Saxo Bank’s Conviction Equities is a list of investment recommendations on stocks that are viewed to be an attractive investment theme with return expectations above the expected market return. The investment horizon is long-term which is typically one year or more unless the price target has been reached. The artificial reproduction technology (ART) industry benefits from demographic trends and societal shifts, and with few pure-play listed investment options, Vitrolife represents an opportunity to gain exposure to long term structural growth in the infertility treatment sector. Vitrolife: IVF for declining fertility Vitrolife is a Swedish biotechnology company that develops, produces and markets fertility treatments aimed at increasing pregnancy rates. Vitrolife aims to be a global leader in the supply of medical devices for assisted reproduction.

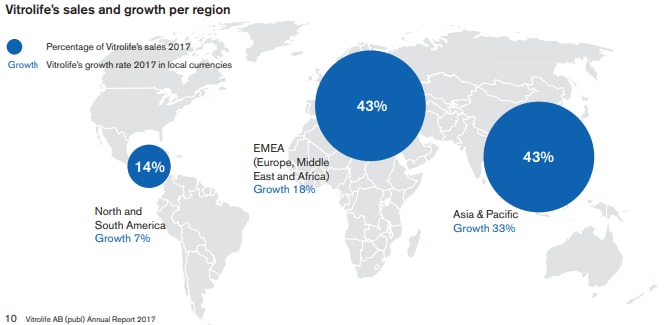

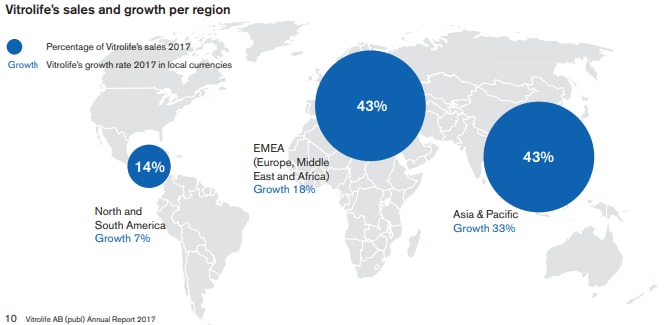

The global market for In Vitro Fertilisation (IVF) - the medical procedure of fertilising woman's egg outside of the body -- is growing at a steady pace of 5-10% per year, with growth accelerating fastest in Asia compared to North America and Europe. Vitrolife has a strong presence in all of these regions, with sales growing fastest in Asia at 33% per annum.

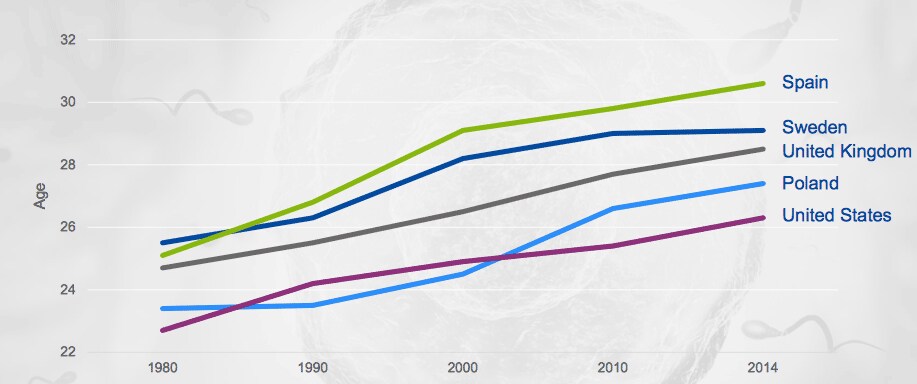

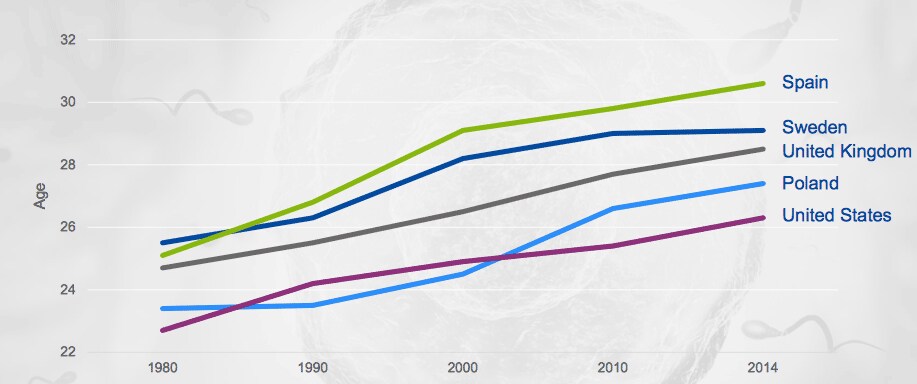

Ten to fifteen percent of all couples in the fertile age range suffer from fertility problems. In developed nations throughout the last decade, changes in the timing of family formation has meant women are postponing the birth of their first child. Throughout most of Europe, first-time mothers are on average 27 to 29 years old. This has increased from 23 to 25 years at the start of the 1970s according to OECD Family Database statistics (2014). This demographic shift is not unique to Europe; the average age at first birth is increasing in Asia, Japan, and the US. This pronounced shift is now also seen in developing nations such as China.

