Key points:

- Macro: US and China agree to 90-day tariff reductions

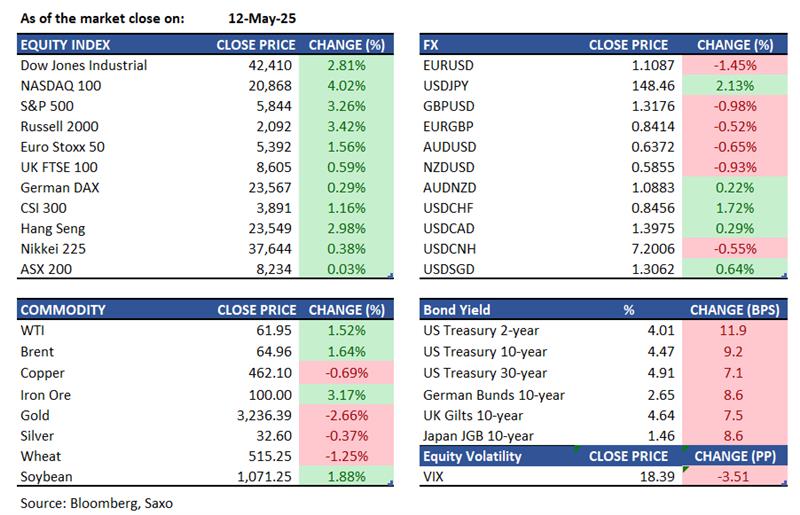

- Equities: Stocks surged across the board after tariff reductions

- FX: USD strengthened significantly as US-China reduced tariffs; USDJPY rose above 148

- Commodities: Gold declined due to the strengthening US dollar and rising yields

- Fixed income: Treasuries dropped as interest in safe-haven assets waned

------------------------------------------------------------------

Disclaimer: Past performance does not indicate future performance.

Macro:

- The US and China agreed to a 90-day tariff reduction after weekend negotiations in Switzerland. The US will lower tariffs on Chinese goods from 145% to 30%, and China will reduce levies on US imports from 125% to 10%.

- UK retail sales rose by 6.8% in April 2025, the fastest growth in over three years, exceeding the expected 2.4%. This contrasts with a 4.4% decline in April 2024, aided by favourable spring weather and Easter falling in April. Food sales increased by 8.2%, compared to a 1.6% drop last year.

- The Indian army reported that discussions with Pakistan's military focused on commitments to avoid firing and aggressive actions, with both sides agreeing to consider immediate steps for reducing troops at the border and forward areas.

Equities:

- US - Stocks surged on Monday after the US and China announced a 90-day tariff reduction, boosting investor confidence. The S&P 500 and Nasdaq rose about 3%, while the Dow Jones jumped over 1,000 points. Consumer discretionary led gains, up 5.5%, with strong performances from megacaps like Apple, Nvidia, Amazon, Meta, Alphabet, and Tesla. Pharmaceutical stocks fell as Trump announced plans to cut prescription drug prices.

- HK– HSI rose 3.0% on Monday, marking its eighth consecutive gain and a 1.5-month high. The rise followed a U.S.-China trade truce, reducing tariffs on both sides, and a 10% yoy increase in China's April car sales. Tech stocks led, with Trip.com up 6.6%, Tencent 4.5%, and Meituan 2.5%.

- EU - European stocks rose sharply on Monday after the US and China agreed to significant tariff reductions, easing trade war fears. The STOXX 50 and STOXX 600 reached their highest since March. Luxury firms like LVMH and Kering gained due to relief for China, while UniCredit surged on strong earnings.

Earnings this week:

Monday: Monday.com, Rigetti, Plug Power, AST SpaceMobile, Rockwell Medical

Tuesday: JD.com, Sea Limited, CyberArk, Honda, Karman Space & Defense

Wednesday: ARS Pharma, Cisco, Sony, Dynatrace, CoreWeave

Thursday: Alibaba Group, Applied Materials, Walmart, Cava, Doximity

Friday: Codere, Flowers Foods, Yatsen Holding, Brady Corporation, RBC Bearings

FX:

- USD surged, marking its best day in a month, following the US-China tariff reduction agreement. Dollar index (DXY) rose more than 1% to above 101.6 level, driven by stretched short positions and a shift in options sentiment.

- EURUSD fell 1.4% to 1.1089, its lowest since April 10. Improved risk sentiment saw the yen and Swiss franc lead G-10 losses, with USDJPY up 2% to 148.34 and USDCHF up 1.7% to 0.8458.

- USDCAD climbed 0.4% to 1.3994, its highest since April 10, making the loonie the top G-10 performer against the dollar.

- Australian and New Zealand bonds fell as the trade truce took effect, with AUDUSD steady at 0.6372 after a 0.7% loss Monday, and NZDUSD gaining 0.1% to 0.5862 after closing down 0.9%.

- Economic data: Germany May ZEW survey, UK March jobless claims & unemployment, US April CPI

Commodities:

- Oil steadied as focus shifted to the Middle East. WTI exceeded $61, and Brent closed below $65. Futures dipped after Trump hinted at US-Iran nuclear talks progress, suggesting possible easing of Tehran’s crude restrictions.

- Gold steadied after a selloff as US-China trade tension eased, reducing haven demand. Trading near $3,237 an ounce, bullion fell 2.7% Monday.

Fixed income:

- Treasuries fell with higher yields, approaching session highs, following a temporary US-China tariff reduction. This trade pause lifted US equities and diminished haven asset demand. Increased corporate bond issuance, including UBS's $4 billion offering, contributed to above-average Treasury futures volumes, with investment-grade offerings nearing $19 billion. Australian and New Zealand bonds mirrored the global debt selloff due to the trade truce, while Japan’s 30-year bond auction drew focus as yields neared 3%.

For a global look at markets – go to Inspiration.