Quarterly Outlook

Q3 Investor Outlook: Beyond American shores – why diversification is your strongest ally

Jacob Falkencrone

Global Head of Investment Strategy

The headline CPI year-over-year has been decreasing since April, when it stood at 3.5%, falling by over 100 basis points primarily due to core goods lowering the overall figure. Meanwhile, inflation expectations have been increasing amid the "Trump Trade." As a result, any indications of month-over-month upside surprises could further boost Treasury yields, which are already on the rise.

Preview

October US inflation print is due today at 2130 SGT and consensus expects MoM numbers to be unchanged at 0.2% for the headline and 0.3% for the core. Headline YOY is expected to rise to 2.6% from 2.4% in September although core is seen to be unchanged at 3.3% YoY. This print will be key for the market to assess December Fed rate odds, currently close to 60%. If core CPI rounds to 0.4% MoM or higher, these odds could reduce to sub-50% and that could bring a fresh rally in USD. However, a 0.2% MoM or lower print on the core could bring some temporary USD weakness after it recently touched a 2-year high as December Fed rate cut could get close to fully priced in.

Time of Release & Consensus

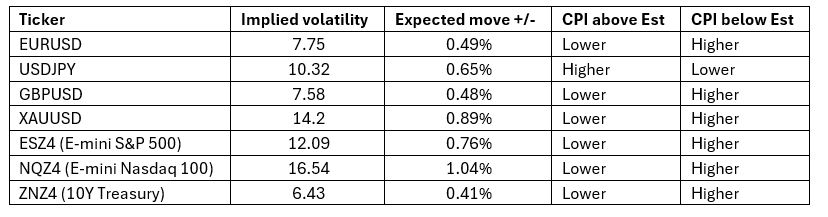

One day expected moves based on implied volatility

Some of the instruments that reacted the most last time for first 30min after the release: USDJPY 120 pips, EURUSD 45 pips, GBPUSD 60 pips, XAUUSD 0.8%, NQZ4 (USNAS100) 0.7%, ESZ4 (US500) 0.4%, ZNZ4 4bps