Outrageous Predictions

Switzerland's Green Revolution: CHF 30 Billion Initiative by 2050

Katrin Wagner

Head of Investment Content Switzerland

Chief Investment Strategist

The US jobs report on Friday wasn’t just soft, it was a moment of recalibration.

After months of surprisingly solid data, the labor market showed a clear loss of momentum. The economy added just 73,000 jobs in July, well below expectations, and more than 250,000 jobs were erased from May and June as prior data was revised down. The unemployment rate rose to 4.2%, and the labor force shrank for the third straight month.

The three-month average job gain now sits at just 35,000, far below the 80,000–100,000 needed to keep unemployment steady. That’s the weakest stretch of job growth since the pandemic recovery began, and it’s shifting how markets think about the outlook.

Rate cut expectations surged. Traders now see more than two 25-basis-point cuts this year, with over 80% odds of the first one coming in September. Treasury yields dropped sharply, especially on the short end: 2-year yields fell more than 25 basis points on the day, and 10-year yields dropped 20.

Here’s why this matters for long-term investors: when interest rates fall, bond prices rise. That relationship means bonds aren’t just offering income again – they may now offer capital gains, too. With yields still elevated and the rate outlook softening, fixed income is once again becoming a meaningful contributor to long-term portfolios.

Markets are now factoring in a meaningful chance of rate cuts starting as early as this autumn. That matters because when interest rates fall, bond prices rise. For investors with a longer horizon, that creates potential for total return, not just income.

Even if the Fed takes its time cutting, the starting yield is doing more heavy lifting today than it has in years. Ten-year Treasuries still yield above 4.2%, and investment-grade corporate bonds offer over 5%. That’s a strong foundation for patient investors, especially in a market where equity returns may be more volatile.

It’s also worth noting: tariff-related risks, particularly if trade tensions escalate, could push inflation higher in the near term. That might delay the Fed’s rate-cutting cycle. But in that scenario, today’s higher bond yields provide a solid income buffer, offering meaningful return even if rate relief takes longer than expected.

Equities have delivered strong returns in recent years, especially in sectors like tech and AI. But that strength has also pushed valuations higher, leaving portfolios more exposed to swings in sentiment or surprise macro shocks.

Bonds, particularly in the short to intermediate range, can help offset that. When equity markets pull back due to weaker growth, geopolitical stress, or inflation surprises, high-quality bonds often act as a cushion. They tend to hold up, or even rise, when stocks fall, helping to smooth out returns over time.

In other words, bonds aren’t just about income, they’re about risk management. For investors who’ve let fixed income allocations drift lower in recent years, this may be a good moment to reintroduce balance to portfolios, especially as the macro backdrop becomes more uncertain.

While bonds look more attractive, investors should be aware of growing risks in the longer end of the curve:

These developments haven’t derailed the bond rally, but they’ve added a layer of caution, particularly for those looking to go out 20 or 30 years on the curve.

As shorter-term yields fall faster than the long end, bonds in the 5–10 year range are positioned relatively well. They’re sensitive enough to benefit from falling rates, but less exposed to the longer-term risks building in the system. For long-term investors, this part of the curve may offer the best balance between income, resilience, and potential price appreciation—particularly in uncertain environments like today.

For most long-term investors, staying focused on quality and balance across durations may prove the most durable approach.

For many buy-and-hold investors, bonds have taken a back seat in recent years. But with yields still elevated and the interest rate outlook shifting, this is a window to rethink how fixed income fits into a long-term portfolio.

Here are some common investment goals, along with ways investors are gaining exposure:

Investors who want exposure to falling interest rates may consider longer-duration government bond ETFs, which are more sensitive to rate moves. When interest rates decline, the value of these bonds typically rises. One example is the iShares USD Treasury Bond 20+yr UCITS ETF (IUSV), which holds U.S. Treasury bonds with maturities of 20 years or more.

This type of exposure can offer meaningful capital appreciation if central banks begin cutting rates—but it also comes with more day-to-day price swings and may be more sensitive to political and fiscal risks.

For those who want to earn consistent income without taking on too much risk, shorter-duration bond ETFs can help. These funds invest in bonds that mature in 1 to 3 years and tend to be less sensitive to interest rate changes. The iShares USD Treasury Bond 1-3yr UCITS ETF (IBTS) or the iShares USD Short Duration Corp Bond UCITS ETF (SDIG) provide access to U.S. government or corporate bonds with short maturities.

Such ETFs typically offer less price movement but still provide attractive income, especially in today’s higher-rate environment.

If inflation stays sticky—or resurges due to tariffs or supply shocks—then inflation-linked bonds can provide some protection. These bonds adjust their payouts based on changes in inflation indexes. A relevant ETF here is the iShares $ TIPS UCITS ETF (ITPS), which tracks U.S. Treasury Inflation-Protected Securities (TIPS) and helps preserve real purchasing power over time.

If your goal is to earn higher income and you’re comfortable with a bit more credit risk, corporate bond ETFs can be worth considering. These funds invest in bonds issued by companies, offering more yield than government debt but also more sensitivity to the economic cycle.

The Vanguard USD Corporate Bond UCITS ETF (VUCP) focuses on high-quality, investment-grade U.S. corporate bonds. It’s suited for long-term investors seeking steady income without venturing too far up the risk curve. For higher yield potential, the iShares USD High Yield Corporate Bond UCITS ETF (SHYU) and the Xtrackers USD High Yield Corporate Bond UCITS ETF (XUHY) offer exposure to lower-rated corporate bonds with higher income. These funds come with more credit risk but can play a role in return enhancement when managed as part of a diversified portfolio.

