Key points:

- AI driving financial strength: Broadcom delivered strong Q3 results with revenue up 22% YoY to $15.95bn and AI revenue surging 63% to $5.2bn. Q4 guidance calls for $17.4bn total revenue and $6.2bn from AI, underscoring AI’s rising share of the business.

- OpenAI partnership as a game-changer: Broadcom’s $10bn deal to co-develop a custom AI chip with OpenAI (production in 2026) secures multi-year revenue visibility and reduces hyperscaler dependence on Nvidia.

- Strategic edge with risks: Broadcom’s “picks-and-shovels” positioning spanning custom chips, Ethernet networking leadership, and VMware’s enterprise AI software makes it a central player in AI infrastructure. However, execution, competition, and potential hyperscaler capex pullbacks remain critical risks.

Broadcom has emerged as one of the most important “behind-the-scenes” players in the AI revolution. The company’s latest partnership with OpenAI, co-developing a new AI chip slated for 2026, cements its role as a critical supplier of the infrastructure that powers artificial intelligence.

For investors, the takeaway is clear: Broadcom is not just riding the AI wave, it is shaping the rails on which it runs.

OpenAI deal: A defining moment

Broadcom confirmed a new multi-billion-dollar AI customer order, which was later reported to be OpenAI.

OpenAI will co-develop a custom AI accelerator with Broadcom, with mass production expected in 2026. The contract is estimated at around $10 billion, making it one of the largest bespoke chip partnerships in the AI industry.

OpenAI’s decision to design its own chips with Broadcom is more than a headline. It signals two key shifts:

- Diversification away from Nvidia – OpenAI’s reliance on Nvidia has been immense, but designing in-house chips reduces single-vendor dependence. Broadcom is now at the center of that diversification.

- Sticky, long-term revenues – Chip design partnerships typically span multiple product generations. If the first OpenAI chip succeeds, Broadcom will likely see repeat business over the next decade.

For investors, this provides multi-year revenue visibility and validates Broadcom’s role as a critical enabler of the AI ecosystem.

The AI growth engine

Broadcom’s latest quarterly results highlight how much AI is already reshaping its business:

- Revenue: $15.95bn, up 22% year-on-year.

- AI revenue: $5.2bn, up 63% YoY, showing accelerating momentum.

- GAAP net income: $4.1bn, versus a loss a year ago.

- Adjusted EBITDA: $10.7bn, up 30% YoY, at a margin of 67%.

- Free cash flow: $7.0bn, up 47% YoY, equal to 44% of revenue.

- Dividend: $0.59 per share, returning $2.8bn to shareholders.

CEO Hock Tan pointed to strength in custom AI accelerators, networking, and VMware, underscoring the company’s diversified AI positioning.

Looking ahead, Broadcom expects further growth in Q4 FY2025:

- Revenue guidance: ~$17.4bn, up 24% YoY.

- AI revenue guidance: ~$6.2bn, marking the 11th consecutive quarter of AI growth.

- Adjusted EBITDA margin: Expected to remain strong at 67% of revenue.

This guidance shows AI is becoming an increasingly dominant driver of the company’s overall top line.

