Outrageous Predictions

Carry trade unwind brings USD/JPY to 100 and Japan’s next asset bubble

Charu Chanana

Chief Investment Strategist

Key points:

------------------------------------------------------------------

Disclaimer: Past performance does not indicate future performance.

Macro:

Equities:

Earnings this week:

FX:

Commodities:

Fixed income:

For a global look at markets – go to Inspiration.

This content is marketing content and should not be considered investment advice. Trading financial instruments carries risks and historic performance is not a guarantee for future performance.

The instrument(s) mentioned in this content may be issued by a partner, from which Saxo receives promotion, payment or retrocessions. While Saxo receives compensation from these partnerships, all content is conducted with the intention of providing clients with valuable options and information.

Key points:

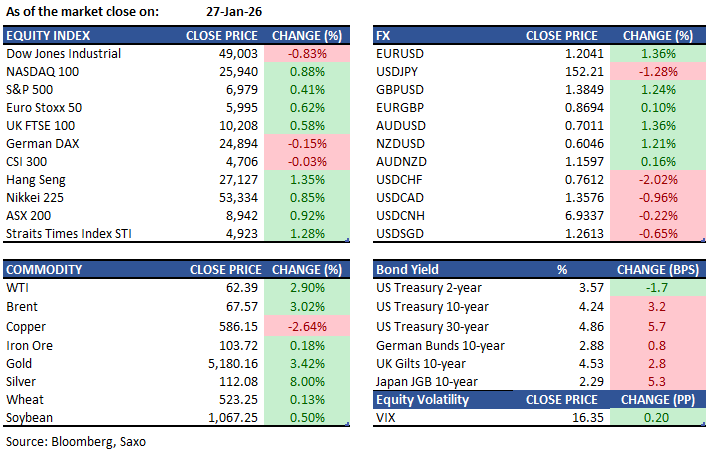

Macro: Potential govt. Shutdown due to Homeland Security funding disputes

Equities: UnitedHealth drops 19.6% on poor earnings; Seagate gains 8% post forecast

FX: USD falls sharply; CHF strengthens, USDCHF hits lowest since 2015

Commodities: Gold at record hitting $5,100; oil near 16‑week high

Fixed income: Treasury yields twist‑steepened driven by the long end

------------------------------------------------------------------

<Table with Source>

Disclaimer: Past performance does not indicate future performance.

Macro:

The Fed is likely to maintain interest rates, amidst concerns over political pressure and speculation of Trump naming a dovish Fed chair. The dollar is under pressure from potential shutdown fears due to Homeland Security funding disputes and a broader "sell America" trade amid possible US-Japan currency intervention.

The Case-Shiller Index rose 1.4% year-over-year in November 2025, slightly above October’s 1.3%, marking the first rise in ten months but near a two-year low. Home prices lagged 2.7% inflation. Chicago led with a 5.7% gain, while Tampa fell 3.9%, and Sun Belt markets like Phoenix, Dallas, and Miami also declined.

The finalized EU-India trade deal creates a free trade zone covering a quarter of global GDP and two billion people after nearly 20 years of negotiations. It aims to open markets amidst US tariffs and Chinese controls, with the EU expecting exports to India to double by 2032.

Equities:

US - US stocks were mixed Tuesday, with the S&P 500 up 0.5% to a record high and the Nasdaq gaining 1% as mega‑cap tech led the advance ahead of key earnings and the Fed decision. Microsoft rose 2.2% and Apple 1.1%, while chipmakers outperformed, including Micron (+5.4%) and Broadcom (+2.4%) on strong AI‑driven demand. General Motors jumped 8.8% after raising 2026 guidance. The Dow fell 0.8%, pressured by steep drops in UnitedHealth (‑19.6%) due to poor Q4 earnings and lower rate increases in medicare plans and CVS (‑14.1%), while Boeing slipped 1.6%. Seagate gained an additional 8% post market after forecasting strong Q3 revenue and earnings, resulting in gains in Western Digital, Sandisk and Micron up between 3% to 6%.