For a middle-of-the-road approach, many investors turn to broad bond market ETFs that include a mix of government and corporate bonds across various maturities. These “aggregate” bond funds are designed to serve as a stable anchor in diversified portfolios. One example is the iShares Core Global Aggregate Bond UCITS ETF (AGGG), which offers exposure to a wide set of investment-grade bonds globally, hedged to the U.S. dollar.

The exact mix will depend on your goals, risk tolerance, and time horizon—but the key takeaway is this: bonds are once again offering a combination of yield and stability that long-term investors haven’t seen in years.

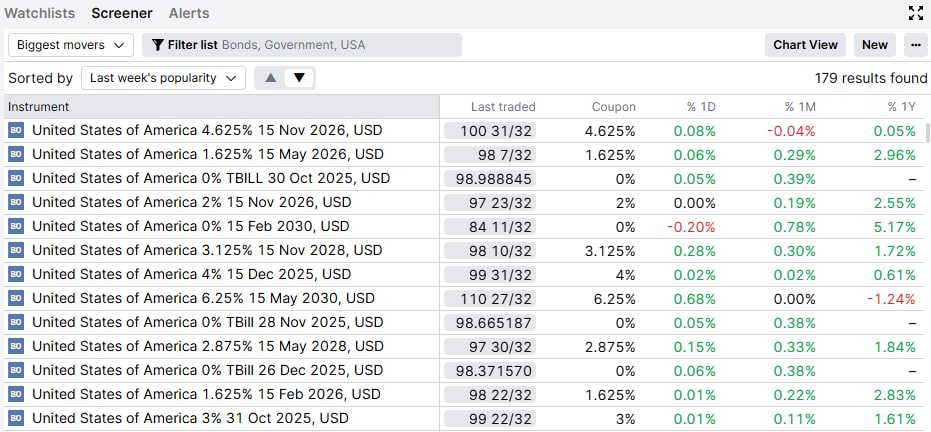

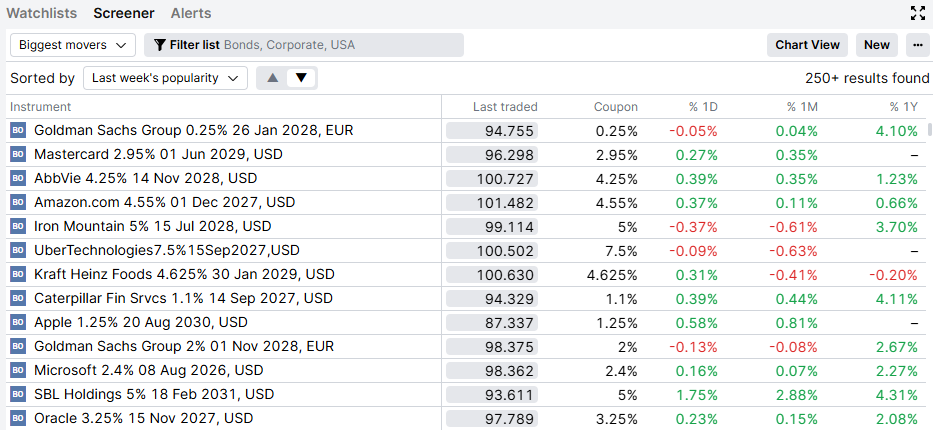

For those who want to go beyond ETFs and hand-pick individual U.S. bonds, Saxo’s screeners can be used as shown below. Image 1 shows the most traded U.S. Treasuries on the Saxo platform over the past week, and image 2 shows the most actively selected U.S. corporate bonds on Saxo. You can filter by maturity (e.g., 1–3 years, 10+ years), yield, and duration to match your investment horizon or income needs.

If inflation plateaus or growth proves more resilient, the cutting cycle could be delayed, hurting rate-sensitive bond positions.

As U.S. debt balloons, and interest costs rise, long bonds may face a credibility premium, meaning yields, particularly in the long-end of the curve, stay high even as the Fed eases.

Attacks on the Fed, political meddling in the BLS, and high-level resignations raise concerns about data integrity and central bank independence. That’s a wildcard risk, especially for the long end.

For non-USD investors, holding U.S. dollar assets introduces currency risk. Even if the bonds perform well, returns can be reduced if the dollar weakens. This is especially relevant for ETF investors, as these products don’t mature. For individual bonds held to maturity, FX impact only matters at entry and exit.

After a long stretch where bonds offered little more than stability, the picture has changed. Yields are still elevated, the rate outlook is softening, creating a rare moment where fixed income can contribute both income and total return to a long-term portfolio.

At the same time, equities have run hard and valuations are high. That makes now an opportune time for investors to consider rebalancing, bringing bonds back into focus not just as a safety net, but as a meaningful contributor to long-term returns.

Whether through individual U.S. Treasuries, corporate bonds, or diversified ETFs, fixed income today offers something it hasn’t in over a decade: yield, downside protection, and the potential for price gains if central banks move to cut.

For patient investors looking to diversify risk, smooth out portfolio performance, and lock in attractive income, this may be one of the most compelling entry points for bonds in years.