Outrageous Predictions

Executive Summary: Outrageous Predictions 2026

Saxo Group

Head of Commodity Strategy

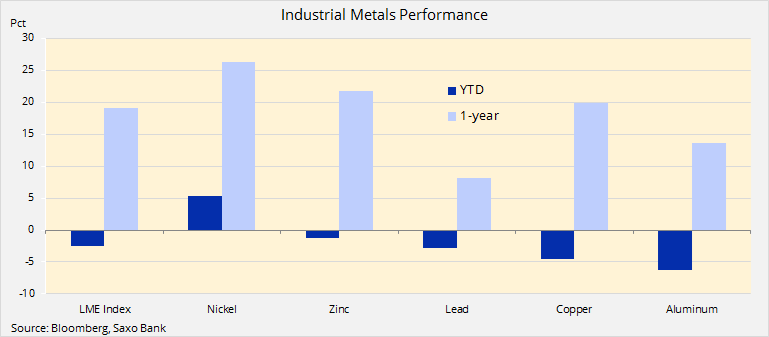

Industrial metals with the exception of nickel are all trading down on the year with the risk of trade wars now adding to the existing nervousness about the short- to medium-term outlook for growth and demand in China. This as China's transition from old to a new and less commodity-intensive economy could take its toll on demand.

The announcement by President Trump last week that he plans to slap tariffs on the import of aluminium and steel have raised the risk of a tit-for-tat trade war. Global growth is likely to be negatively impacted in such a scenario and of all the different commodity sectors, industrial metals risk being the most impacted.

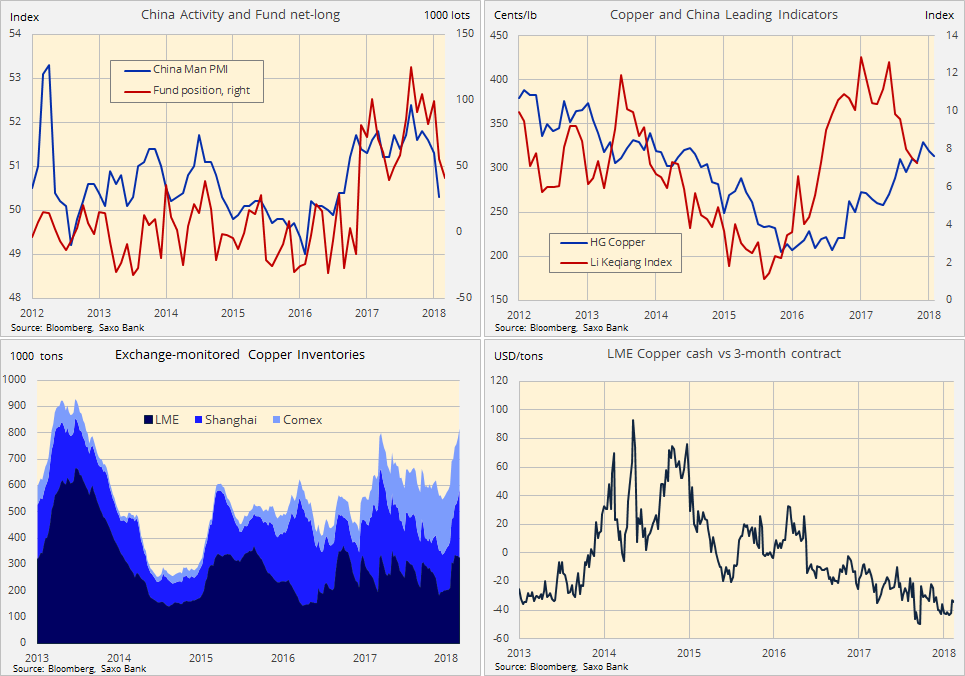

The China Manufacturing PMI began its current slowdown during Q3'17 and in response to this we have seen money managers cut bullish bets on HG copper by two-thirds from the record high last September.

Inventories of copper held at exchange-monitored warehouses have risen to the highest since 2013 with a post-Lunar holiday pickup in demand so far failing to emerge. Ample supplies of copper have resulted in LME Copper cash trading at an elevated discount (contango) to the three-month contract.

HG Copper's strong surge from the 2016 low has been running out of steam during the past few months with the price struggling to break above resistance at $3.30/lb, the 50% retracement of the 2011 to 2016 selloff. For now the price remains stuck in a range with support just below $3/lb.

The market is very likely to continue to adopt a wait-and-see approach while we await the response from countries negatively impacted by Trump's tariffs on aluminium and steel imports.

The supply side may still provide some support should key wage negotiations in Peru and Chile over the coming months fail to deliver results.

Overshooting fundamentals and a potential trade war have left the short-term risk skewed to the downside with key support found just below $3/lb.

I will finish on a more positive note by quoting Glencore who in their longer-term outlook say: "a structural deficit is expected to open in the early 2020s, at which point we see some sustained upside for prices.”