Quarterly Outlook

Q3 Investor Outlook: Beyond American shores – why diversification is your strongest ally

Jacob Falkencrone

Global Head of Investment Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: Swiss CPI (Sep), EZ/UK/US Final Services and Composite PMIs (Sep), US Durable Goods R (Aug), US ISM Services PMI (Sep), US Initial Jobless Claims, Mainland China market holiday

Earnings: Constellation Brands, Angiodynamics

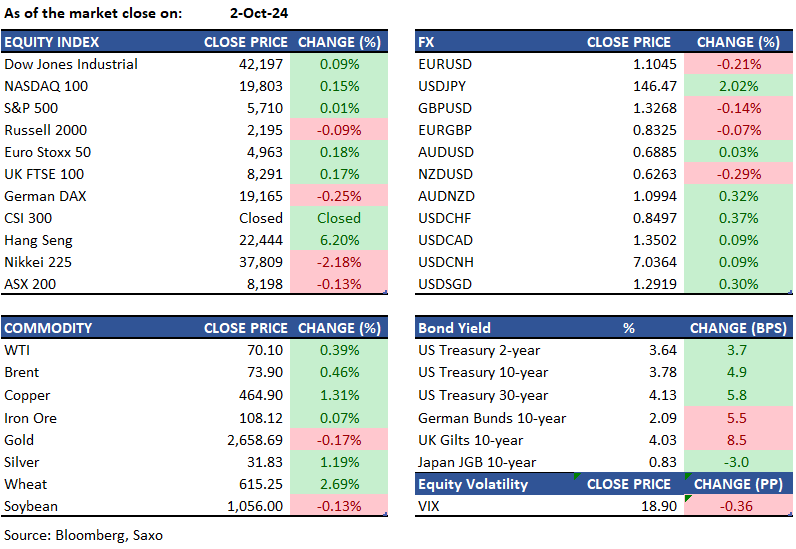

Equities: US stocks closed slightly higher on Wednesday as investors remained cautious due to escalating tensions in the Middle East. The S&P 500 ended nearly flat, while the Dow Jones gained 39 points and the Nasdaq inched up by 0.1%. Meanwhile, Hang Seng Index continues to make new highs, gaining 6.2% in the Asia session, with consumer and property names outperforming. Meituan was up 14.6% yesterday while Longfor Group rose 24.7%. ADP jobs data revealed stronger-than-expected growth, with 143,000 private-sector jobs added in September, prompting investors to look forward to Friday’s jobs report for more insights into the economy and the Fed’s interest rate decisions. Nike shares fell 6.8% post earnings after withdrawing its full-year outlook, and Tesla dropped 3.5% following weaker-than-expected deliveries numbers (462,890 vs 463,310). Defense and energy stocks continue to be in focus with rising geopolitical tensions. You can refer to the defence theme page for inspiration.

Fixed income: Treasuries declined influenced by a larger-than-expected rise in the September ADP employment change and an upward revision to August's data, as well as rising oil prices during the US morning session. Yields retreated from their session highs as oil prices reversed most of a 3.8% surge. Yields ended the day 3 to 6 basis points higher across the curve in a bear-steepening move, with the 2s10s and 5s30s spreads widening by 3 basis points and 2 basis points, respectively. The 10-year yield settled around 3.785%, closer to the higher end of its daily range of 3.722% to 3.815%. Most of the losses occurred shortly after the ADP data release, with futures block trades, particularly those involving 2-year and 5-year contracts, contributing to a steeper yield curve.

Commodities: WTI crude futures rose overnight due to concerns about Israel's potential response to Iran's missile attack. Despite no significant changes in OPEC+ production expectations, the anticipation of increased production starting December 1st and an EIA crude oil inventory report showing a build instead of a projected draw led to a midday decline in futures. WTI crude November contract closed near its low but still gained 0.39% to $70.10, while Brent increased by 0.46% to $73.90. Gold fell by 0.17% to $2,658, and silver rose by 1.19% to $31.83. The decline in precious metals was the third in four sessions, mainly due to profit-taking after recent gains and a stronger US Dollar.

FX: The Japanese yen plunged 2% against the US dollar on reports that the supposedly hawkish new Japan PM Ishiba commenting that the economy is not ready for an additional rate hike. This has added weight to Bank of Japan Governor Ueda’s cautious stance on further normalization, at a time when markets are also seeing a pushback on Fed’s rate cut expectations after a hawkish tilt in Fed Chair Powell’s comments earlier in the week and upbeat labor market data from JOLTS job opening to ADP jobs survey last night. The US dollar gained, mostly on the back of yen’s losses. Activity currencies generally outperformed, led by Norwegian krone, while New Zealand dollar lagged the pack on the back of increasing rate cut expectations from the Reserve Bank of New Zealand.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.