Outrageous Predictions

Executive Summary: Outrageous Predictions 2026

Saxo Group

Head of Commodity Strategy

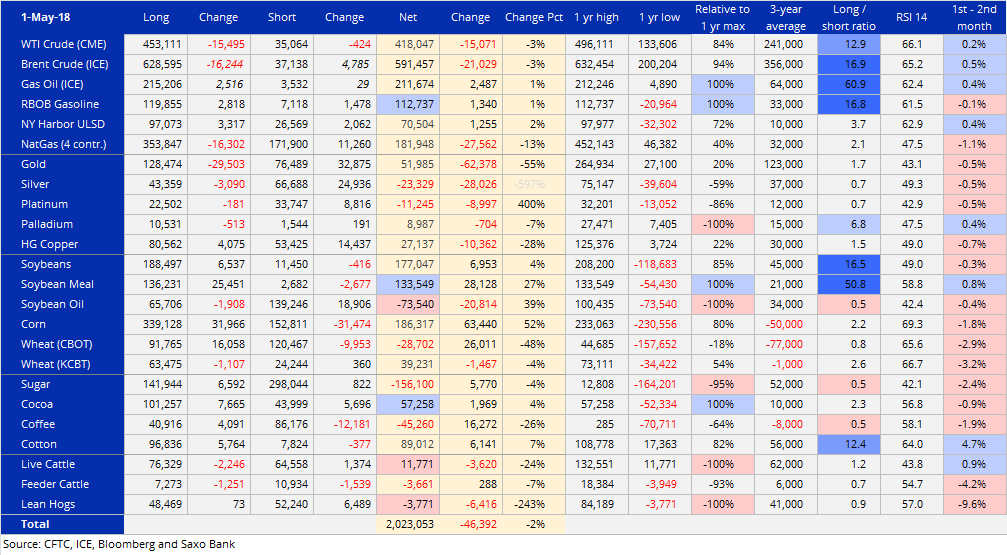

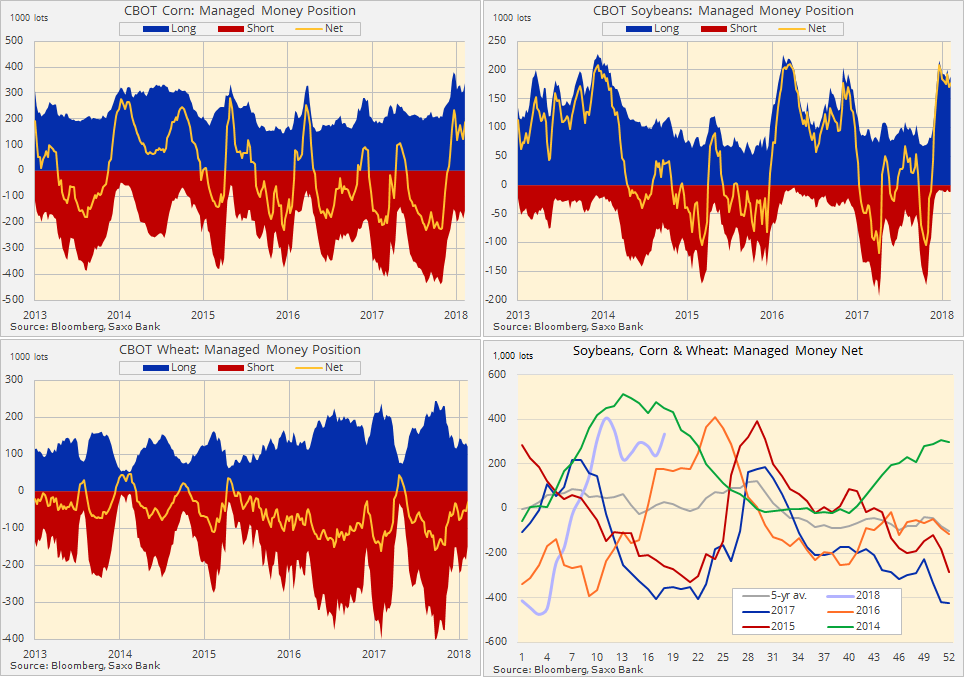

Hedge funds reduced bullish commodities bets for a second week. The modest 2% or 46k lots reduction disguised a rotation out of energy (crude oil) and metals (all) and into agriculture, not least the three major crops of soy, corn and wheat.

