Outrageous Predictions

Carry trade unwind brings USD/JPY to 100 and Japan’s next asset bubble

Charu Chanana

Chief Investment Strategist

Head of Commodity Strategy

Summary: Given the fact that most oil producers (including Russia and Saudi Arabia) are currently selling at a price well below their budget break-evens, we will eventually see the market recover.

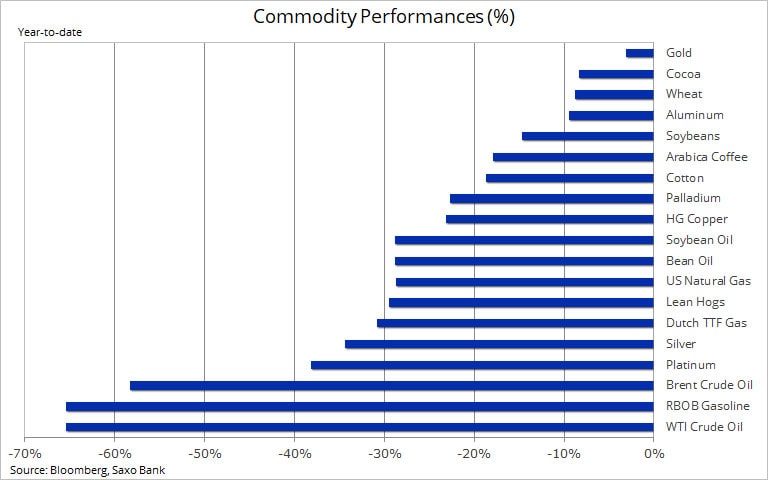

The coronavirus outbreak has set three major macro impulses in motion. They will all have a major impact on commodities, especially the energy sector, over the coming months. The global economy is currently dealing with the biggest demand shock since the global financial crisis, plus a global supply shock and an oil price war which is driving a destruction of capital. The lockdowns in China at the beginning of the outbreak have now spread to the rest of the world, most noticeably Europe and the US. The short-to medium-term result is going to be a slump in global growth, rising unemployment, rising mortgage rates and lower consumer confidence.

The second quarter is likely to begin with the focus squarely on the price-damaging impact of the dramatic drop in demand for many key commodities: from crude oil and industrial metals to some agriculture commodities. But as coronavirus continues to spread it is very possible that the supply outlook will become challenging as well. Miners and producers may begin to feel the impact of staff shortages and breakdown in supply chains. The impact of lower fuel prices is being felt from agriculture to mining as it drives down input costs. However, the potential risks to supply could see some markets find support sooner than the demand outlook suggests.

Without making any price predictions, we’ve taken a look at some of the commodities that could potentially benefit from the current troubling developments.

The impact on global growth and demand will be significant. With millions of people around the world being ordered to work from home and refrain from traveling, the demand for transportation fuel has collapsed. The drop in consumer confidence, meanwhile, will impact demand for consumer goods.

The biggest effect has so far been seen across the energy sector. A combination of strong non-OPEC supply growth and a weakening outlook for global demand led to the inevitable breakdown of OPEC+ co-operation on March 6.

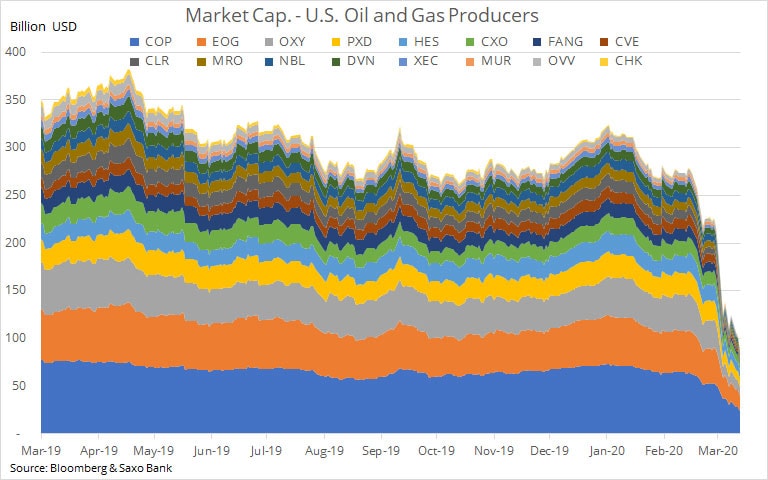

Instead, Saudi Arabia started an all-out price war by dumping the price while ramping up production. Whether the intended target was Russia or high-cost producers in the US shale oil industry, the impact on oil has been devastating. If the aim was shock and awe, the timing has been perfect — global demand has fallen off a cliff as the global community goes into lockdown to combat COVID-19.

