Key points:

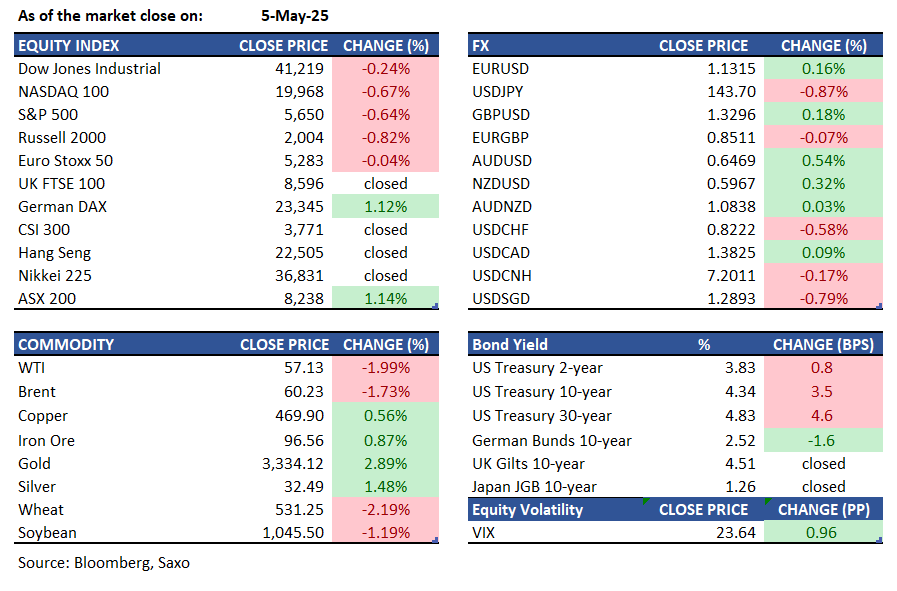

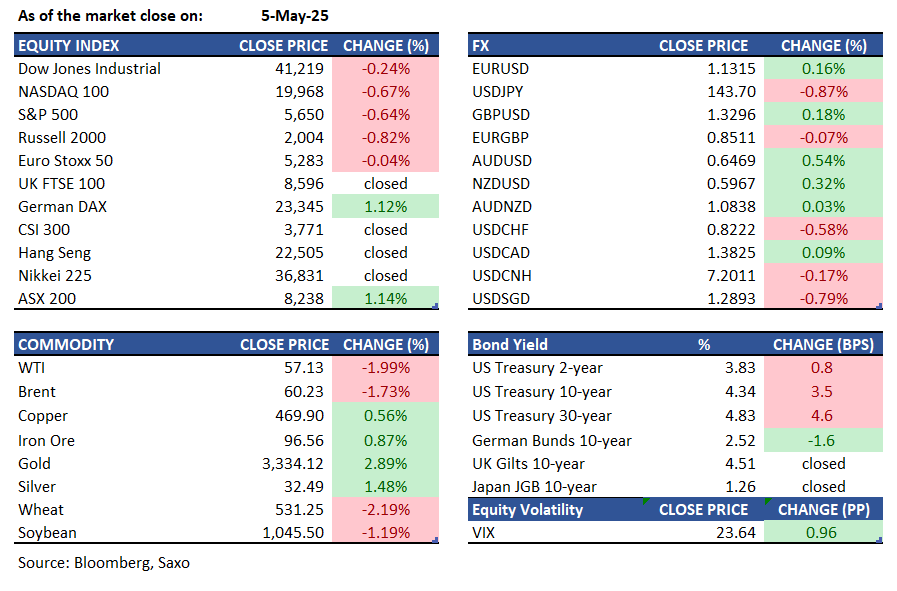

- Macro: Trump announces tariffs targeting non-US film industry

- Equities: S&P 500 broke its 9-day winning streak; Palantir fell 9.25% in after hours

- FX: USD weakened against most major currencies; TWD surged 6.5% in 2 days

- Commodities: Gold rallies on broad based US dollar weakness

- Fixed income: Treasury yields rose for the third consecutive session

------------------------------------------------------------------

Disclaimer: Past performance does not indicate future performance.

Macro:

- Trump announced tariffs targeting the non-US film industry, impacting companies such as Netflix, Disney, and Amazon.

- US rejected Japan's request for full exemption from 'reciprocal' tariffs but may lower the 14% Japan-specific tariff. US officials told Japan's negotiator that only a cut in the 14% tariff, suspended until early July, is negotiable. The US may extend the suspension or reduce the tariff based on negotiation progress, according to sources.

