Quarterly Outlook

Q3 Investor Outlook: Beyond American shores – why diversification is your strongest ally

Jacob Falkencrone

Global Head of Investment Strategy

Head of Macroeconomic Research

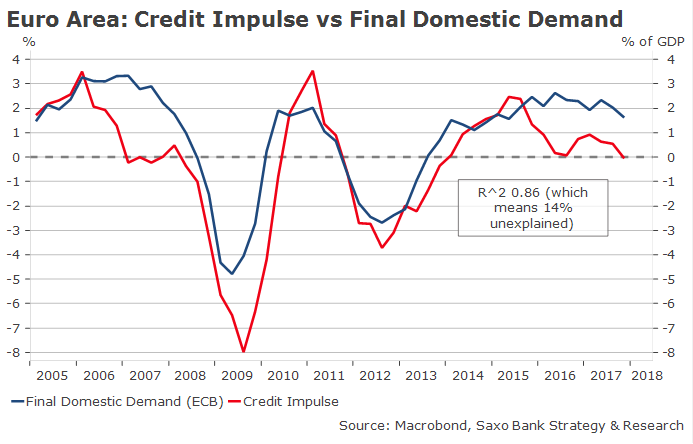

Credit Impulse in the euro area is slightly negative. Due to the very high correlation with final domestic demand (R^2 0.86), we can expect growth to slow down significantly in the next nine to 12 months.

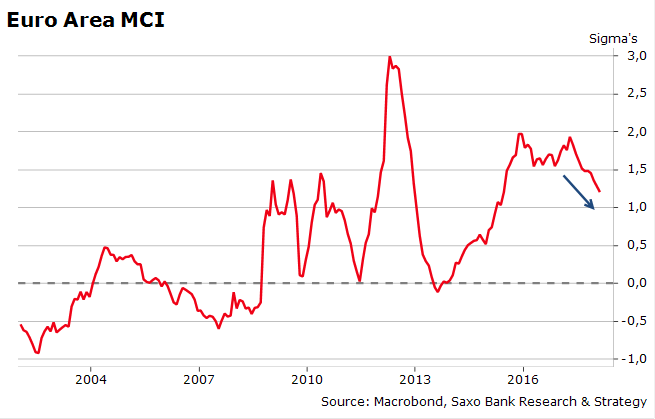

In addition, a simple model of MCI (Monetary Conditions index) based on variables reflecting interest rates, money growth, exchange rates and unconventional measures, confirms that monetary conditions are deteriorating. The impact will likely be more important in PIIGS than in core countries. It is not alarming yet but it is certainly something that the governing council of the European Central Bank will monitor closely in the coming months. From my viewpoint, the next ECB president (German or not) will have no other choice than to think about easing monetary policy rather than tightening.