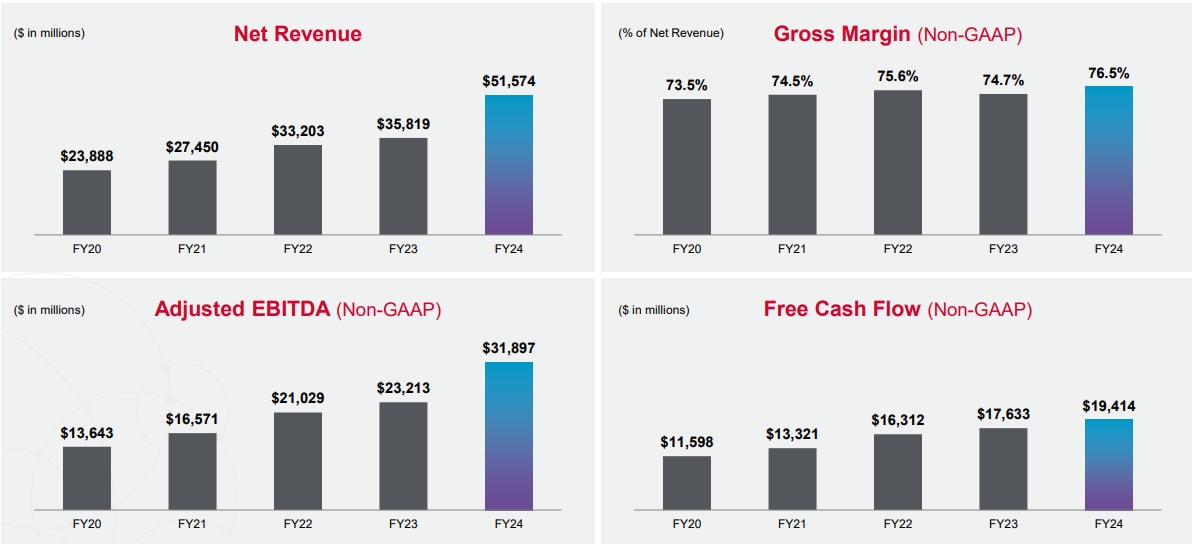

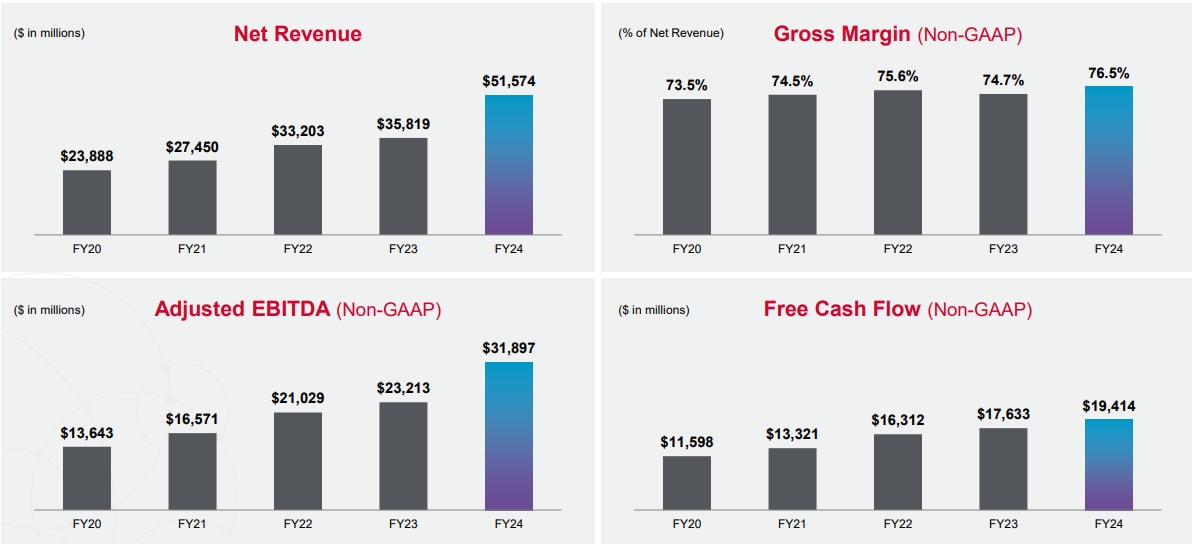

Source: Broadcom

The strategic edge

Unlike rivals focused only on hardware, Broadcom is also expanding into AI infrastructure software, building a cohesive ecosystem that strengthens client retention and upsell opportunities.

Broadcom’s positioning is unique because it touches multiple layers of the AI stack:

- Custom AI chips: Now including OpenAI, Broadcom already designs accelerators for major tech players.

- Networking leadership: Its Ethernet products dominate the market for connecting thousands of chips together in AI data centers—an alternative to Nvidia’s more closed systems.

- Enterprise AI (via VMware): With VMware Cloud Foundation embedding AI capabilities, Broadcom also has exposure to companies running AI on private or hybrid systems.

This “multi-pronged” approach makes Broadcom less dependent on any single client, model, or trend.

Broadcom’s ability to deliver end-to-end solutions, from silicon to software, is becoming a key differentiator in a market where integration matters most.

Risks investors should track

No investment story is without challenges:

- Execution risk: If OpenAI’s new chip faces delays, the $10bn revenue opportunity could be pushed out.

- Competitive pressure: Nvidia’s next-generation systems still set the benchmark. Broadcom must prove that Ethernet-based networks can scale as efficiently.

- Hyperscaler capex pullback: Cloud giants continue to spend heavily on AI infrastructure, but questions about how quickly AI investments translate into profits could lead to a slowdown in spending. If hyperscalers rein in budgets, Broadcom’s growth trajectory could moderate.

- Innovation challenge: Can Broadcom maintain its pace of innovation in such a rapidly evolving field?

- Macro/geopolitics: Export restrictions to China and slower global IT spending could weigh on near-term results.

Investment takeaway

Broadcom is evolving into a picks-and-shovels leader of the AI economy. Unlike pure AI model companies, it profits from the infrastructure demands of the entire ecosystem—training chips, networking, and enterprise software.

For investors, Broadcom offers:

- Strong AI revenue momentum already visible in earnings.

- Long-term visibility through the OpenAI partnership.

- Diversification across hardware and software layers of AI.

The risks are real, but the structural trend of rising AI infrastructure spending gives Broadcom an enviable positioning.