Quarterly Outlook

Q3 Investor Outlook: Beyond American shores – why diversification is your strongest ally

Jacob Falkencrone

Global Head of Investment Strategy

Global Head of Macro Strategy

EM currencies have seen broad weakness, driven mostly by the USD rally and higher dollar rates. This week looks pivotal for the outlook for the USD and therefore for EM, with a Federal Open Market Committee meeting and the latest US earnings data possibly setting the tone for the rest of the month as the dollar faces down key resistance levels. But the US dollar isn’t the only story afoot here, as emerging markets have also been weighed down by a rise in EM credit spreads. Additionally, geopolitical tensions will remain high at least until and just after President Trump’s decision on the Iran nuclear deal on or before a declared May 12 deadline.

EM news and views

Below is a selection of highlighted EM movers and shakers over the last week as well as details of what may lie ahead for these selected currencies.

RUB: the ruble was the weakest performer over the last week and over the last month after the devaluation move linked to new US sanctions targeting Russian oligarchs. There have been no fresh aggravations to Russian assets on the sanctions front, and credit spreads have actually compressed slightly on USD-denominated Russian bonds, while oil prices have been about as supportive as possible. And yet, the ruble has been pushed back to the weak side of the range established after the spike move triggered by the sanctions news in April. It appears investors may continue to give the currency a wide berth as long as general risk conditions are not supportive.

Alternatively, perhaps there has been a move to currency hedge Russian investments, as Russian stocks have actually recovered (in RUB terms) back towards the highs for the cycle. As well, the US Democratic National Committee’s move to sue the Trump campaign and Russia for interfering with the 2016 US presidential election and the drumbeat of threats from the US side on possible changes to the Iran nuclear deal could have investors sidelined on the risk that this leads to further geopolitical tension or worse.

TRY: the Turkish lira has been oddly calm over the last couple of weeks in an environment of generally weak EM currencies, though this calm arrives after an ugly devaluation move. Still, the fall in weekly Turkish central bank reserves data suggests episodic TRY intervention is ongoing. Snap elections are set for June 24, where President Recep Erdogan is seen as the easy winner. The election will see the implementation of the new powerful executive presidency that was approved in a referendum over a year ago.

The obvious political imperative is for Erdogan to appear in control ahead of the election and continue to call for lower interest rates and higher fiscal investment, neither of which Turkey can afford with its reliance on foreign capital flows and its current account deficit. But will the tone change after the elections to address financial reality? The Turkish lira is one of the few currencies priced at attractive risk/reward levels provided that Erdogan chooses to send the right political signals after the elections and allows the central bank to do what is needed to shore up confidence in the currency. It is soon either/or time for the lira.

CNY: USDCNY has backed up to the high end of the very narrow 6.25-6.35 range established since February of this year. There has been no signalling from China on currency policy intent outside of a declaration some time ago that the country would not seek currency devaluation as a policy option. The weaker CNY has seen the most China-linked exporters’ currencies (the quartet of KRW, MYR, THB and SGD) weakening more or less in lock step with the move over the last month. We’ll watch the top of the range in USDCNY with considerable interest in the event the USD continues to strengthen for signs that China is allowing more exchange rate dynamism.

INR: The rupee weakness has accelerated over the last week on the general weakness in EM assets, but also on India’s dependence on increasingly expensive energy imports and perhaps as the market nervously eyes the next state election in Karnataka, which will be seen as a referendum on the popularity of President Narendra Modi’s ruling BJP party in elections next year. Uncertainty on the strength of Modi’s popularity has crept into the political picture as members of the BJP party have been embroiled in an ugly sex scandal that has blown up in the national media and could tilt sentiment.

MYR: elections are slated for May 9 and that event risk may test whether the ringgit can shift notably from its link to the Chinese renminbi. The ruling Barisan coalition has been charged with manipulating the electoral system to tilt the result in its favour.

