Quarterly Outlook

Q3 Investor Outlook: Beyond American shores – why diversification is your strongest ally

Jacob Falkencrone

Global Head of Investment Strategy

Head of Macroeconomic Research

The US expansion, which started in 2009 when the then-Federal Reserve chair Ben Bernanke noticed “green-shoots”, is one of the oldest on record. Assuming that we make it to July 2018 (which is highly certain), the current expansion will be nine years old. That said, warning signs are popping up here and there, indicating that the economy is losing momentum.

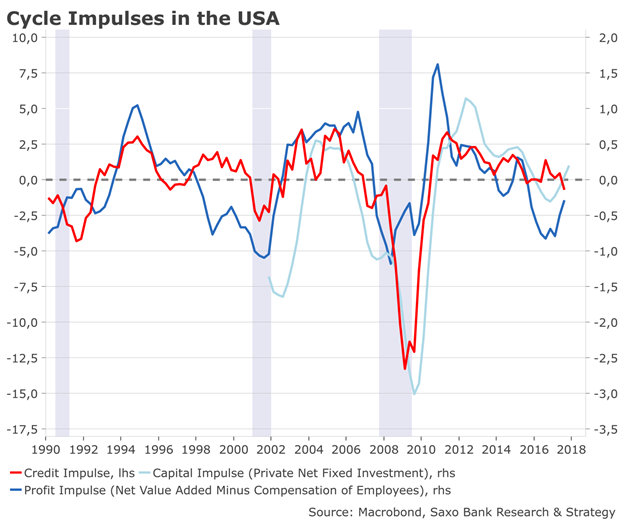

Two of three key drivers of the US economy are negative: credit impulse (which represents the flow of new credit issued by the private sector in % of GDP) and profit impulse (calculated as net value added minus compensation of employees).

Chart explanation: Credit impulse is calculated based on the flow of loans from the domestic nonfinancial sector on a quarterly basis, then a second derivative is calculated and finally expressed as a percentage of GDP. Capital impulse represents net fixed investments as a percentage of GDP. Profit impulse is the net value added minus compensation of employees expressed as a percentage of GDP.

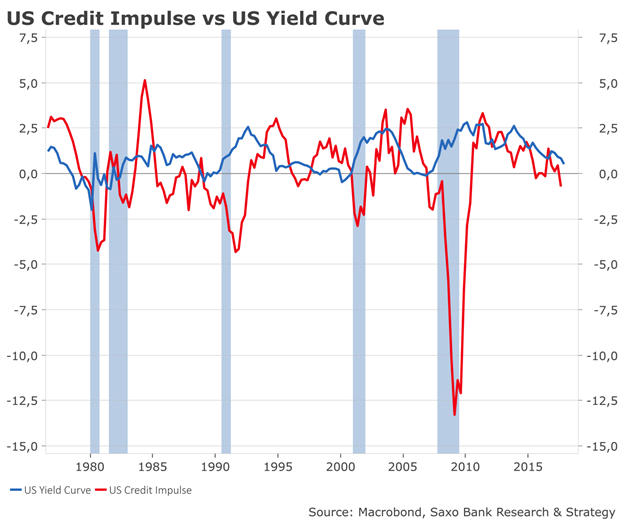

The US credit impulse, which leads the real economy by nine to 12 months, has been in contraction since Q3 2017. It was running at 0.4% of GDP in Q2 and by Q3 it had fallen to minus 0.7% of GDP. The magnitude of this negative impulse is not comparable with the decline observed after Lehman Brothers but the signs are still worrying. The recent negative trend could be confirmed on March 8 with the release of data about the flow of funds from domestic nonfinancial sectors for Q4 2017 by the Fed. The slowdown is also visible in demand for C&I loans which has declined over the past quarters to 1.6% year-on-year in Q4 2017 versus 5.4% y/y in Q4 2016 on the back of tightening standards on loans and monetary policy normalisation.

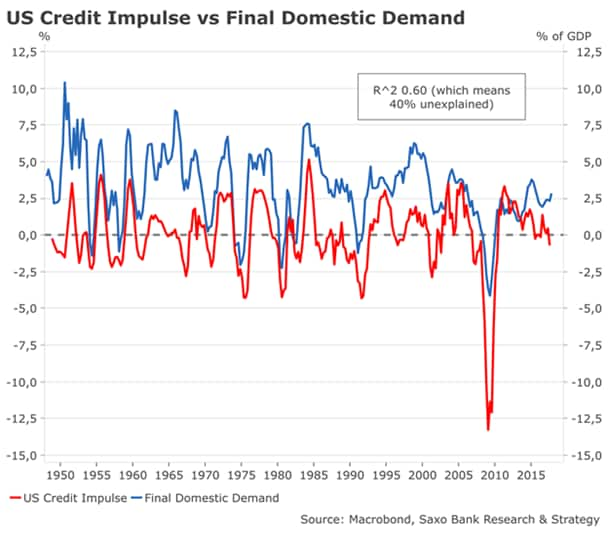

In a highly leveraged economy like the US, credit is a key determinant of growth. In the coming quarters, lower credit generation will translate into lower demand and lower private investment, thought it might be partially mitigated by Trump’s tax reform. There is a high correlation (0.70) between US credit impulse and private fixed investment and a significant (0.60) correlation between credit impulse and final domestic demand.

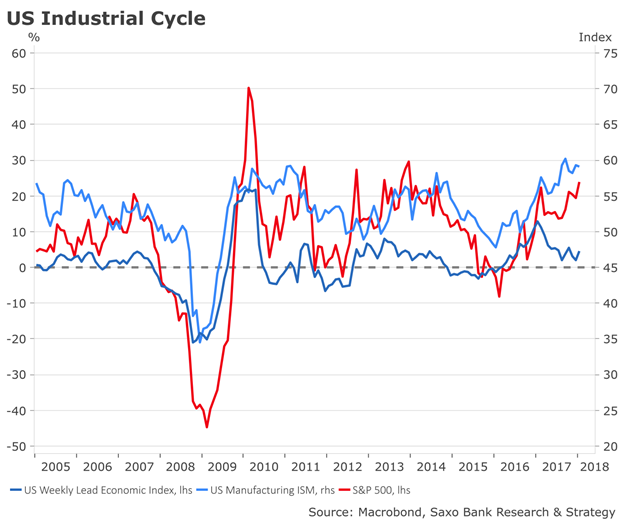

Lower credit generation is happening at a pivotal moment for the US economy since the risk of a downturn in the industrial cycle has increased over the past six months. US manufacturing, known as an efficient coincident indicator of the industrial earnings cycle, has certainly already reached a peak in the cycle. It hit a 13-year high in September 2017 at 60.2 and since then it has slightly decreased to 59.1 in January of this year.

The combination of a contraction in the US credit impulse, lower but not yet negative C&I loans growth, and the risk of yield curve inversion are clear signs that the USs is close to the end of the cycle. So far, these indicators have not yet reached levels associated with a recessionary risk but they validate the scenario of an upcoming economic slowdown that could be worsened when the lagged effect of decline in China's credit impulse since last year also impacts global growth.

For more on the US credit impulse, download Saxo Bank's monthly view of this metric here.