Balanced ETF portfolios GBP Q34 2021 commentary

| Asset classes | Stocks (developed and emerging equity), bonds, non-traditional |

| Instruments | ETFs |

| Investment style | Macro, diversified investment focus |

| Quarterly return (net of fees) | |

| Defensive | 2.11% |

| Moderate | 3.42% |

| Aggressive | 4.62% |

Market overview

Q4 2021 was generally positive for risky assets, as investors focused on economic resilience and corporate earnings. The quarter began with the emergence and spread of the new Omicron variant across the globe, necessitating new restrictions in some economies. Europe, in particular witnessed high resurgence rates and a rise in hospitalizations, forcing governments to re-introduce restrictions on activity. As such, markets witnessed some deleveraging of risky assets and equities in a typical risk-off move. As the quarter progressed, mounting evidence arguing that the Omicron variant was a ‘less deadly one’, dissipated some investor concerns and resulted in risky assets rallying back up.

In general, developed market equities performed better than their emerging market peers, wherein China continued to remain a drag on performance, given its regulatory uncertainty and ‘Zerocovid’ stance.

On the policy front, the quarter saw the Fed opting for a more aggressive stance on tackling inflation which was seen rising at its fastest pace to 6.8% year-over-year in November. The Fed conceded that there are mounting signs that inflation is not only broadening out, but also at a greater risk of becoming more entrenched. As such, it is set to double the pace of tapering of its pandemic-era stimulus package.

On the macro front, December saw a string of robust economic data releases. The U.S. unemployment rate fell further to 3.9%, with job creation being the highest in the leisure and hospitality sector, suggesting a recovering labour market.

The U.S. Composite PMI printed at 57, suggesting that the economy was still in strong expansionary territory. On the other side, the Eurozone Composite PMI printed 53.3 in December. Within fixed income, government bonds showed mixed performance, with inflation linked bonds performing better than nominal government bonds. On the credit side, high yield bonds outperformed investment grade bonds in an overall risk-on market environment.

Portfolio performance

| Returns net of fees | Defensive | Moderate | Aggressive |

| Oct | 1% | 1.7% | 2.3% |

| Nov | 0.6% | 0.5% | 0.5% |

| Dec | 0.5% | 1.2% | 1.7% |

| Since Inception (Feb 2017) | 32.6% | 55.76% | 67.10% |

All models posted positive returns over Q4 2021. Broad equities were the largest contributor to return, especially US equities, which were particularly resilient in the Omicron driven risk-off rotation we saw in November that benefitted sectors like IT.

UK equity and European equity were also strong contributors, benefitting especially in December from the cyclical recovery observed in equity markets as it became clear that Omicron may not be as large a headwind to global economic activity as initially feared.

Emerging markets equity was a drag across the period. Fixed income was also a broad contributor over the quarter, with modest contribution from longer dated Gilts, Index Linked Gilts and Treasuries.

Gold contributed modestly over the period, whereas high yield and emerging market debt has a very muted impact on performance over the quarter. Portfolio Allocation and top portfolio holdings (as of Dec

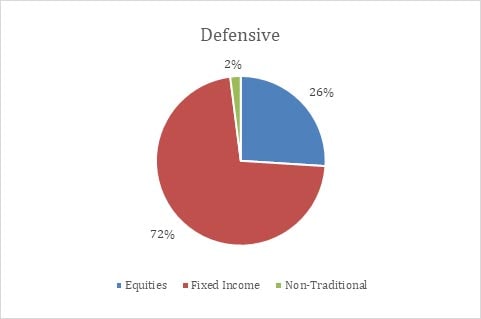

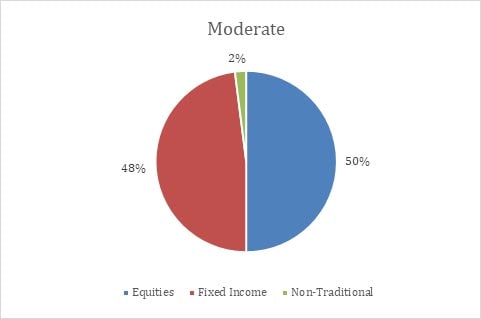

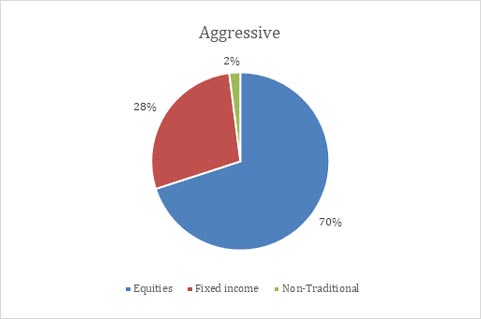

Portfolio Allocation and top portfolio holdings (end of Dec 2021)