Key points:

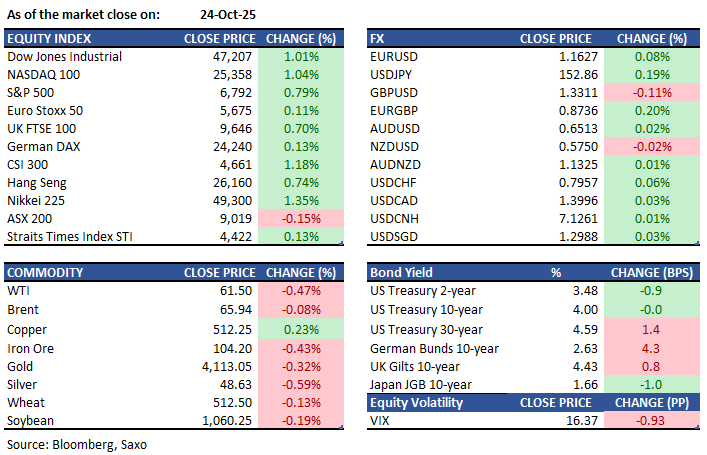

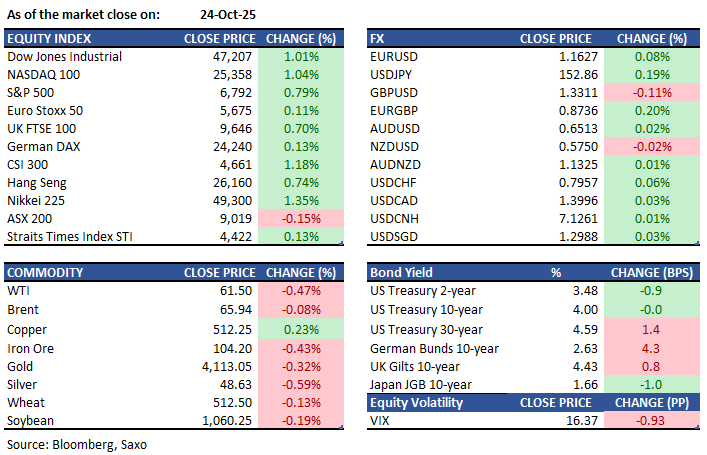

- Macro: US inflation cools and US China ready to make a trade deal

- Equities: Ford surged on earnings; Crypto stocks rose as JPM accepts crypto collateral

- FX: USD stayed flat despite a cooler-than-expected US CPI report on Friday

- Commodities: Oil up on US-China trade talks; Brent at $66

- Fixed income: Treasuries steady; yields flat after unwinding gains from CPI rally

------------------------------------------------------------------

Disclaimer: Past performance does not indicate future performance.

Macro:

- September 2025 US inflation rose to 3%, up from 2.9% in August and below the 3.1% forecast. Energy prices climbed 2.8%, with notable increases in fuel oil and gasoline. New vehicle prices slightly rose, while food, used cars, trucks, and transportation services slowed. Shelter inflation stayed at 3.6%. Core inflation dipped to 3%. The monthly CPI increased 0.3%, driven by a 4.1% rise in gasoline, with the core index up 0.2%.

- Chinese and US officials developed a trade deal framework for Presidents Trump and Xi to finalize, delaying US tariffs and China's rare earth export controls, as per Reuters. US Treasury Secretary Scott Bessent stated that ASEAN Summit talks stopped Trump's planned 100% tariffs and expects China to delay its rare earth licensing. Trump and Xi will meet Thursday at the APEC summit to finalize the agreement.

- Moody's maintained France's Aa3 credit rating but changed its outlook to negative due to political risks affecting deficit reduction. Recently, Fitch, DBRS, and S&P Global downgraded France's ratings. Finance Minister Roland Lescure emphasized the need for budgetary compromise and is committed to reducing the deficit to 5.4% of GDP by 2025 and below 3% by 2029. S&P rates France at A+ with a stable outlook, while DBRS rates it at AA, also stable.

- Trump increased tariffs on Canada by 10% after reacting to an Ontario ad during the World Series. He ended trade talks with Ottawa, citing the ad as misleading. Ontario Premier Doug Ford, after discussions with Prime Minister Mark Carney, announced a pause in the U.S. ad campaign to resume trade talks.

Equities:

- US - Stocks closed at a record as softer inflation strengthened expectations for Fed rate cuts, with tech leading. The S&P 500 rose 0.8%, the Nasdaq 100 gained 1.0%, and the Magnificent Seven added 0.6%. Focus now turns to earnings from Alphabet, Meta and Microsoft on Thursday, and Apple and Amazon on Friday. Alphabet climbed 2.7% on a tens‑of‑billions AI‑chip deal with Anthropic; chips rallied broadly (Philadelphia Semi +1.9%, Nvidia +2.3%, Broadcom +2.9%), while Intel trimmed gains despite returning to profit and offering an upbeat outlook. Ford jumped 12% on earnings beats and a recovery outlook; Palantir rose 2.3% on a $200m Lumen deal; crypto stocks advanced, with Coinbase up 9.8% as JPMorgan plans to accept Bitcoin and Ether as loan collateral; Bitcoin rose 1% to $110,741.

