Outrageous Predictions

Executive Summary: Outrageous Predictions 2026

Saxo Group

Chief Investment Officer

Summary: Policymakers are taking yet another dip in the 'pretend-and-extend' punchbowl as both monopolies and central banks snap up assets across the board. No market trades freely, price discovery is zero, and it is time to get long inflation.

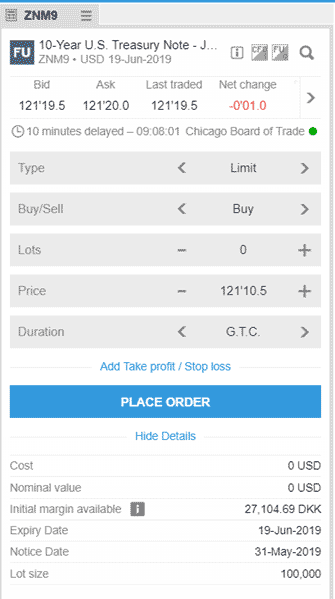

Instrument: 10-year US Futures

Price Target: not specified

Market Price: spot 121 19.5/32

Entry: spot 121 19.5/32

Stop: 122 28/32 on the close

Target: 118 ½

Time Horizon: long term

For those of you who are inclined to learn from history, I implore you to read Paul Volcker's book 'Keeping At It', noting particularly the chapters on how he and then-Treasury Secretary Connally took the US out of the Bretton Woods agreement with the policy at the time being: controls, tariffs (on Germany), devaluing the dollar and trying to ditch the trade deal in place with Canada!