Outrageous Predictions

Obesity drugs for everyone – even for pets

Jacob Falkencrone

Global Head of Investment Strategy

Head of Commodity Strategy

Click here to download Saxo Bank's Commitment of Traders (Commodities) update for the week ending April 24.

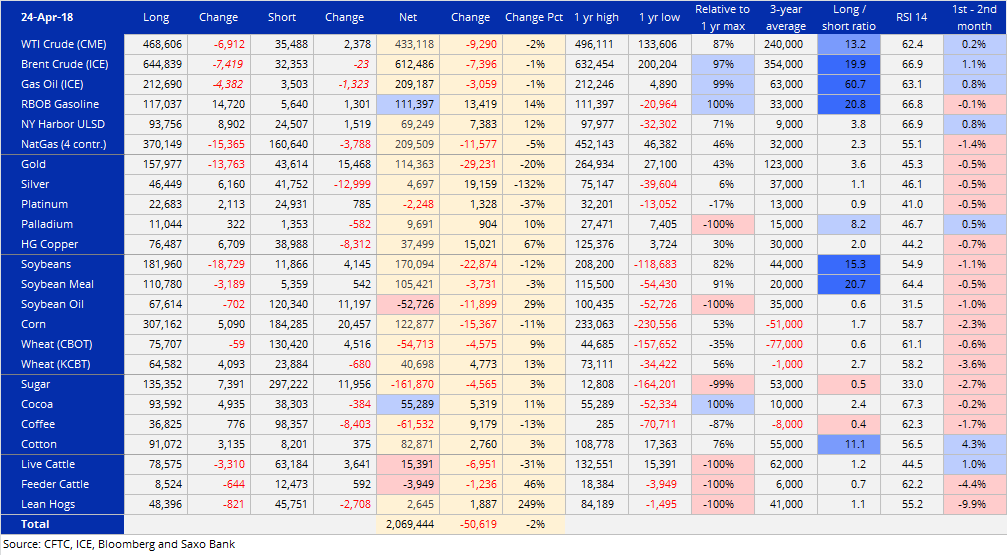

Leveraged funds reduced bullish commodity bets by 2% to 2.1 million lots in the week to April 24. Buying of metals and softs struggled to offset selling in energy, livestock, and not least grains.

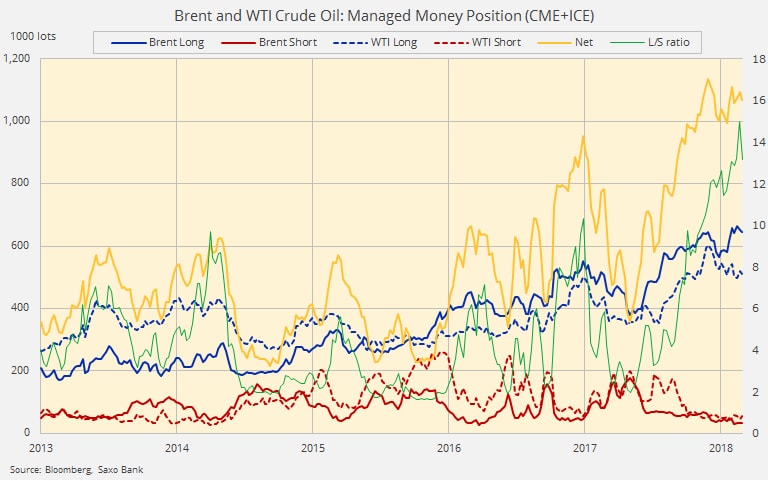

Both WTI and Brent crude saw profit-taking with a few traders taking the opportunity to book some profit after French president Emmanuel Macron's visit to Washington temporarily raised hopes of a deal on Iran and after Brent and WTI reached $75 and (almost) $70/barrel respectively. Funds overall maintain a very bullish short-term outlook with the combined long anchored above one million lots.

Geopolitical risks related to Iran sanctions, Venezuelan production trouble and robust global demand has helped support a rising backwardation and with that, rising demand from speculative accounts.

