Quarterly Outlook

Q3 Investor Outlook: Beyond American shores – why diversification is your strongest ally

Jacob Falkencrone

Global Head of Investment Strategy

Summary: AMD is down 28% from its recent high of $163.46, while NVDA is down by just 13%. What’s causing the big divide, and more importantly, is this a buying opportunity?

What’s going on in AMD?

While the current buzz around Generative Artificial Intelligence (AI) has sent stocks of chip makers soaring, AMD ended Tuesday’s session at $163.46, marking a 28% decrease from its recent peak of $227.30. The AI chip sector has been highly competitive, with key players such as Intel and Nvidia making significant breakthroughs in technology and growth.

However, despite the hype, most of the price gains goes to Nvidia as the computers that process data and power Generative AI run on Graphics Processing Units (GPUs) and Nvidia now controls about 80% of the GPU market. This puts them in the pole position that has helped to push their market valuation across $1 trillion.

With so much expectations built into the stock prices, it is inevitable for markets to cool and consolidate before resuming its uptrend even in a bull cycle let alone a correction.

When is a good time to buy AMD?

It is challenging to time the market consistently over time but valuations are starting to look more attractive than before especially for medium term investors. The fact that the stock price has already declined 28% from its recent highs could prove to be a good entry point for investors who wants to take a position in one of the largest chip makers in the world. But it is hard to make a case that we have seen the full scale of correction yet.

Back when the rivalry between Intel and AMD were strong in the CPU space, AMD was the underdog for many years before they turned things around. This could turn out to be the same for the competition in the AI chips space.

What can you do?

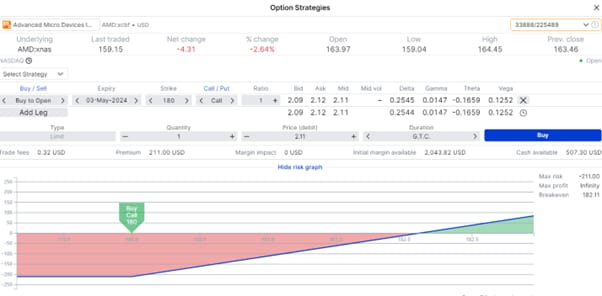

Investors who are bullish on the stock may buy calls directly on AMD. Buying a call gives you the right to buy the underlying stock at the strike price any time before the option expiry. Call options can be an alternative to outright stock purchase, allowing for profit when AMD rises while keeping the maximum risk limited to the premium paid if the stock were to correct further. Call options also provide leverage, offering the exposure to more shares than your initial capital might allow.

Steps:

1. With AMD’s stock at $163 on 18th April 2024, a 2-week out of the money call option with a $180 strike could be purchased for $212, giving you exposure to 100 shares.

2. If AMD rises above $180, you will be effectively long 100 shares from $180 at expiry.

3. If AMD stays below $180, the call option will expire worthless.

What if you think AMD might fall further?

If you think AMD still has further downside before it becomes an attractive stock to purchase, you can look to sell cash secured puts.

Selling puts means that you receive a premium while waiting for your stock to fall to your ideal purchase price (strike). If the stock falls below the strike, and the option is exercised against you, you would be obliged to purchase the stock at the predetermined strike price.

Steps:

1. With AMD’s stock at $163 on 18th April 2024, sell an out of the money put option on AMD with a $145 strike price for $2.68 with a 2 week expiry (15 days). You receive a total of $268 ( $2.68 x 100 shares).

2. This is an annualized yield of 39.4% (2.68/163) x (360/15 days)

3. If AMD's price falls below $145 at expiry, you have the opportunity to purchase the stock at $145—a good discount from the current price of $163.

4. If AMD’s price stays above $145, the option expires worthless and you get to keep the premium of $268.

Options are complex, high-risk products and require knowledge, investment experience and, in many applications, high risk acceptance. We recommend that before you invest in options, you inform yourself well about the operation and risks. In Saxo Capital Markets' Terms of Use, you will find more information on this in the Important Information - Options, Futures, Margin and Deficit Procedure. You can also consult the Essential Information Document of the option you want to invest in on Saxo Capital Markets' website.

This article may or may not have been enriched with the support of advanced AI technology, including OpenAI's ChatGPT and/or other similar platforms. The initial setup, research and final proofing are done by the author.