Quarterly Outlook

Q3 Investor Outlook: Beyond American shores – why diversification is your strongest ally

Jacob Falkencrone

Global Head of Investment Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

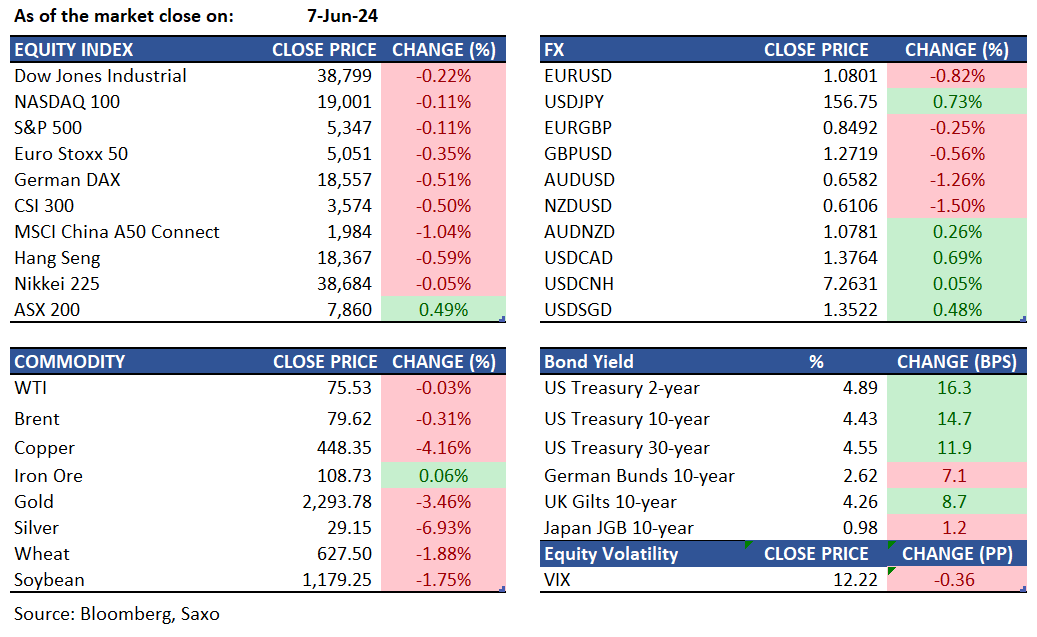

Macro: US non-farm payrolls for May came in surprisingly hot. Headline NFP was above expectations at 272k, beating expectations of 180k and April’s 165k. There was a huge jump in private payrolls to 229k, above the 170k forecast and prior 158k. The wage metrics were also hot, rising to 4.1% Y/Y from an upwardly revised 4.0%, above the 3.9% forecast, with M/M earnings rising 0.4% above the 0.3% forecast and prior. The hot labour market report is at odds with some of the softer reports we have seen recently (falling JOLTS, rising jobless claims, soft ADP) and is likely to keep the Fed away from considering rate cuts at this point. Focus this week is on the US CPI release as well as the dot plot from the Fed meeting.

Macro events: Norway CPI (May), EZ Sentix Index (Jun), US NY Fed Inflation Expectations (May)

Earnings: FuelCellEnergy, YEXT, SkillSoft, Calavo

Equities: The US nonfarm payrolls surged by 272,000, surpassing the anticipated +180,000 and the previous +175,000. Initially, the market experienced a slight decline, but by mid-morning, we observed a shift to positive territory in both the S&P and Nasdaq. However, small caps continued to exhibit weakness, with the Russell 2000 declining by 0.37% compared to the SPX Index's gain of 0.15% and the Nasdaq's increase of 0.10%. In terms of sectors, Financials, Energy, and Industrials emerged as the top performers, while Real Estate and Materials faced significant declines, lagging the general market.

Fixed income: Treasury futures saw a significant decline following a robust May jobs report, finishing the session near the day's lows, maintaining losses after the release of the data, particularly in the front and intermediate segments of the yield curve. Projections for a rate cut by the Federal Reserve were pushed back, with the first anticipated easing now fully priced in for December, instead of the previously expected November meeting. In the options market, post-jobs activity in SOFR included strategies anticipating higher rates for a longer period, while bullish positions further along the yield curve were unwound. The stronger-than-expected US jobs report on Friday led to a yield increase of over 10 basis points and delayed expectations for a Fed rate cut, with the 10-year Treasury yield rising by 15 basis points to 4.43%. After widening for four consecutive days, spreads for high-grade Asian dollar bonds narrowed on Friday. With markets closed on Monday in China and Hong Kong for a holiday, there may be a slowdown in primary issuance. In early Asia trading, Treasury futures experienced a slight decline following a sell-off in the cash market on Friday. French and German bond futures continue downward for third day following European Parliament election voter backlash against leaders.

Commodities: Gold and Silver experienced a sharp decline on Friday. and failed to recover following reports of a pause in China's buying activity and pre-market release of higher payroll data. An increase in yields and a strengthening Dollar constrained gold, as investors sought to reassess their expectations regarding future Federal Reserve actions. Additionally, exacerbating the pressure from the payroll data was a report indicating that China had halted its gold purchasing program after around 18 months. Oil remained stable following a weekly decline, as the market continued to process OPEC+'s decision to commence supply restoration and looked ahead to upcoming significant market reports and a Federal Reserve decision. Traders are expected to encounter a week filled with data, including the release of monthly reports from OPEC and the International Energy Agency on Tuesday and Wednesday, as well as the Federal Reserve's interest rate meeting on the same day.

FX: Strong employment data in the US on Friday boosted the USD, resulting in declines in all G10 currencies. EUR suffered a double-blow from dollar strength, and the results of European parliamentary elections out over the weekend which saw far-right parties gaining momentum. EURUSD broke below 1.08 from highs of 1.09 on Friday, hitting one-month lows. EURGBP extended its decline to 0.8457, the lowest since August 2022. EURCHF is down to 0.9650 amid a safe-haven bid as political uncertainty in Europe comes in focus. Activity currencies slumped on the back of dollar strength, with NZDUSD testing 0.61 handle and AUDUSD plunging to 0.6580. USDJPY rose back to 157b from lows of 154.55 seen last week, and Fed and BOJ meeting this week could keep the pair volatile.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.