Quarterly Outlook

Q3 Investor Outlook: Beyond American shores – why diversification is your strongest ally

Jacob Falkencrone

Global Head of Investment Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: Eurozone Industrial Production, Eurozone CPI, Japan Industrial Production, U. Michigan Consumer Sentiment

Earnings: N/A

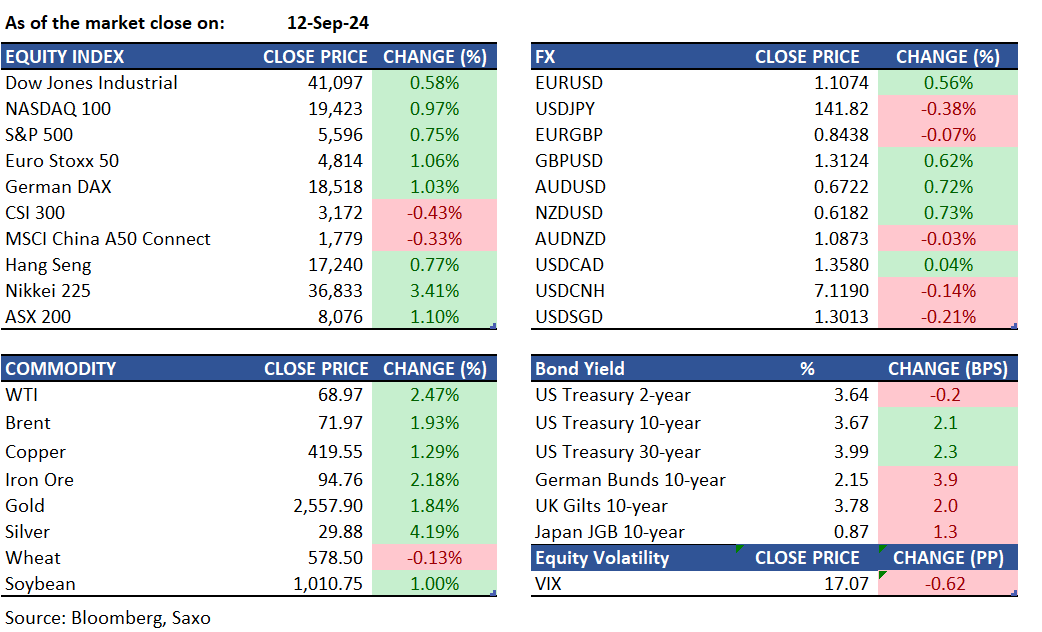

Equities: US equities continued their rise for the second day in a row on Thursday, fueled by strong performances in tech and semiconductor stocks as investors digested key inflation and labor data. The S&P 500 gained 0.7%, the Nasdaq 100 went up by 1%, and the Dow Jones climbed 235 points. Leading the rally were major tech giants, with Nvidia up 1.9% and Alphabet and Meta Platforms increasing by 2.3% and 2.7%, respectively. All sectors closed in the green, with communication services and consumer discretionary showing the strongest gains. The August Producer Price Index (PPI), came in slightly above forecasts, rising 0.2% month-over-month, while the month-over-month core PPI figure came in at 0.3%, also above forecasts of 0.2%. This follows a trend seen in consumer price data and raises expectations for a 25-basis-point interest rate cut at next week’s Federal Reserve meeting. Moderna fell 12.3% after announcing plans to cut $1.1billion in expenses by 2027 which included some pauses on some products in its pipeline and trimming R&D expenditure.

Fixed income: Early Treasuries were impacted by weaker bund prices after ECB President Christine Lagarde announced that interest rates would stay sufficiently restrictive following an anticipated quarter-point cut to 3.5%. Losses continued through the US afternoon session, including the 30-year bond auction, which tailed by 1.4bp. The September Fed-OIS sold off slightly, increasing the chances of a half-point rate cut after a Wall Street Journal report indicated policymakers were debating between a 25bp or 50bp cut. Treasury yields had risen by up to 3bp across the long end, with a bear steepening move widening the 2s10s and 5s30s spreads by 1.5bp and 1bp, respectively. The 10-year yield ended around 3.675%, near the day's lows, while bunds lagged by about 2bp. The 30-year bond auction saw slightly weak pricing, tailing by 1.4bp, though bidding metrics were solid.

Commodities: Oil prices rebounded with Brent Crude futures rising by 1.93% to$71.97, and WTI crude increasing by 2.47% to $68.79. According to the IEA's monthly report, global oil demand growth is "slowing sharply" due to China's cooling economy, pushing prices to a three-year low. Gold prices closed near record highs, with gold spot rising by 1.84% to $2,557.90. Silver also surged 4.19% to $29.88, driven by expectations of an upcoming Federal Reserve rate cut amid signs of a slowing US economy.

FX: EURUSD trading above $1.1 as traders digested the ECB's decision to lower borrowing costs, with inflation data aligning with expectations and core inflation projected higher for 2024 and 2025. The ECB plans to keep restrictive policy rates and follow a data-dependent approach, with traders anticipating one or two more rate cuts this year. GBPUSD trading above $1.3 amid mixed economic data, including stalled GDP growth, lower wage growth, and a slight drop in unemployment. The Bank of England is expected to cut rates in November and possibly December. The Japanese yen eased to around 142.5 per dollar as the US dollar strengthened on mixed inflation data, but remained near its highest levels this year, with BOJ officials indicating plans to steadily hike rates to achieve a 2% inflation target. Dollar index (DXY) fell to 101.50.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.