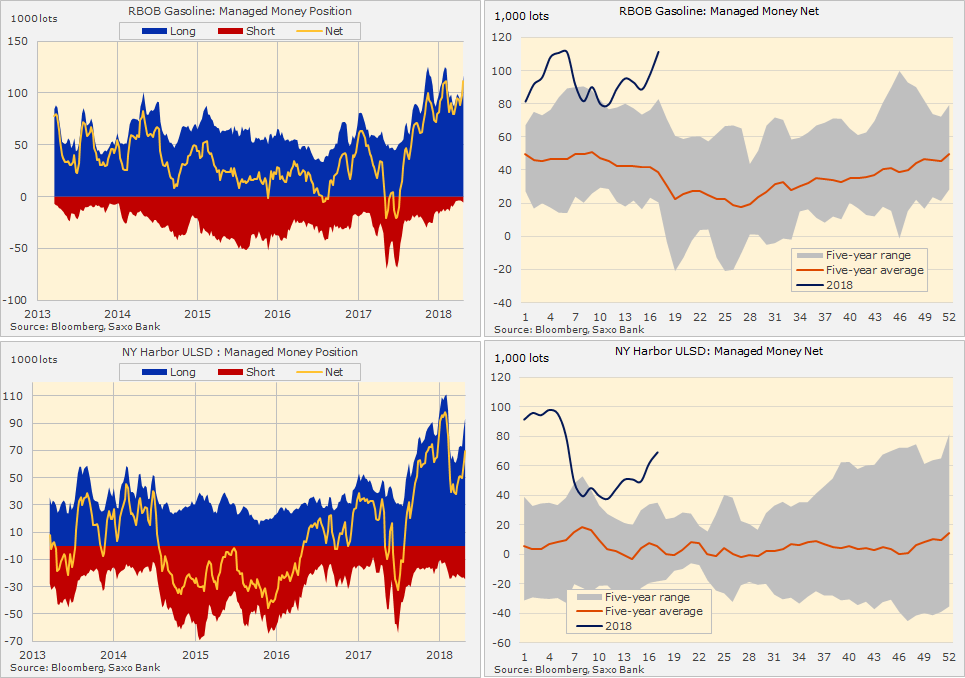

Gasoline saw its net-long hit a fresh record of 111,000 lots with demand and the price expected to remain supported ahead of and during the annual US driving season.

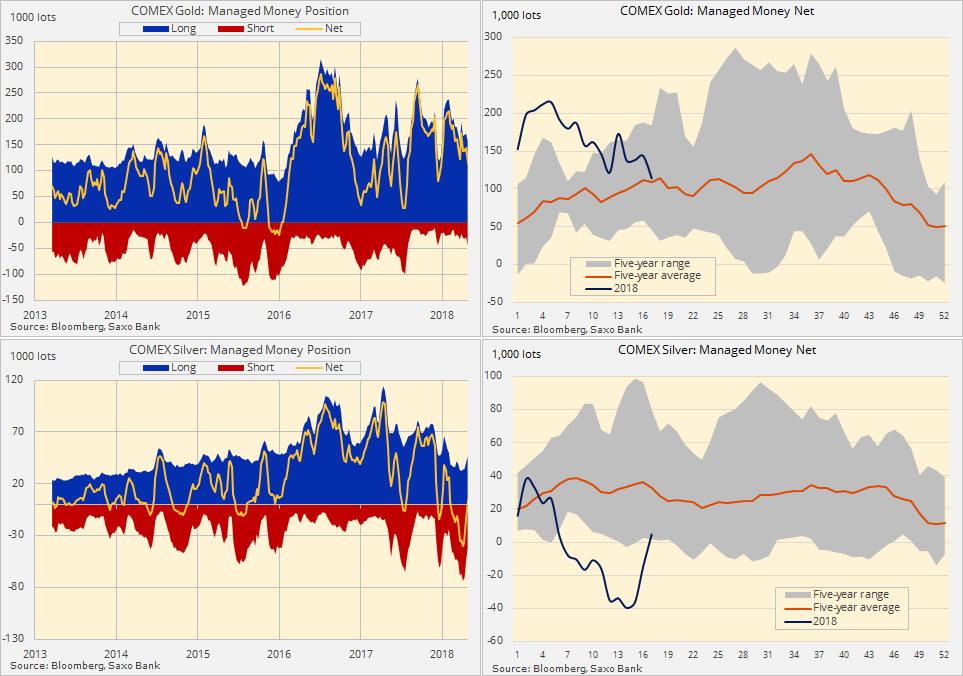

Gold was sold while funds flipped their silver position back to long for the first time in 11 weeks. The temporary surge in aluminium saw silver briefly break above its 200-day moving average while strengthening against gold. The rally at the beginning of the reporting week squeezed out the remaining short and by the time it tumbled again on April 23, the selling appetite had failed to recover.

