Key points:

- Macro: Trump to decide whether to extend tariff truce with China after talks

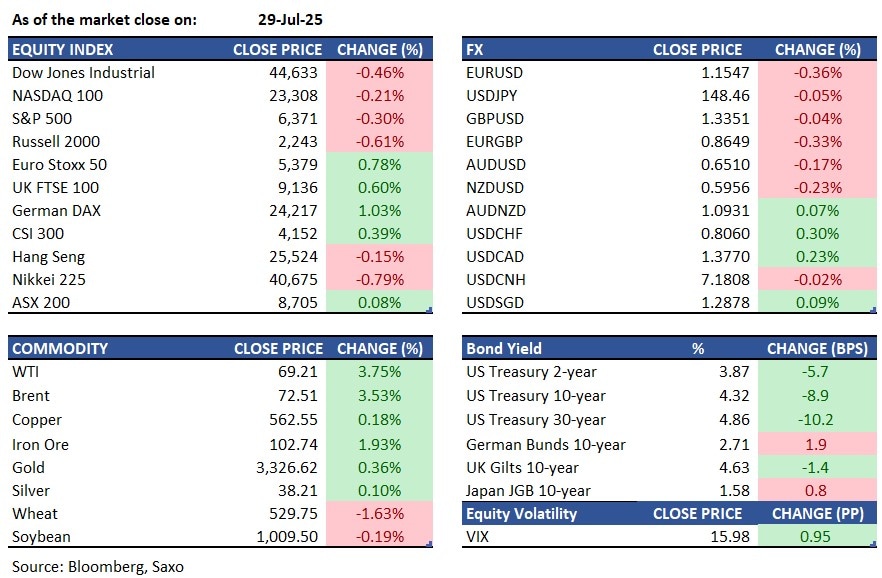

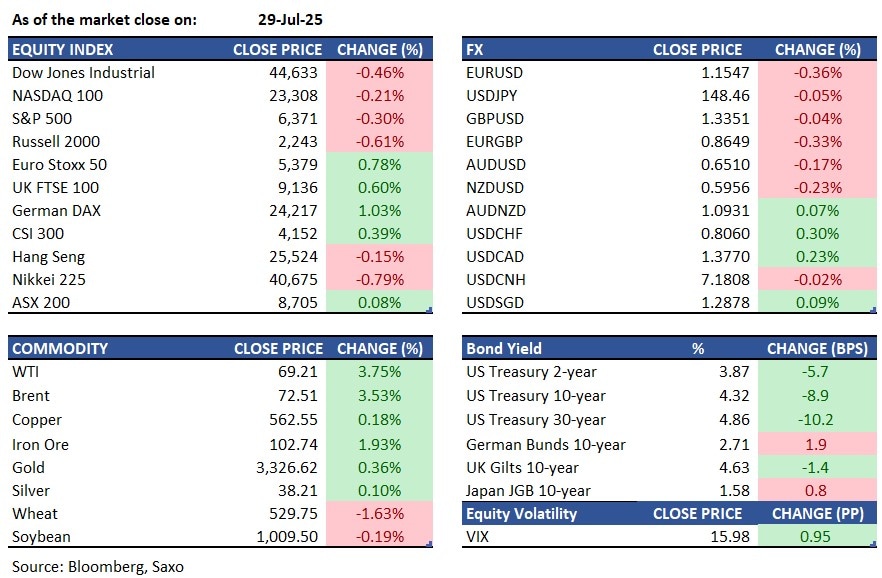

- Equities: Equities fall due to mixed earnings and Fed decision ahead

- FX: USD strengthened; EUR fell to 1.1550 due to trade deal tensions

- Commodities: Oil hit a monthly high as Trump threatened more US levies on Russia

- Fixed income: Treasuries surged on strong demand for a 7-year note auction

------------------------------------------------------------------

Disclaimer: Past performance does not indicate future performance.

Macro:

- U.S. and Chinese officials agreed to pursue extending their 90-day tariff truce after constructive talks in Stockholm. No major breakthroughs were announced, leaving the decision to extend the truce up to President Trump as the August 12 deadline nears. U.S. Treasury Secretary Scott Bessent indicated Trump is likely to approve the extension.

- US job openings dropped by 275,000 to 7.437 million in June 2025, missing expectations of 7.55 million. Declines were seen in accommodation and food services (-308,000), health care (-244,000), and finance (-142,000), while increases occurred in retail trade (+190,000), information (+67,000), and state/local government education (+61,000).

- The US goods trade balance deficit narrowed by $10.4 billion to $86 billion in June 2025, below expectations of $98.4 billion. Importers reduced foreign orders after front-loading inventories due to tariff concerns, following a record deficit of $162 billion in March.

- The S&P CoreLogic Case-Shiller 20-City Home Price Index increased 2.8% year-over-year in May 2025, down from 3.4% in April and missing the expected 3.0%. This is the slowest growth since August 2023, impacted by higher mortgage rates, tighter financial conditions, and localized market dynamics.

