctions on Iran’s oil export. It would give companies 180 days to wind down their deals before sanctions are implemented. Furthermore it would provide the US and Europe more time to find a common ground.

3) A hard exit which could see Trump remove the waiver with immediate effect

Adding domestic US politics to the equation, option 2 could potentially be the best choice for a president who needs to deliver a tough response but at the same time also has a fight for survival on his hands later this year. The next midterm election is due on November 6 and it includes all 435 seats in the House of Representatives, and the full terms for one-third of the 100 seats in the Senate. The election has increasingly become a battle for his survival given the risk of a democratic-led majority opting to start impeachment procedure.

On that basis a continued sharp rise in crude oil prices due to Iranian supply disruption carries the risk of further raising the cost of gasoline at the pumps. The national average US gasoline price, currently at $2.81 has risen by 20% during the past year and already trades at the highest for this time of year since 2014. Seasonal higher prices are expected during the coming months when the annual summer driving season boosts demand. A sanctions-related spike in oil prices could therefore add further pressure on US motorists. A move above $3 will attract some unwelcome attention at a time where middle-class voters as a whole are already feeling the impact of higher Medicare bills and rising mortgage rates, a development that would undercut Trump’s populist appeal.

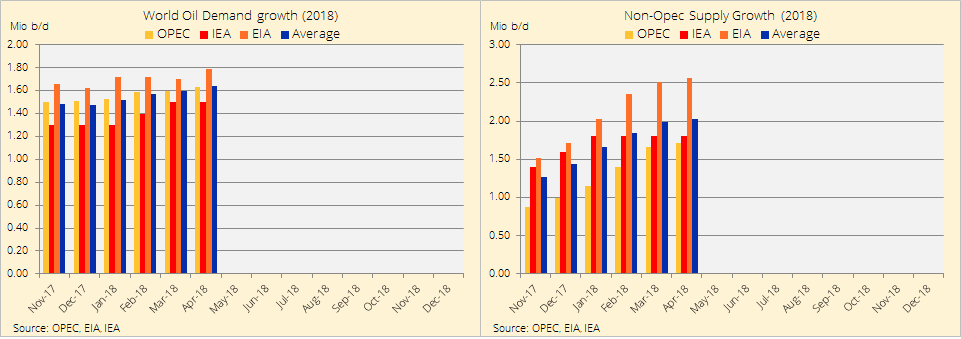

Ahead of today’s announcement around 16:00 GMT the US Energy Information Administration will release its monthly “Short Term Energy Outlook”. While unlikely to receive much attention, the market will nevertheless look out for any major changes in its outlook for non-Opec supply, especially from US producers and global demand.