Brent crude oil has dropped to an 18-year low. The SPDR Energy Select ETF (XLE), representing some of the biggest US oil companies, has more than halved since December. A group of 12 major independent US oil and gas producers, meanwhile, have seen their market cap collapse to below $90 billion from above $300 billion in December.

Given the fact that most oil producers (including Russia and Saudi Arabia) are currently selling at a price well below their budget break-evens, we will eventually see the market recover. However, before that happens the virus either needs to show signs of retreating or we need to see a meaningful and long-overdue reduction among high-cost production companies in places like the US and Brazil. In addition, the long road to recovery back towards the $50 to $60 range in Brent will be hampered by the rapid rise in global stocks. These will need to be reduced before Brent can recover — we recommend you to take a look at Peter Garnry’s assessment of which companies could end up being potential winners and losers.

Staying with energy sector, it is our belief that a meaningful reduction in US shale oil production over the coming months may lead to a long-overdue reduction in associated gas production. Rising production, a mild winter across the northern hemisphere and the virus-related drop in activity have all helped send global gas prices sharply lower. US gas prices touched a 25-year low in March. Depending on how quickly production slows, we see gas prices rise beyond levels currently reflected in the forward market.

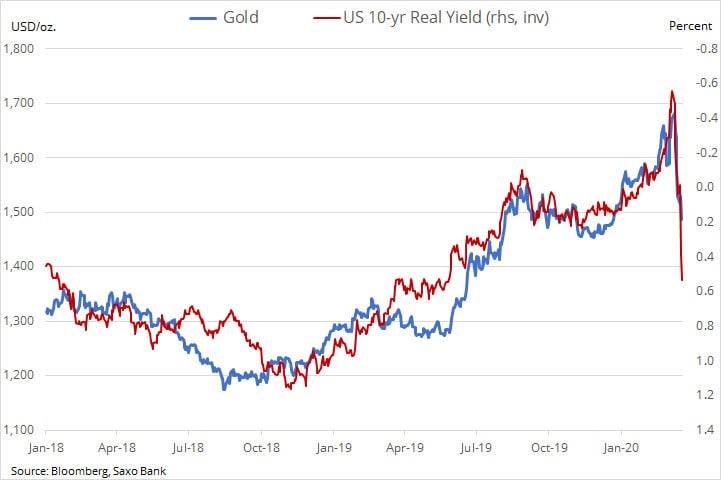

Gold’s failure to rally as COVID-19 spread and economic uncertainty rose has brought back memories of 2008. During the early part of the GFC, all assets were sold as investors deleveraged to realise cash or pay for losses elsewhere. In the early weeks of the crisis, gold suffered a 27% sell-off to $725/oz before beginning an ascent which eventually took it to $1920/oz.

The rally started in gold mining stocks before moving to gold and it took another few months before the stock market finally bottomed out. With this in mind, we are keeping a close eye on gold mining companies through the Vaneck Major Gold Miners ETF (Ticker: GDX:arcx). We also have to keep in mind that the cost of fuel, which accounts for 20% of mining costs, has collapsed. Gold miners have therefore, at least for now, not suffered the hit that the drop in gold would otherwise imply.

We believe the long-term reasons for holding gold have, if anything, been strengthened by current developments. While official interest rates have been slashed, corporate bond yields have been rising. The broken transmission between central bank actions and developments on the ground is likely to trigger a major fiscal and potential inflationary response from governments around the world. US 10-year real yields, another major driver of gold, have risen sharply in response to much lower inflation expectations. We believe this move is unsustainable and that real yields will eventually move back into deeper negative territory.

The aggressive sell-off in crude oil hasn’t helped gold. The Russian central bank has been a strong buyer of gold in recent years. That buying has now stopped, and depending on how long it takes before crude oil recovers, we could potentially see Russia become a net-seller. After all, they will have to cover the shortfall of oil slumping below their budget break-even, which is somewhere close to $40/b.

Silver’s complete collapse to an 11-year low in March drove its relative value to gold down by more than 50% below the five-year average. A combination of inadequate liquidity to withstand the aggressive dash-for-cash phenomenon and its correlation to economic growth are helping drive the steep loss. Once the market stabilises, we see the potential for a strong recovery with traders focusing on its relative cheapness to gold.

HG copper, which started the year with a forecast of a small supply deficit, finally broke key support at $2.50/lb. However, with the outlook for aggressive fiscal measures and the potential risk to supply from virus-related disruptions, we see risk being skewed to the upside in Q2.