Futures - An introduction

Level: Beginner / Length: 13 minutes

This module is all about futures trading, what futures contracts actually are, how they work in the marketplace and why you might want to start trading them. Though not a preferred instrument for risk-averse investors, the futures market is extremely liquid and is therefore highly attractive to the more enterprising trader.

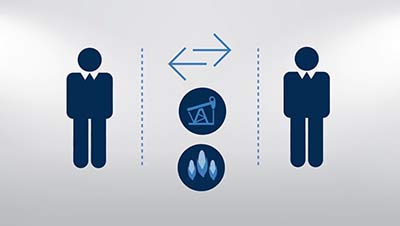

The simple definition of a futures contract is that it’s an agreement between a buyer and a seller. It’s an agreement to buy or sell a specific asset – such as a commodity or a financial instrument - at an agreed price at a date in the future. Futures are traded on exchanges all over the world. Most futures traders don’t engage to take delivery of the asset – bushels of corn for example – instead they speculate on price movements, similar to stock investments. In this course you’ll learn about:

- The workings of a futures contract

- Hedgers and speculators and their roles

- The key terminology used in futures trading

- How futures might work for your trading

IMPORTANT INFORMATION

The materials published on all Saxo Group websites should not be considered as financial, investment, tax, trading or other advice, or recommendation to invest or disinvest in a particular manner. Saxo assumes no liability for any losses resulting from trading in accordance with a perceived recommendation or reliance on Saxo material. Past performance is not indicative of future results.