- The IMF raised global growth forecasts to 3.0% in 2025 and 3.1% in 2026 respectively, citing stronger early economic activity, lower US tariffs, improved financial conditions, and fiscal expansion. Despite the optimism, the IMF cautions that risks remain skewed to the downside.

Equities:

- US - The three major US indices fell on Tuesday, impacted by mixed corporate earnings and caution ahead of the Federal Reserve’s policy decision. The S&P 500 dropped 0.3%, the Nasdaq 100 declined 0.2%, and the Dow slipped 204 points. Weak earnings from UnitedHealth (-7.5%), Boeing (-4.4%), and Merck (-1.7%) weighed on the market, with UPS and Whirlpool also falling over 10% due to disappointing results. Investors noted a decline in June's job openings and hiring, while July's consumer confidence exceeded expectations. US-China trade talks ended without a deal, focusing hopes on extending the current tariff truce. The Fed is expected to keep interest rates unchanged on Wednesday, with attention on future policy signals amid moderating inflation.

- EU - European stocks closed higher on Tuesday, recovering from the previous session's losses. The STOXX 50 rose 0.7% to 5,376, while the STOXX 600 increased 0.2% to 550, despite Novo Nordisk's decline. EssilorLuxottica surged 6.4% on higher operating profits despite tariff challenges. Banks like Santander, BBVA, and Intesa Sanpaolo gained over 2%. Stellantis bounced back to close slightly positive after a €2.3 billion first-half net loss. Outside the Eurozone, AstraZeneca rose 3.5% after its earnings release, and Barclays announced better-than-expected profits with a £1 billion share buyback. Novo Nordisk plunged 22% following a profit warning and a CEO change.

- HK - Hang Seng fell 0.15% to 25,524 on Tuesday, reversing the previous session's gains as most sectors weakened. Traders were wary of the U.S.-EU trade deal’s potential impact on growth and inflation, while President Trump suggested a global tariff of 15% to 20% on non-negotiating partners. Hang Seng pared earlier losses after Commerce Secretary Howard Lutnick mentioned a possible extension of a 90-day tariff pause with Beijing, which might lead to a Trump-Xi meeting later this year. Investors are now focused on upcoming China's July PMI. Decliners included KE Holdings (-3.0%), Xiaomi Corp. (-2.6%), HKEX (-1.7%), and Want Want China (-1.6%).

Earnings this week:

- Wednesday: Meta (META), Microsoft (MSFT), Ford (F), Qualcomm (QCOM), Altria (MO), Airbus (AIR)

- Thursday: Apple (AAPL), Amazon (AMZN), Reddit (RDDT), AbbVie (ABBV), Merck (MRK), Coinbase (COIN), Comcast (CMCSA)

- Friday: Chevron (CVX), Exxon (XOM)

FX:

- USD continued to strengthen, driven by a EUR sell-off after the EU-US trade deal that drew criticism from Germany and France. US Commerce Secretary indicated ongoing negotiations with "plenty of horse trading" remaining in EU talks. In Stockholm, US-China trade discussions focused on extending the tariff truce for 90 days, pending President Trump's decision following his meeting with Treasury Secretary Bessent on Wednesday.

- EUR continued to decline, reaching 1.1550 against the USD, due to the trade deal and limited data from the EU. GBP remained stable around 1.3300, showing resilience among G10 currencies.

- JPY made slight gains, with USDJPY movement restrained at the 148.00 level as the BoJ's two-day meeting started.

- CAD weakened past 1.375 against USD due to trade uncertainties and strong US deals. A 1.1% drop in May retail sales hints at economic cooling, leading to expectations of earlier rate cuts by the Bank of Canada.

Economic Calendar - AU Inflation Rate, FR GDP Growth Rate, DE Retail Sales, EU GDP Growth Rate, US GDP Growth Rate, US ADP Employment Change, CA BoC Interest Rate Decision, CA BoC Monetary Policy Report

Commodities:

- Oil sustained its largest six-week gain as US President Trump threatened more penalties on Russia if no Ukraine truce is reached. WTI traded near $69 a barrel, Brent above $72. Trump suggested tariffs and increased US production.

- Gold maintained a modest gain as investors anticipated the Federal Reserve's upcoming interest-rate decision, expected to offer insights into future monetary policy. Bullion hovered around $3,330 an ounce, building on a 0.4% increase Tuesday.

Fixed income:

- Treasuries surged without a clear catalyst, driven by strong demand for a 7-year note auction and expectations of supportive borrowing plans from Washington. The 7-year auction saw impressive metrics, with the bid-to-cover ratio highest since November 2012. Australian bonds rose on inflation data anticipation. Treasury futures were steady as the Federal Reserve is expected to keep rates unchanged. Meanwhile, the Bank of Japan began its policy meeting, with economists predicting no change to the 0.5% rate and an inflation forecast increase.

For a global look at markets – go to Inspiration.

This content is marketing content and should not be considered investment advice. Trading financial instruments carries risks and historic performance is not a guarantee for future performance.The instrument(s) mentioned in this content may be issued by a partner, from which Saxo receives promotion, payment or retrocessions. While Saxo receives compensation from these partnerships, all content is conducted with the intention of providing clients with valuable options and information.