- EU - European stocks edged higher on Friday, supported by mixed corporate earnings and assessments of growth prospects. The STOXX 50 rose slightly to 5,674, and the STOXX 600 added 0.2% to reach a record 575. Sanofi gained 3% following strong Q3 profits, Saab surged 6% on an increased sales forecast, and NatWest climbed 5% after upping its performance target. ENI saw nearly a 2% rise post-results, while Safran fell 1.4% despite topping earnings expectations. Autos and consumer discretionary sectors benefited from declining yields across Europe due to softer-than-expected U.S. inflation. The Eurozone PMI exceeded expectations, indicating improved economic activity. For the week, the STOXX 50 and STOXX 600 gained 1.2% and 1.6%, respectively.

- HK/CH -On Friday, the Shanghai Composite climbed 0.71% to reach 3,950, marking a ten-year high, and the Shenzhen Component surged 2.02% to 13,289, following news of President Trump and President Xi's forthcoming meeting at the APEC summit. The Hang Seng also rose 0.7%, closing at 26,160. Gains spanned tech, consumer, and property sectors, with SMIC soaring 7.4%, Horizon Robotics up 6.1%, China Hongqiao Group rising 4.1%, and Trip.com gaining 3.3%. For the week, the index rose 3.6%, its first increase in three weeks, buoyed by easing Sino-U.S. trade tensions ahead of President Trump's meeting with Xi Jinping in South Korea. Anticipated Fed rate cuts also supported the index, while caution prevailed before September trade and Q3 GDP data in Hong Kong.

Earnings this week:

Asia: Jiangsu Hengrui, Canon, Bank Mandiri, China Northern Rare Earth, China Coal

Outside Asia: Welltower, NXP Semiconductors, Deutsche Boerse, Keurig Dr Pepper, Arch Capital Group

Asia: Bank of China, HSBC, Ping An Insurance, Advantest, Foshan Haitian

Outside Asia: Visa, UnitedHealth Group, Novartis, NextEra Energy, Booking Holdings

Asia: Moutai, Foxconn, China Merchants Bank, Keyence, Sinopec

Outside Asia: Microsoft, Alphabet, Meta, Caterpillar, ServiceNow

Asia: AgBank, ICBC, CCB, PetroChina, China Life Insurance

Outside Asia: Apple, Amazon, Eli Lilly, Mastercard, Shell, Gilead Sciences, S&P Global,

Asia: Tokyo Electron, Daiichi Sankyo, Hoya, Denso, Maruti Suzuki India

Outside Asia: Exxon Mobil, AbbVie, Linde, Intesa Sanpaolo, Aon

FX:

- USD stayed flat despite a cooler-than-expected US CPI report on Friday. A 25 basis-point rate cut at the upcoming FOMC is nearly certain, and US S&P Global indices showed strength. DXY trading near 98.91.

- EUR saw marginal gains amid positive German PMI data. EURUSD traded around 1.1630.

GBP rose on strong UK retail sales but eased slightly post-PMI data, peaking at 1.3359. - CAD drew attention after President Trump ended trade talks, with USDCAD trading around 1.40.

- JPY was subdued, with USDJPY reaching 153.06.

Commodities:

- Oil extended gains as progress in US–China trade talks brightened the outlook for energy demand and supported risk assets. Brent crude climbed above $66 a barrel after an almost 8% rally last week, while West Texas Intermediate traded near $62. Senior negotiators said they had agreed on a range of issues, clearing the way for Presidents Donald Trump and Xi Jinping to finalise a deal when they meet on Thursday.

- Gold fell, marking its first weekly decline since mid‑August, as US–China progress towards a trade deal and signs of an overstretched precious‑metals rally dampened safe‑haven demand. Bullion dropped as much as 1.2% to around $4,065 an ounce, with Washington and Beijing signalling they were close to a sweeping agreement as President Donald Trump visits the region for diplomatic talks. A deal would ease geopolitical tensions that have buoyed gold.

Fixed income:

- Treasuries ended Friday little changed, with yields within 1bp of prior closes after unwinding most of the rally sparked by softer‑than‑expected September CPI. A compressed auction cycle begins Monday with 2‑ and 5‑year note sales, likely adding pressure. Markets still price 25bp Fed cuts on Wednesday and in December as the US government shutdown delays employment and most other data. Rate‑volatility gauges neared the multi‑month lows last seen on 3 October. Australian bonds fell as US–China trade‑deal hopes curbed demand for safe‑haven assets, while New Zealand’s bond market was closed for a local holiday.

For a global look at markets – go to Inspiration.

This content is marketing content and should not be considered investment advice. Trading financial instruments carries risks and historic performance is not a guarantee for future performance.

The instrument(s) mentioned in this content may be issued by a partner, from which Saxo receives promotion, payment or retrocessions. While Saxo receives compensation from these partnerships, all content is conducted with the intention of providing clients with valuable options and information.