CFDs Margin, leverage and assets for CFD trading

Level: Beginner / Length: 12 minutes

In this module we’ll expand on the subject of margin and leverage and look more closely at the key characteristics of CFDs. We’ll also explore ‘short’ positions and how they impact profits and losses.

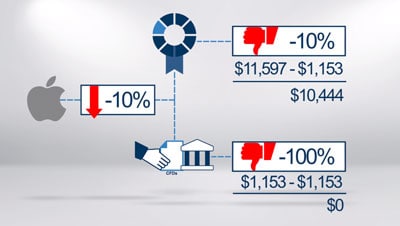

Margin is essentially ‘borrowed’ money. It gives the CFD trader the opportunity to trade on leverage. It is very important to understand that CFD trading magnifies both profits and losses. Whilst potential profits can be increased (due to the fact that the full Stocks price of the CFD position has not been funded by the trader), losses can also be higher.

- The importance, benefits and risks of using leverage

- How margins create leverage or gearing

- How to calculate percentage profits and losses

- And how to take a ‘short’ position

IMPORTANT INFORMATION

The materials published on all Saxo Group websites should not be considered as financial, investment, tax, trading or other advice, or recommendation to invest or disinvest in a particular manner. Saxo assumes no liability for any losses resulting from trading in accordance with a perceived recommendation or reliance on Saxo material. Past performance is not indicative of future results.