Quarterly Outlook

Investor Outlook: Beyond American shores – why diversification is your strongest ally

Jacob Falkencrone

Global Head of Investment Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: Sweden CPIF (Jun), French & Spanish Final CPI (Jun), US PPI (Jun), Uni. of Michigan Prelim. (Jul), Chinese Trade Balance (Jun)

Earnings: JPMorgan Chase, Wells Fargo, Citi, BNY Mellon, Fastenal, Ericsson

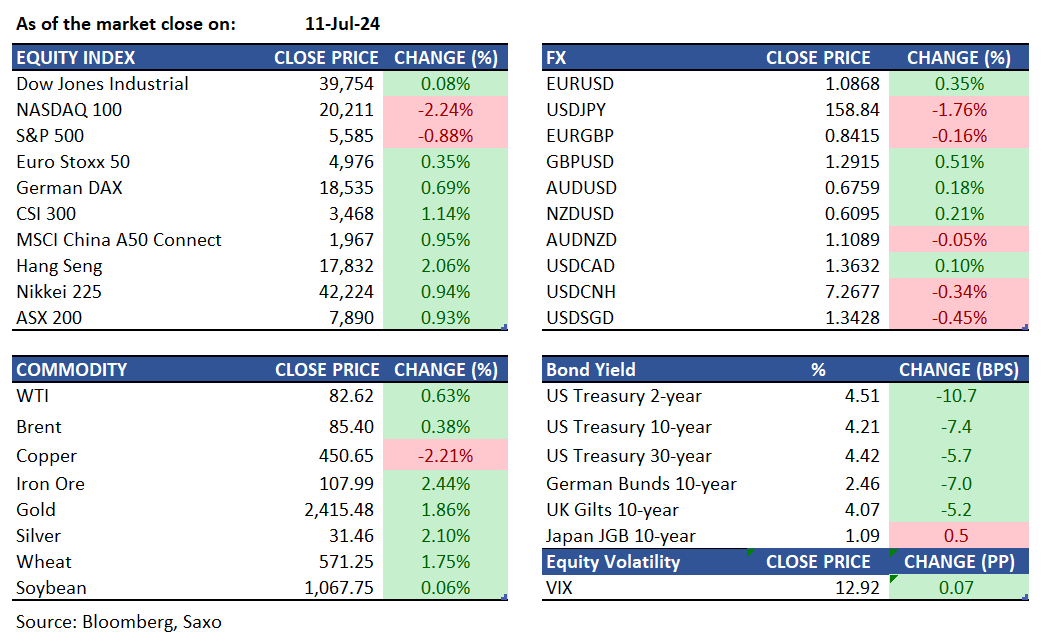

Equities: U.S. equities experienced significant sector rotation following a softer-than-expected June inflation report. The Russell 2000 index surged over 3.5% (YTD +1.2%), while the AI-driven Nasdaq 100, which had been on a 7-day winning streak and hitting record highs, dropped 2.24%. The S&P 500 (SPX), which closed above 5,600 for the first time on Wednesday, also fell more than 60 points from its intraday highs, trading below the previous day's lows. Tesla fell 8.4%, snapping an 11-day winning streak after delaying its Robotaxi launch to October from August. The CPI report increased expectations for a 25-bps rate cut from the Fed in September, with potential for another cut in late 2024, boosting interest rate-sensitive sectors such as homebuilders, finance/lending stocks, solar companies, and utilities.

Fixed income: Treasury yields plummeted after mild inflation data reinforced confidence that the Federal Reserve will cut interest rates at least twice this year. Treasuries rallied on Thursday, highlighted by a significant bull-steepening move driven by increased expectations for Fed rate cuts this year and next. The front-end and belly of the yield curve outperformed, pushing the 5s30s curve to its steepest level since February. Weak demand for the 30-year bond auction during the US afternoon further contributed to the steepening trend. Most rates fell to their lowest levels since March, with two-year yields — which are more sensitive to changes in Fed policy — dropping as much as 13 basis points to 4.486%.

Commodities: Gold surged past $2,410 per ounce, nearing its record-high close, driven by expectations of Federal Reserve rate cuts. WTI crude oil futures rose 0.6% to $82.62 per barrel due to a significant drawdown in US crude inventories and softer inflation. US natural gas futures fell below $2.3/MMBtu, hitting a two-month low due to a larger-than-expected storage build. Copper futures traded near $4.5 per pound amid demand uncertainties in China and rising inventories. Investors are looking to a key political meeting in China next week for potential economic support.

FX: The cooler US inflation fueled gains in the Japanese yen, and suspected intervention from Japanese authorities amplified the move. While Japanese authorities have not confirmed intervention, another few rounds of yen strength this morning have prompted intervention talk. Volatility in the yen remains high and BOJ may need to follow up with a rate hike at the July meeting to make this move in yen sustainable. Sterling also gained on the back of strong monthly GDP report in the UK, but Aussie dollar erased its gains. We wrote an FX note yesterday to discuss the cyclical weakness in the US dollar and which G10 currencies can benefit. Focus today will be on US PPI report to confirm the softening trend seen in the CPI. Sweden’s inflation will also be on the radar with Riksbank hinting at three more rate cuts this year.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.

Q3 Macro Outlook: Less chaos, and hopefully a bit more clarity