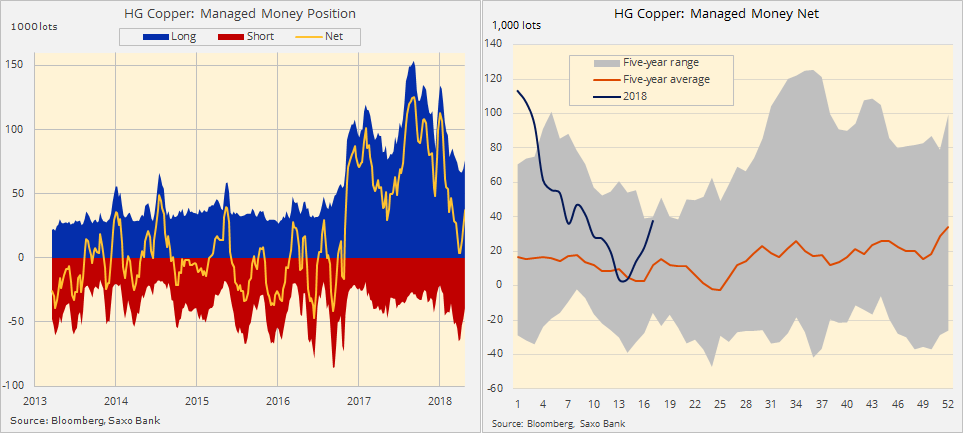

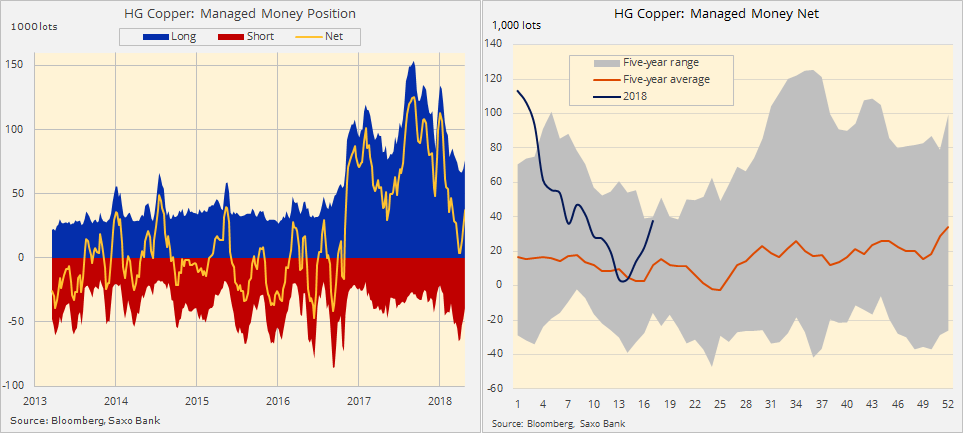

Funds added 67% to the net-long in copper as a continued reaction to the increased volatility in aluminium and nickel. Easing trade tensions between China and the US also supported sentiment before the stronger dollar post April 24 began challenging recently established longs.