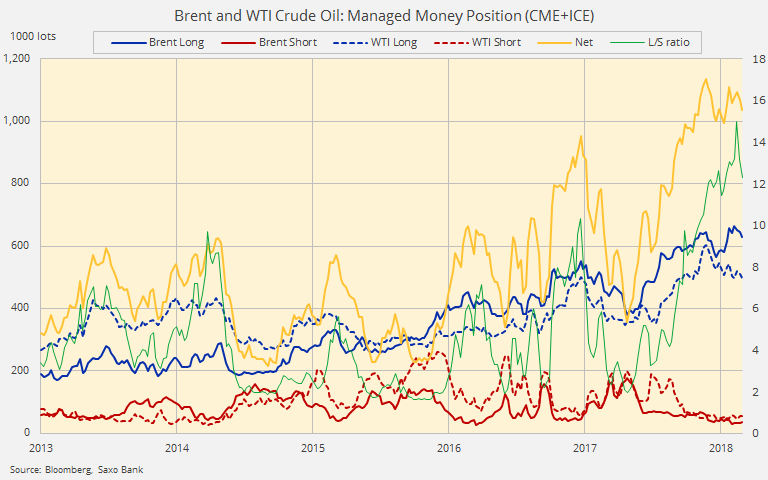

Both WTI and Brent saw long liquidation despite the ongoing support from geopolitical worries related to Trump’s May 12 decision on Iran. Some traders opted to cut longs given the potential binary outcome and the risk premium already built into the current price.

Focus this week: Crude oil’s geopolitical risk premium continues to build with traders gearing up for a worst-case scenario ahead of Trump’s Iran move. Stepping away from the 2015 nuclear deal risks raising Middle East tensions while curbing production from Opec’s third biggest producer.

