Outrageous Predictions

A Fortune 500 company names an AI model as CEO

Charu Chanana

Chief Investment Strategist

Chief Investment Strategist

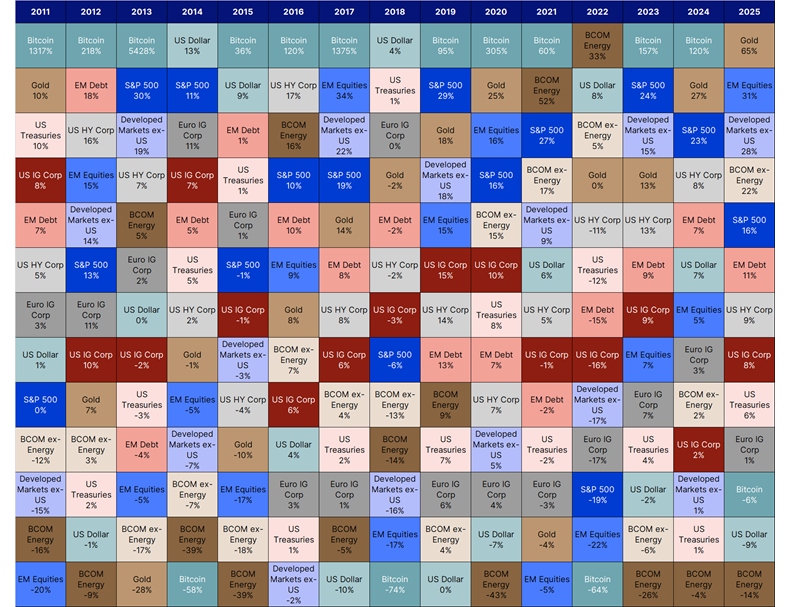

2025 delivered a clear message: market leadership can shift quickly, and portfolios need to be prepared for that.

Different parts of the portfolio worked for different reasons—which is exactly what diversification is meant to achieve.

In 2023 and 2024, bitcoin was the standout performer. In 2025 it turned negative, while gold moved to the top of the table.

The takeaway is not a debate about which asset is “better.” It is a reminder that markets rotate, and the trades that become most popular can also become the most vulnerable when conditions change.

Portfolio lesson: avoid building a strategy around what just worked. It can leave you exposed when leadership shifts.

For several years, investors could feel comfortable with a US-heavy approach. In 2025, returns broadened: EM equities (+31%) and Developed Markets ex-US (+28%) outperformed the S&P 500 (+16%).

This doesn’t mean the US market is no longer attractive. It does mean that relying on one region can create unnecessary dependence on a single set of outcomes—policy, growth, earnings, and valuation trends.

Portfolio lesson: global exposure is not about being “balanced for the sake of it.” It is about being prepared when leadership rotates away from the same winners.

Gold and broad commodities ex-energy performed well in 2025. For long-term investors, that is important because these assets often play a different role than equities: they can help when the macro backdrop is uncertain, when inflation concerns re-emerge, or when investors want protection against geopolitical risk.

Diversifiers are rarely popular in calm markets. Their value becomes clearer when a portfolio needs sources of return that are not tied to equity performance alone.

Portfolio lesson: a good portfolio does not depend on one engine. It has more than one way to work.

The US dollar fell -9% in 2025. That matters because currency moves can lift or drag returns, even when the underlying assets perform as expected.

Many investors carry more USD exposure than they realise, simply because their holdings are dominated by US assets or USD-based instruments. When the dollar moves, it can change the results meaningfully.

Portfolio lesson: understand whether you are unintentionally making a large currency bet—and whether you are comfortable with it.

A key feature of 2025 was the divergence inside commodities: BCOM ex-Energy rose +22%, while BCOM Energy fell -14%.

This is a useful reminder that energy prices are driven by their own set of factors—supply decisions, inventories, demand sensitivity, and geopolitics—while other commodity groups can behave quite differently.

Portfolio lesson: broad labels can hide important differences. Investors should be clear about what they own and why.

2025 was a reminder that long-term investing is less about finding the next hero and more about building a portfolio that can withstand leadership changes.

It simply means markets rotate, narratives fade, and discipline tends to beat prediction over time.