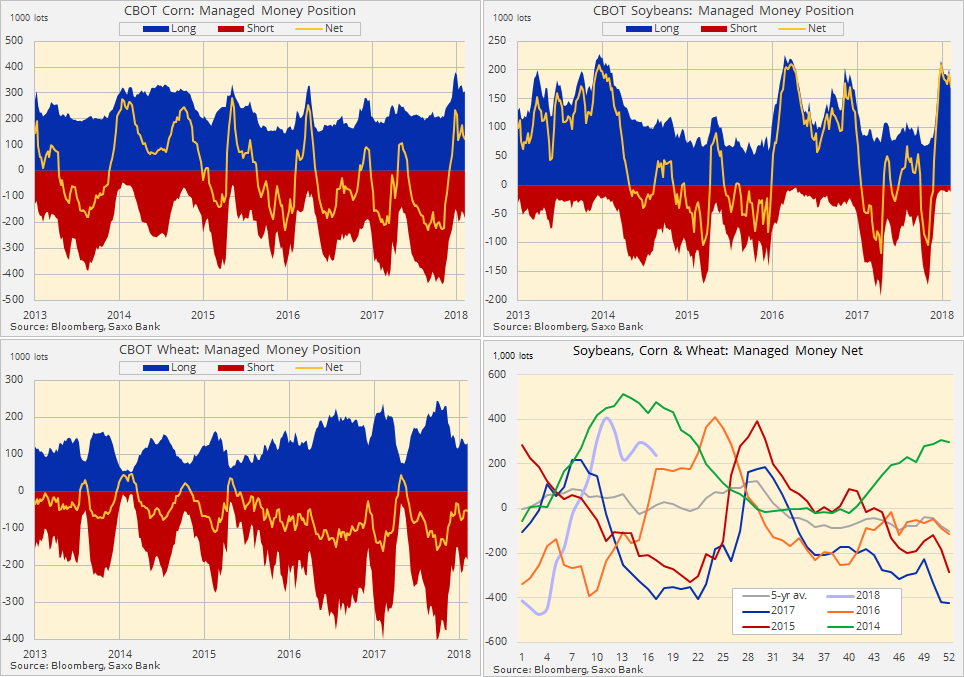

The grain and soy sector saw renewed selling attacks despite a very slow beginning to the US planting season. All contracts apart from the weather troubled Kansas (hard red winter) wheat crop contract were sold. However, the combined net-long in soybeans, corn and wheat remains at the highest for this time of year since 2014, so we're not seeing any convincing downturn in price optimism yet.

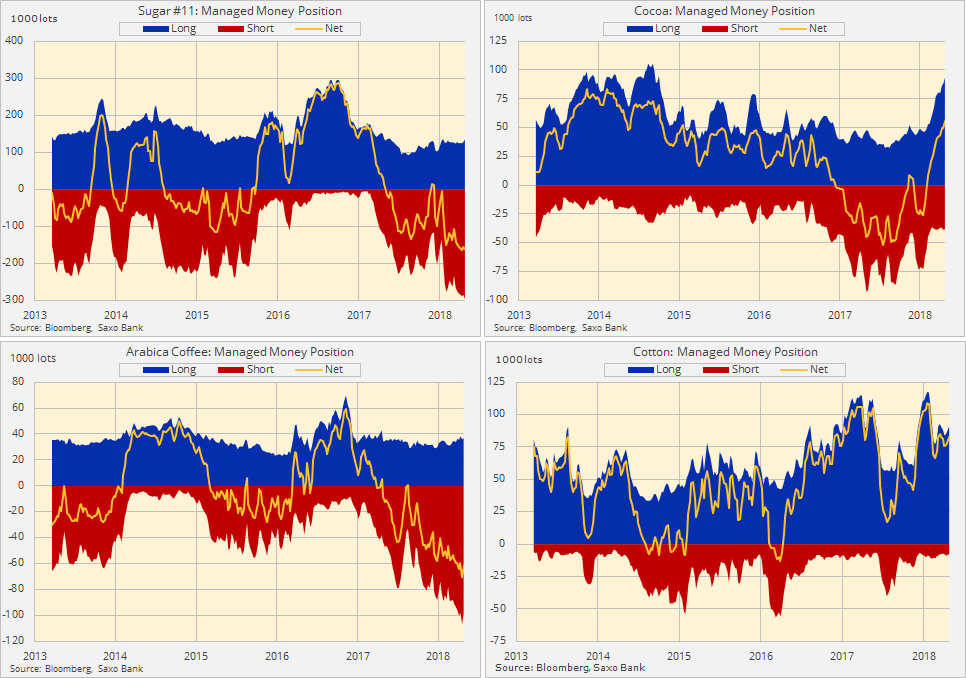

Cocoa buyers extended the net-long to a fresh four-year high following 14 weeks of non-stop accumulation. The sugar short remained close to a record as the sweetener continued its tumble. Coffee buyers returned as the downtrend from 2016 was challenged before eventually being broken on Friday.