Quarterly Outlook

Q3 Investor Outlook: Beyond American shores – why diversification is your strongest ally

Jacob Falkencrone

Global Head of Investment Strategy

Key points:

------------------------------------------------------------------

Disclaimer: Past performance does not indicate future performance.

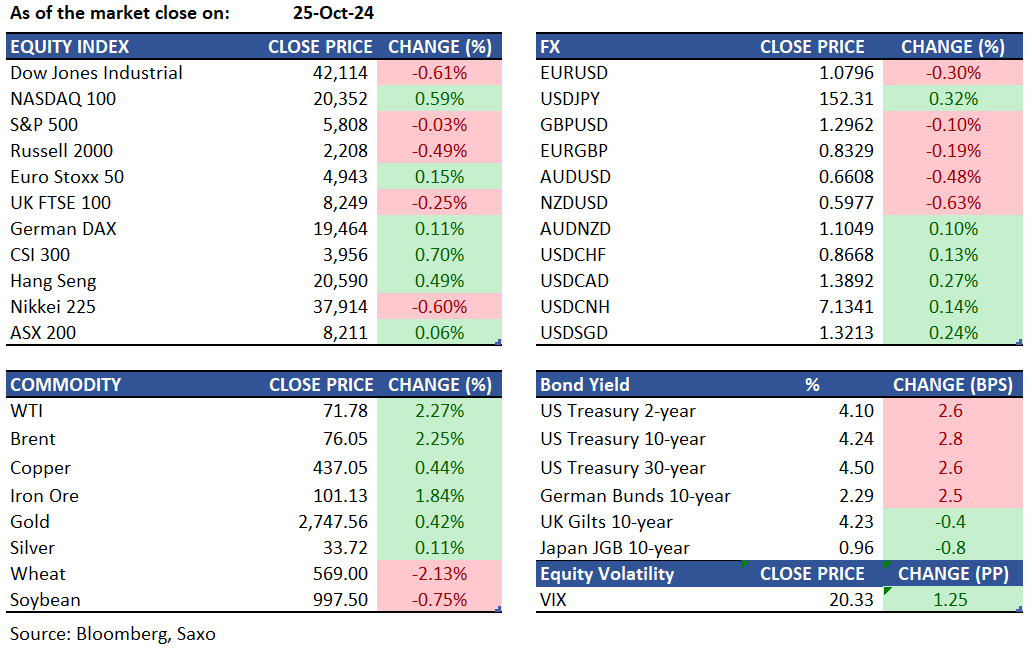

Macro:

Equities:

FX:

Commodities:

Fixed income:

For a global look at markets – go to Inspiration.