EU - European equities moved higher on Tuesday, extending the week’s gains on optimism around earnings and improved trade prospects. The STOXX 50 rose 0.7% to 6,000 and the STOXX 600 gained 0.6% to 613. The EU and India finalized a free trade agreement after nearly 20 years, expected to boost EU goods exports by 2032 through tariff reductions on over 96% of EU products. Argenx climbed 4% and ASML added 3.4% ahead of earnings, while banks stayed strong with UniCredit and BBVA up nearly 2%. Puma surged 9.9% after Anta Sports acquired a stake.

HK - Hang Seng jumped 1.4% to 27,127 on Tuesday, its fifth straight gain and near a two‑week high, as broad sector strength lifted the market. Sentiment improved following Wall Street’s continued rally ahead of the Fed decision. Financials rose 2.5% after China’s central bank pledged stronger market links with Hong Kong. Data showing China’s industrial profits grew in 2025 for the first time in four years also supported sentiment, though caution lingered ahead of upcoming PMI data. Zijin Gold surged 9.2% on plans to acquire Allied Gold, while Minimax, AIA, Techtronic, and China Taiping also posted strong gains.

Earnings this week:

Wednesday - ASML, GE Vernova, AT&T, Microsoft, Meta, Tesla, Lam Research, IBM

Thursday - Mastercard, Caterpillar, Nokia, Visa, Apple, Sandisk, SAP

Friday - Verizon, American Express, CN, Chevron, ExxonMobil

FX:

USD fell over 1%, reaching its lowest level in nearly four years after former President Donald Trump expressed indifference to the currency's decline.DXY hit a low of 95.953. Trump's comments suggest potential efforts to depreciate the dollar compared to major currencies.

JPY strengthened as USDJPY dropped 1.4% to 152.10, its lowest since late October. Japan's Finance Minister suggested possible coordinated intervention with U.S. authorities to stabilize the yen amid ongoing discussions ahead of the BoJ's April meeting.

EUR and GBPbenefited from the dollar's weakness, with EURUSD climbing 1.7% to 1.2081, and GBPUSD rising 1.4% to 1.3868, their strongest levels since 2021. The Swiss franc outperformed among G-10 currencies, driving USDCHF down 2.1% to 0.7605, a low not seen since 2015.

CAD strengthened, with USDCAD reversing gains and dropping as much as 1.1% to 1.3559, its lowest intraday level since July, ahead of the Bank of Canada's meeting.

Commodities:

Oil hovered near a 16‑week high as the dollar slumped and traders monitored US President Donald Trump’s threats against Iran, with WTI around $63 after a 2.9% jump to the highest since early October, while a dollar gauge hit a near four‑year low after Trump said he wasn’t concerned about US currency weakness.

Gold climbed to a record above $5,100/oz, rising as much as 3.6% to $5,190 as geopolitical risks and a flight from bonds and currencies extended its six‑session rally and a weaker dollar followed President Donald Trump’s remarks; silver held near a peak after a 9% jump, with YTD gains near 20% for gold and 50%+ for silver.

Fixed income:

Treasury yields twist‑steepened, with the long end up ~3bp and the 5‑year little changed as the belly firmed after a slightly tailing 5‑year auction and the front end outperformed on a soft January consumer‑confidence print; the US cycle wraps Thursday with a $44bn 7‑year sale, while focus turns to Japan’s ¥400bn 40‑year (Mar‑2065) JGB reopening a week after turbulence in that tenor rattled global rates.

For a global look at markets – go to Inspiration.

This content is marketing content and should not be considered investment advice. Trading financial instruments carries risks and historic performance is not a guarantee for future performance.

The instrument(s) mentioned in this content may be issued by a partner, from which Saxo receives promotion, payment or retrocessions. While Saxo receives compensation from these partnerships, all content is conducted with the intention of providing clients with valuable options and information.