Quarterly Outlook

Q3 Investor Outlook: Beyond American shores – why diversification is your strongest ally

Jacob Falkencrone

Global Head of Investment Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: Japan Unemployment Rate (Jun), Australia Building Approvals (Jun), Spain Flash CPI (Jul), German GDP (Q2) and Prelim. CPI (Jul), EZ Consumer Confidence Final (Jul), US JOLTS (Jun)

Earnings: AMD, Microsoft, Pfizer, Paypal, Procter&Gamble, Starbucks, BP

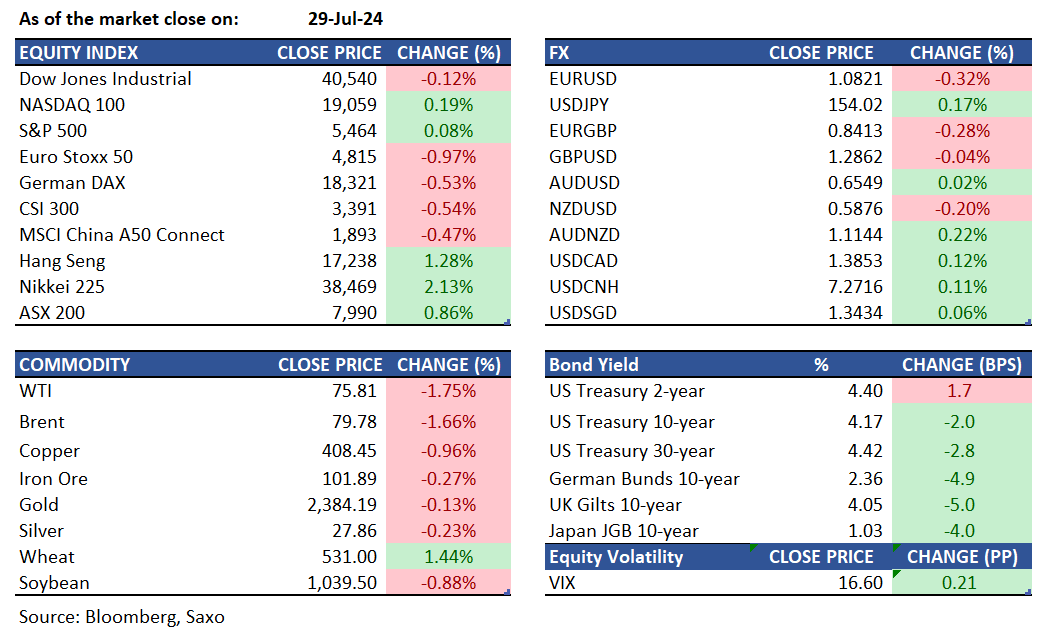

Equities: US stocks saw modest gains, with the S&P 500 and Nasdaq 100 each closing 0.1% higher, while the Dow dropped 49 points. Heavyweight tech companies like Microsoft, Apple, Alphabet, and Amazon, which gained between 1.5% and 0.3% as they prepare to release their Q2 earnings report this week while Tesla surged 5.6% after a Morgan Stanley upgrade. Investors are eyeing key earnings reports and a Federal Reserve monetary policy decision due Wednesday. The Fed is expected to maintain its funds rate, but markets will scrutinize the FOMC's rhetoric for hints of a possible rate cut in September. On Semiconductor and McDonald's reported strong earnings, both up 11.5% and 3.7% respectively. In extended trading, CrowdStrike tumbled more than 5% following reports that Delta Air Lines hired an attorney to seek damages from CrowdStrike and Microsoft after an outage led to thousands of flight cancellations.

Fixed income: Treasuries closed Monday with slightly lower yields and a marginally flatter curve, supported by favorable short-term technical factors such as the absence of note auctions until August 6 and the month-end index rebalancing on Wednesday. With few other catalysts, the yield on the 5-year note reached its lowest level since March, and the 50-day moving averages for both 5- and 10-year yields fell below their 200-day averages, indicating a downward trend since late May. The 5-year note's yield touched 4.037%, the lowest since March 11. The Treasury's latest cash balance estimate for the upcoming quarter suggests reduced borrowing and a smaller cash buffer by year-end, with the debt ceiling set to be reinstated at the beginning of 2025. The Treasury Department now projects $740 billion in net borrowing from July through September, with a cash balance of $850 billion. For the October to December period, debt managers expect $565 billion in net borrowing, with a cash balance of $700 billion at the end of December.

Commodities: Gold prices fell by 0.13% to $2,377.80 an ounce, erasing earlier gains amid geopolitical tensions and expectations of a U.S. rate cut in September. Markets are focused on this week’s Federal Reserve policy meeting. Oil prices continued to decline, with prices dropping by 1.75% to $75.81 per barrel, a two-month low. Brent Crude futures also fell by 1.66% to $79.78 per barrel. The OPEC+ meeting will be closely watched for any policy changes. Natural gas prices dropped, with the August contract expiring at $1.907 per mmBtu (down 4.9%) and September delivery slipping by 0.7% to $2.036 per mmBtu, marking the fifth consecutive session of declines

FX: The US dollar started the week firmer ahead of key event risks from major central bank meetings and Big tech earnings in the week. The euro weakened the most against the buck relative to its G10 FX peers, and Germany’s Q2 GDP and flash CPI report out today will be key. Both activity and haven currencies were softer, although the Australian dollar was resilient ahead of the Q2 inflation report on Wednesday and British pound also held up ahead of the Bank of England meeting on Thursday. The Japanese yen was also back lower after last week’s surge, but remains very volatile ahead of the Fed and Bank of Japan meeting announcements. We covered the Fed preview here and how to position for the announcement here.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.