Outrageous Predictions

Carry trade unwind brings USD/JPY to 100 and Japan’s next asset bubble

Charu Chanana

Chief Investment Strategist

Chief Investment Strategist

Note: This content is marketing material.

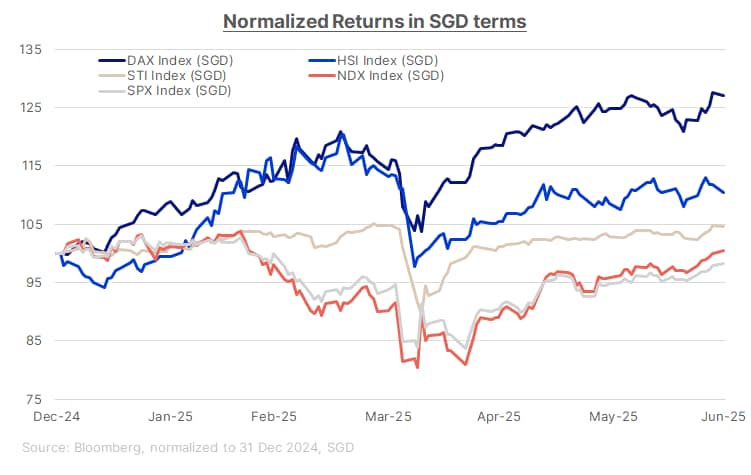

The first half of 2025 has underscored a critical truth for global investors: returns are not just about what you invest in, but also where you're investing from.

While US equities have posted solid gains—with the Nasdaq 100 up 7.9% and the S&P 500 rising 5.5%—many Singapore-based investors are finding little to celebrate. The US dollar has weakened by over 6.9% against the Singapore dollar this year, significantly eroding returns when converted back to SGD.

This makes it an opportune time to reassess portfolio allocations, especially for those relying on US assets for growth or income.

Despite strong performance in US dollar terms, SGD-adjusted returns tell a different story.

Meanwhile:

These figures highlight the growing importance of currency effects when allocating capital globally. For SGD investors, 2025 has shown that FX can be a decisive factor in portfolio returns.

Several structural and cyclical factors are putting pressure on the US dollar, and more downside could be in store:

Investors should consider adjusting their portfolios in light of these developments, with a greater emphasis on regions and sectors better positioned for SGD-based returns.

European equities are showing strong momentum in 2025, driven by:

Germany’s DAX index, for instance, has delivered a 27% return in SGD terms YTD. This underscores the case for increased exposure to European markets for both growth and income-focused investors.

For investors seeking exposure to Europe’s long-term structural shifts, our “European Independence” shortlist highlights companies at the heart of the region’s industrial transformation—spanning clean energy, defence, and semiconductor manufacturing.

After years of underperformance, Hong Kong equities are regaining investor interest:

The Hang Seng Index is up over 10% in SGD terms YTD, suggesting that a strategic re-entry into Hong Kong could enhance both return potential and diversification.

For investors looking to capture China’s structural growth in innovation and automation, our “China Innovation” shortlist offers a focused set of Hong Kong-listed stocks aligned with government priorities in advanced manufacturing, green energy, and AI technologies.

For investors seeking income without currency risk, Singapore-listed dividend stocks remain compelling. These stocks offer:

Our “Dividend Aristocrats” shortlist features top dividend-paying companies across Singapore, the US, and Europe—screened for consistent payouts, market strength, and resilience. It’s a useful starting point for building a globally diversified, income-generating portfolio that doesn't rely solely on US stocks.

To position effectively, investors should consider the following:

The strength of US markets in 2025 has not translated into strong returns for SGD investors. As the USD continues to weaken, the cost of holding US-centric portfolios is rising—both in terms of missed opportunity and FX drag.

This is a timely moment to rebalance towards regions offering better local-currency adjusted returns and to refocus on assets that generate reliable income in SGD.

For investors looking to protect purchasing power, generate sustainable income, and capture global opportunity, thinking beyond the US has never been more relevant.