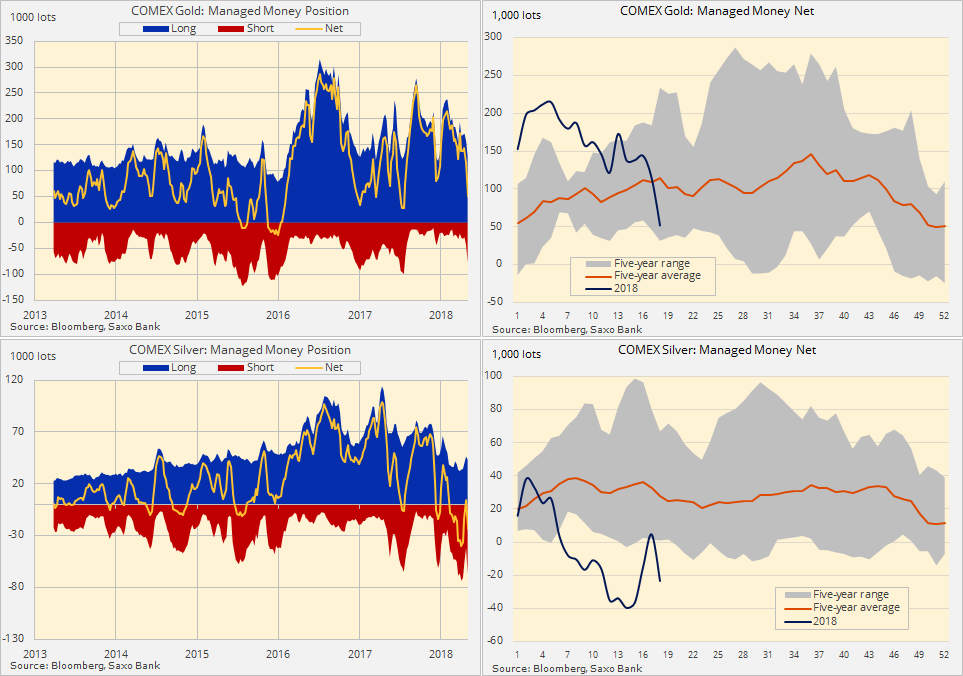

The stronger dollar and pre-FOMC jitters took its toll on metals, both precious and industrials. Gold’s net-long was cut by 55% to just 52k lots, the lowest since last July, while silver traders flipped their silver long straight back to a net-short. Aggressive selling was also seen in platinum while three weeks of copper buying came to halt.

Focus this week: Geopolitics with Iran sanctions and troubled Chinese trade talk providing some underlying support against the stronger dollar. Gold has been putting up a fight against the stronger dollar with XAUEUR trading at a four-month high. Also worth some attention is the potential impact on US bond yields during and following a bumper $73 billion auction of 3-, 10- and 30-year bonds.

Adverse weather conditions from South and North America to Europe continue to raise the risk of a potential troubled growing season. With this mind, funds have returned to grains and the soybeans complex and are currently holding a combined net-long in the three major crops of 335,000 lots, a seasonal four-year high.

Focus this week: With grain prices having climbed to the highest since last August, World Agricultural Supply and Demand Estimates, due Thursday, may offer clues to how solid the foundation currently is. The US Department of Agriculture’s first outlook for the next season is expected to show a price supportive decline in global inventories for corn and wheat.

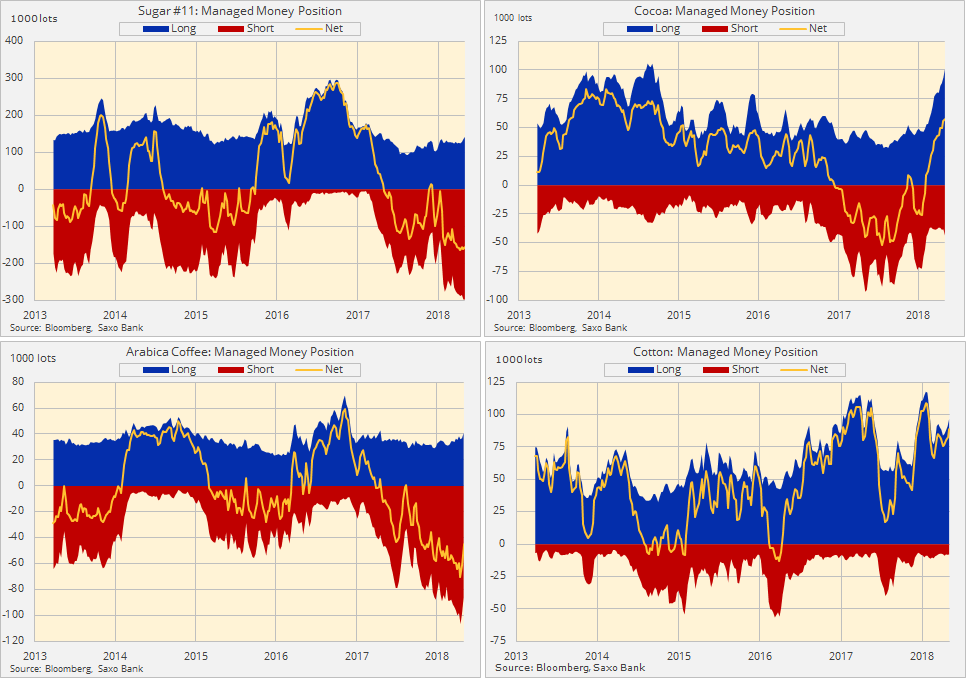

Non-stop buying of cocoa extended into a 15th week while the net-long at 57k still remains below the 2013 record of 84k lots. Aggressive short covering supported Arabica Coffee for a second week as the short-term technical outlook continued to improve.