- The US ISM Services PMI rose to 51.6 in April 2025 from 50.8 in March, surpassing expectations of 50.6. New orders and inventories increased, while business activity stayed in expansion (53.7 vs 55.9). Employment contracted less sharply (49 vs 46.2). Supplier delivery slowed (51.3 vs 50.6), and price pressures hit their highest since February 2023 (65.1 vs 60.9).

- S&P Global Canada Services PMI increased slightly to 41.5 in April from 41.2, marking a fifth consecutive contraction. New business and output fell near five-year lows due to uncertainty over US tariffs and the upcoming election. Firms faced job losses for the fourth month amid excess capacity.

Equities:

- US - On Monday, US stocks closed lower as investors balanced strong economic data with trade tensions and the upcoming Fed meeting. The S&P 500 and Nasdaq dropped 0.6% and 0.7%, respectively, breaking nine-day streaks, while the Dow lost 98 points. Early market jitters followed President Trump's tariff threats, including a 100% levy on foreign films, but sentiment improved after better-than-expected ISM services data. Netflix, Paramount, and ON Semiconductor suffered notable losses, and Berkshire Hathaway fell 5% with news of Warren Buffett's 2026 departure. Palantir fell 9.25% post market despite reporting better than expected revenue and raised annual sales forecast to 3.89b to 3.90b, up from 3.74b-3.76b.

- EU - Frankfurt’s DAX increased 0.6% on Monday, surpassing 23,200, its highest since March 19, marking a nine-session winning streak and outperforming peers. Investors focused on trade tariffs and corporate earnings, while anticipating key policy decisions from the US Federal Reserve and Bank of England this week. Rheinmetall rose 2.5% with positive sentiment ahead of its earnings. Major companies like Continental, Hugo Boss, BMW, Fresenius, Infineon, Puma, Commerzbank, Zalando, and Siemens Energy will report quarterly results. Audi, Volkswagen’s premium brand, maintained its full-year outlook despite potential US tariff impacts, following a 12.4% Q1 revenue increase driven by strong electric vehicle sales.

Earnings this week:

Tuesday: Celsius, Supermicro, AMD, Rivian, Marriott International, Ferrari

Wednesday: Uber, Disney, Novo Nordisk, Teva, Unity, AppLovin, Arm, DoorDash

Thursday: Peloton, Shopify, ConocoPhillips, D-Wave, Hut 8, Coinbase, Cloudflare

Friday: Terawulf, 1stDibs, Enbridge, ANI Pharmaceuticals, Telos

FX:

- USD regained losses due to strong ISM Services data, despite declining business activity. Ahead of the FOMC meeting, President Trump showed willingness to reduce China tariffs and proposed tariffs on the non-US film industry, pending discussions with executives.

- EUR lost early gains as the USD rebounded, stabilising around the 1.13 level. ECB's Stournaras commented on inflation and suggested continued rate cuts, while EZ Sentix data improved to -8.1 from -19.5.

- GBP experienced volatility around the 1.33 level due to a lack of catalysts and UK markets being closed on Monday.

- JPY remained strong, with USDJPY falling below 144.00 amid cautious market sentiment, and Japanese markets will be closed on Tuesday for Greenery Day.

- Australian PM Albanese's Labor Party gained a larger majority in Saturday's election. AUDUSD peaked at 0.6493 from a low of 0.6435, while NZDUSD ranged between 0.5941 and 0.5995.

- TWD experienced its biggest single-day increase against the USD since 1988. The Taiwanese central bank confirmed its intervention in the FX market to ensure stability.

- Economic data: China Caixin Service PMI, Canada Balance of Trade, Canada Ivey PMI, US Balance of Trade

Commodities:

- Oil prices stabilised after a sharp drop, influenced by potential OPEC+ supply increases and the US-China trade war. WTI rose above $57 a barrel post a 2% fall, with Brent near $60. Saudi Arabia warned of more production hikes if members overproduce.

- Gold steadied after a 3% surge, driven by a weaker dollar and potential US trade deals. Trading near $3,325 an ounce, bullion reacted to dollar declines amid speculation of exchange rate changes. Trump suggested deals could be struck this week.

- Copper imports to the US hit a record 170,000 tons in April as traders rush to dodge possible tariffs, tightening the physical market. Stockpiles are rapidly declining on the Shanghai Futures Exchange and inventories are dropping on the London Metal Exchange.

Fixed income:

- Treasury yields climbed for the third straight session, boosted by a strong ISM services report and a busy corporate issuance calendar. Yields peaked post 3-year note auction, despite high demand. Auction cycle began early due to Wednesday's FOMC decision including 10-year and 30-year issues on Tuesday and Thursday.

For a global look at markets – go to Inspiration.