Key points:

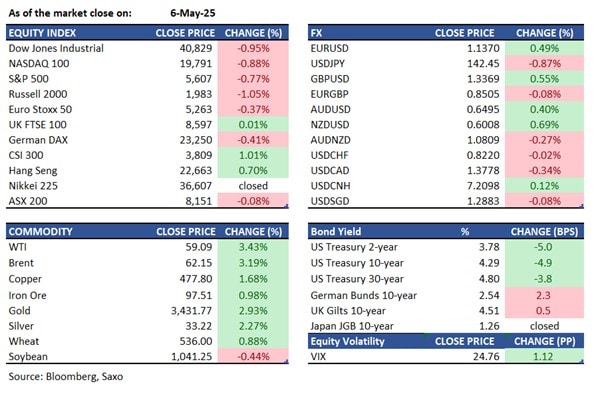

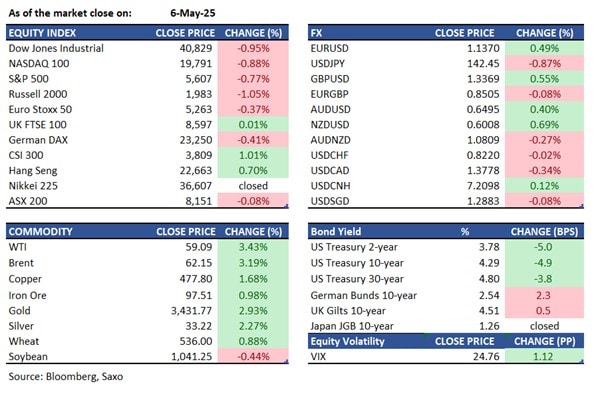

- Macro: Bessent and Greer to meet Chinese counterparts in Switzerland

- Equities: US futures positive after news of US China counterpart to meet in Switzerland

- FX: USD weakened, losing 100 level; USDJPY slipped below 143

- Commodities: WTI neared $60 with its largest gain in three weeks

- Fixed income: Treasuries rallied across the curve after a strong 10-year auction

------------------------------------------------------------------

Disclaimer: Past performance does not indicate future performance.

Macro:

- Treasury Secretary Scott Bessent and trade official Jamieson Greer will meet Chinese counterparts in Switzerland, lifting investor sentiment before the Federal Reserve's expected decision to hold interest rates. Investors will watch Fed Chair Jerome Powell's remarks for hints on future rate changes amid pressure to ease policy.

- The US trade deficit reached a record $140.5 billion, surpassing the forecast of $137 billion. Imports rose 4.4% to $419 billion due to expected tariffs, with increased purchases of pharmaceuticals, passenger cars, and computer accessories. Exports grew by 0.2% to $278.5 billion, led by passenger cars, natural gas, and computer accessories, while civilian aircraft exports declined.

- Canada's trade deficit decreased to C$0.51 billion in March 2025 from C$1.41 billion in February, as imports dropped more than exports due to Ottawa's reciprocal tariffs and a boycott of U.S. products by Canadians.

- UK-India trade deal cuts tariffs on 90% of UK imports, with 85% tariff-free within a decade, and reduces whisky, gin, and auto tariffs. It's expected to boost UK GDP by GBP 4.8 billion and trade by GBP 25.5 billion annually by 2040.

Equities:

- US - The S&P 500 dropped 0.8%, Nasdaq 100 declined 0.9%, and the Dow fell by 389 points. President Trump’s shifting trade stance, stating “we don’t have to sign deals,” clashed with Treasury officials’ optimism, diminishing hopes for tariff relief. Tensions escalated with Canadian PM Mark Carney responding to Trump’s trade comments with, “Canada is not for sale,” leading to Trump’s retort of “Never say never.” In after-hours trading, AMD climbed 2% following better-than-expected quarterly earnings, while Rivian dropped over 1% amid a reduction in its 2025 delivery forecast. Supermicro also fell 4.7% after cutting its revenue outlook. S&P 500 futures also gained over 1% after Bessent said US will meet Chinese counterparts in Switzerland to start trade negotiations.

- EU - The Eurozone's STOXX 50 slipped 0.4% to 5,261, while the pan-European STOXX 600 declined 0.2% to 536. Friedrich Merz’s election as German chancellor didn't reverse stock losses from the prior vote. French consumer discretionary firms led declines, with L'Oreal and EssilorLuxottica dropping over 2%, and Hermes and LVMH down nearly 1%. Novo Nordisk also fell nearly 4% ahead of its earnings this week. Conversely, Intesa Sanpaolo and Ferrari rose significantly after reporting positive corporate results.

- HK - Hang Seng rose 158 points, or 0.7%, reaching a one-month high of 22,663, marking its fourth consecutive gain amid easing trade tensions. Hong Kong's economy expanded by 3.1% year-on-year in Q1 2025—the fastest in five quarters—boosted by strong tourism and exports before U.S. tariff hikes. The yuan's rally and support from the Hong Kong Monetary Authority improved sentiment. Gains were constrained by data showing China’s services activity (Caixin PMI) in April grew the least in seven months amid tariff concerns. Financials, consumers, and property sectors led gains, with Nongfu Spring up 6.8%, followed by Chow Tai Fook (5.7%), Sands China (5.2%), and Meituan (4.6%).

Earnings this week:

Wednesday: Uber, Disney, Novo Nordisk, Teva, Unity, AppLovin, Arm, DoorDash

Thursday: Peloton, Shopify, ConocoPhillips, D-Wave, Hut 8, Coinbase, Cloudflare

Friday: Terawulf, 1stDibs, Enbridge, ANI Pharmaceuticals, Telos

FX:

- USD continued its decline, unable to maintain the 100 level due to a lack of new macroeconomic catalysts, as market participants anticipate the FOMC meeting.

- EUR gained strength from the dollar's weakness, stabilising around 1.13, with Germany in focus following CDU Leader Merz's election as Chancellor in the second round of the Parliamentary vote.

- GBP was supported by reports of the UK nearing a trade agreement with the US, featuring reduced tariff quotas for cars and steel, alongside a free trade agreement with India and an arrangement with the EU to hold annual summits. GBPUSD has risen above its 10-day moving average of 1.3330, while EURGBP is hovering near 0.85 level, recovering from earlier lows of 0.8462.

- JPY appreciated as USDJPY fell below 143.00, influenced by dollar pressure and a cautious risk sentiment.

- Economic data: UK S&P Global Construction PMI, Eurozone Retail Sales, US MBA 30-year Mortgage Rate, US Fed Interest Rate Decision, US Fed Press Conference

Commodities:

- Gold drops 1.6%, ending a two-day rise, as US-China trade talks progress, reducing haven demand despite escalating India-Pakistan tensions. US officials to meet China's Vice Premier in Switzerland.

- Oil rises after a 3% rally as US-China trade talks boost optimism for easing tensions. WTI approached $60 per barrel, marking the largest gain in nearly three weeks on Tuesday, while Brent surpassed $62.

- US authorities are likely to decide on copper tariffs before the year-end deadline, following President Trump's February directive for a Commerce Department investigation and report within 270 days.

Fixed income:

- Treasuries closed near daily highs following a robust 10-year note auction, outperforming expectations and allocating fewer notes to primary dealers. A bid emerged as stocks fell on news of the EU's plan for additional tariffs on approximately €100 billion of US goods.

For a global look at markets – go to Inspiration.