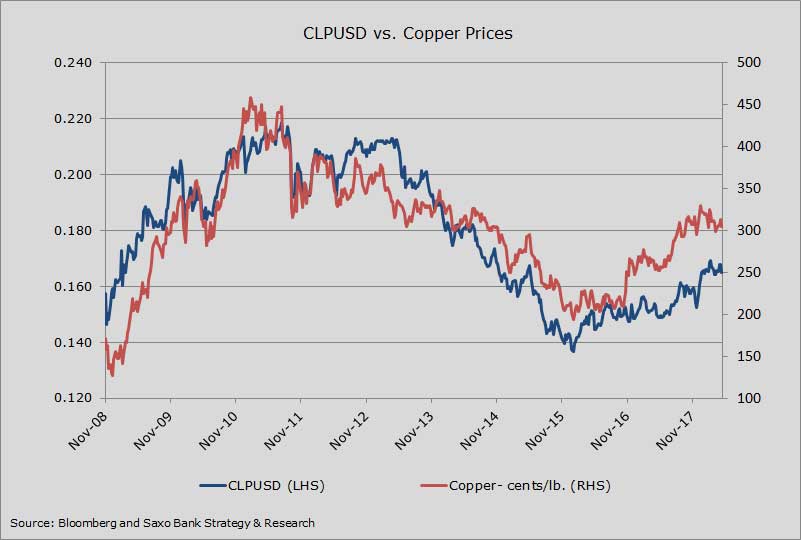

CLP: The Chilean peso has shown up in the underperformance category for the first time in our recollection. Copper is the nation’s chief export and copper prices have been fairly stable after threatening a significant break lower in late March. We keep our eye on the $3/lb. level for the risk of significant further weakness in copper and therefore CLP. The currency has a long history of tight correlation with copper prices, given the dependence of Chile’s economy on the industrial metal, but over the last 5-6 years, Chile has developed a structural vulnerability that we think is underappreciated as the country has been running a current account deficit and fairly large external debt load (as high as 25% of GDP when CLP was at its weakest back in 2013).

That current account shortfall and focus on credit considerations could pick up quickly if copper prices don’t hold up. As well, copper extraction in Chile is becoming permanently more expensive as mining companies’ water supplies from rivers have been shut off by the government, requiring the construction of enormous desalination plants to satisfy the mines’ enormous water demands. We have strong concerns on the fate of CLP if the global economy is headed for a weak patch later this year.

Chart: CLPUSD vs. copper prices

The Chilean peso has a strong historical correlation with copper prices as that industrial metal is the country’s chief export and is linked to around 20% of the country’s GDP. Chile exports about a third of the world copper demand. The three dollar per pound level is a very clearly etched one on the copper chart, and a sustained drop below this level could lead to significant CLP weakness, even back toward the sub-0.1400 area lows for the cycle from early 2016.

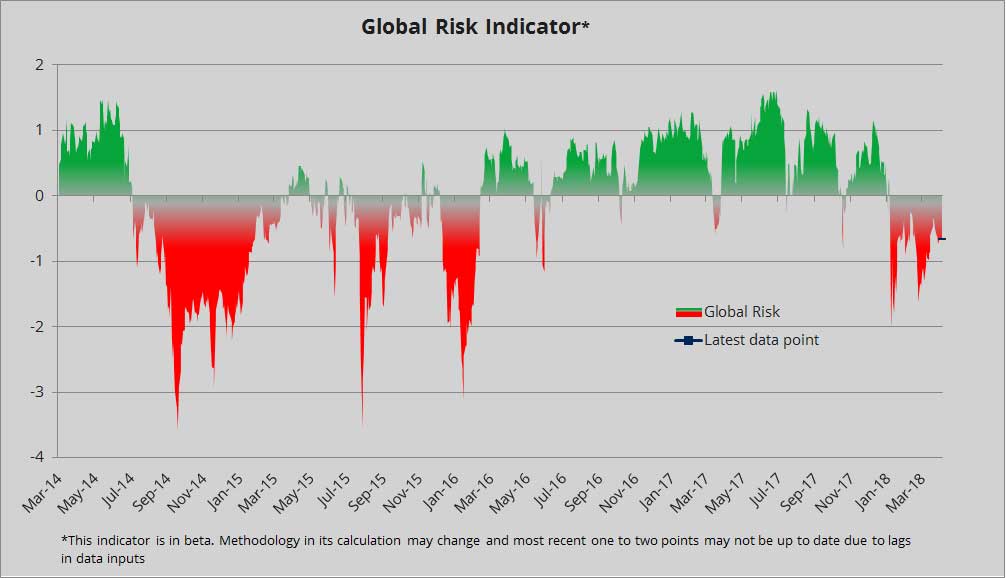

Chart: Global Risk Index – EM spreads worsening, big dollar strength uncomfortable

In the previous edition of this publication, we continued to note our general aversion to EM currency exposure, noting still-negative readings on our Global Risk Indicator, but in particular fretting the risk of higher US bond yields, with a focus on the 10-year benchmark and the 3.0% level. This concern proved well grounded as US treasury yields rose and risk conditions worsened.

The next leg of action looks particularly pivotal, as the 3.0% US 10-year level remains in play, and the US 2-year yield has risen as high as 2.50% ahead of this week’s (not particularly anticipated) FOMC meeting. Many are noting the unprecedented speculative short position as evidenced in the weekly CFTC futures positioning reports as a sign of excessive bearishness, but even if US treasuries find support, it could be for the negative reason that risky assets are under pressure. Either way, the environment doesn’t look supportive for EM. And for EM- assets specifically, for the first time this week we can report that EM credit spreads have widened while a number of other risk measures have actually improved.

EM currency outlook: US dollar and US yields will do much more damage to EM if moves aren’t halted here

The coming one to two weeks look pivotal for the ongoing EM currency outlook as the US dollar rally and US yields, particularly the 10-year benchmark, have reached critical levels. If the move is stopped here, there may be some breathing room for EM currencies and a chance of limited recovery at minimum. But if the USD rally extends and in particular, if US yields advance all along the curve again, with the US 10-year heading above 3.05% and thus posting a 6-year high for the first time since the early 1980s, EM currencies will be in trouble.

Opportunities are best in EM carry trades in two very different conditions. The best cyclical opportunities for broad EM currency exposure arrive when global markets have overreacted to negative developments and EM assets and currencies can be picked up at very cheap levels – these are rare and dramatic opportunities like in the teeth of the global financial crisis or the bottom of the risk-off move in early 2016. Otherwise, carry traders need the prospect of long periods of smooth sailing and complacency and a slow and steady rise in risk appetite.

Our baseline scenario for the next year to eighteen months is that we’re unlikely to see the latter type of opportunity on the strong risk of a rising volatility environment, which is likely to mean that EM currency opportunities may only show up in relative value terms or once we reach the occasional excess in risk aversion. Patience is the keyword for now, just as courage will be the operative word if asset prices experience an ugly meltdown, which is nearly always the time when the opportunity bell tolls loudest.

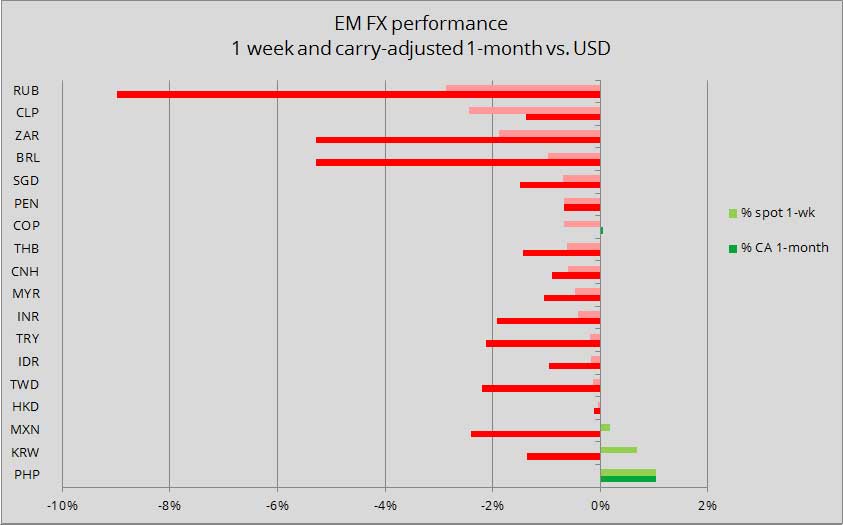

EM currency performance: Recent and longer-term, carry-adjusted

Chart: the weekly spot and 1-month carry-adjusted EM FX returns vs. USD. A sea of red for the short-term performance of EM currencies over the last week and month, as only the Philippine peso (PHP) managed to appear in the plus column over both time frames as S&P upgraded the country’s outlook to positive from stable on a positive growth outlook, strong external position and healthy fiscal credentials.

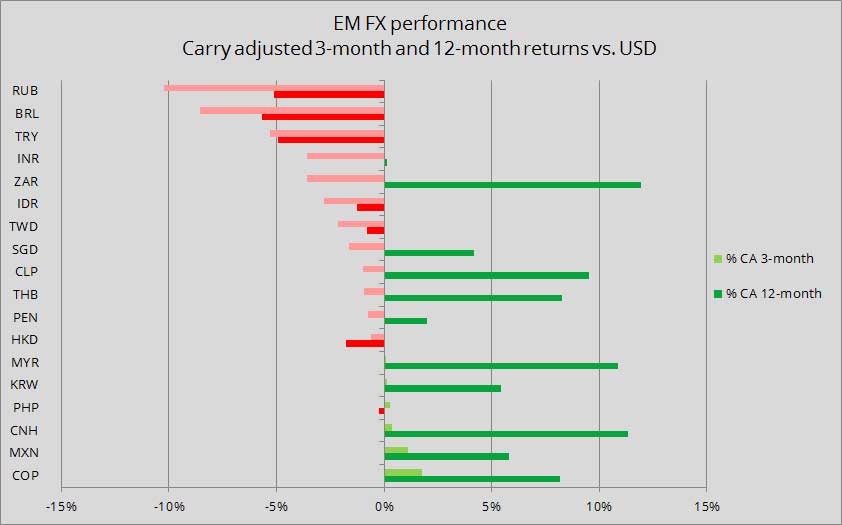

Chart: Three- and 12-month carry-adjusted EM FX returns versus USD

The longer-term performance continues to erode due to the extended bout of unfavourable conditions for EM currencies since early this year. Most of our universe now has a negative performance versus the US dollar in the 3-month horizon. The ruble is the worst performer over the last three months due to sanctions worries and would be very vulnerable if longer-term global growth concerns start to erode the price of oil (as is already suggested in a very steep backwardation in forward oil prices). The Brazilian real is also very weak on the extended uncertainty over the fate of necessary pension reform needed to avert a fiscal meltdown as well as the long wait for the presidential election in October.