Age is one of the most important factors that can affect a woman’s ability to conceive. From the age of 30, fertility starts to decline for most women with the number of eggs and quality of those eggs being reduced, thus the chances of natural conception are significantly reduced. More specifically, once a woman reaches the age of 36 the chance of conceiving naturally is halved compared to the chance at 20 years of age. At age 41, this chance falls to 4%. The risk of miscarriage also increases with age, so for older women it is not only more difficult to conceive naturally but also more difficult to carry the pregnancy to full term.

As these demographic shifts persist, the need for ART has increased. The increasing rate of infertility is expected to be a continued driver of growth for years to come in the IVF market. Other factors such as increased technological advances increasing IVF success rate, growing awareness of infertility consequences, and an increase in lifestyle disorders (smoking and obesity) that increase infertility are also contributing to the growth of the IVF market. In developing economies, like China and India, a key contributor to driving growth is the growing middle class resulting in higher incomes and increased social acceptance of IVF treatments.

According to Allied Market Research, the global IVF services market generated $10.6 billion in 2017 and is projected to reach $22.5bn by 2025, growing at a compound annual growth rate of 9.8% from 2018 to 2025. Government funding in many developed nations is expected to contribute significantly to this ongoing growth as egg/sperm freezing allows women to have a child later and advances in ART enable pre-identification of genetic disorders.

This trend is already in place in developed nations. In 2016, for example, the Canadian province of Ontario announced a $50m fertility program to cover IVF treatment for 5,000 people, and in Singapore the government offers up to 75% co-funding for various ART procedures such as IVF, gamete intrafallopian transfer, and intracytoplasmic sperm injection.

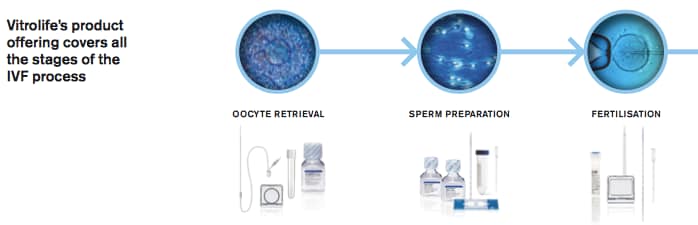

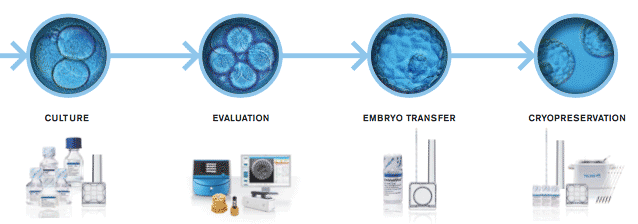

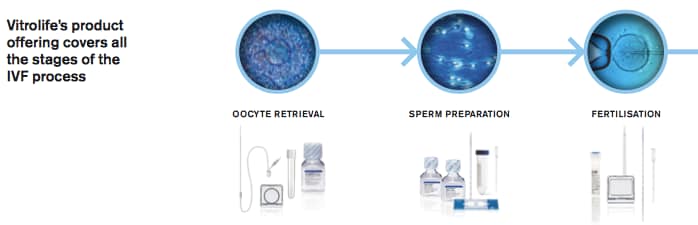

The company The IVF market is segmented based on reagents and media, instruments, technology, and end users. Vitrolife’s product offering covers all the stages of the IVF process, from the handling of eggs and sperm to the culture and transfer of embryos as well as cryopreservation for eggs, sperm, and embryos. The product range includes needles for oocyte retrieval; nutrient solutions and media (where Vitrolife leads the market) for the handling and culturing of eggs, sperm, and embryos; and disposable plastic products. Vitrolife is also a market leader in Timelapse technology, used by clinics worldwide to monitor embryo development and selection.

Vitrolife’s brand name is strong within the IVF industry. According to data from Allied Market Research, Vitrolife accounts for approximately 36% of the IVF market for reagents/media, instruments and technology, ahead of rivals EMD Serono Inc, Irvine scientific, Cooper Surgical Inc, Cook Medical, Thermo Fisher Scientific, Genea Biomedx, Auxogyn, Oxford Gene Technology, and Ovascience. Vitrolife products are not only market leading but their perceived quality as measured by customer satisfaction is outstanding. The company surveyed customers in 2017 with the results illustrating a positive response – 81% of customers gave Vitrolife a grade of between eight and 10.

Valuation

Valuation Aside from investing in ART, Vitrolife stands alone as an attractive investment. The company has a long history of profitable growth, with little debt and strong increasing cash flows.

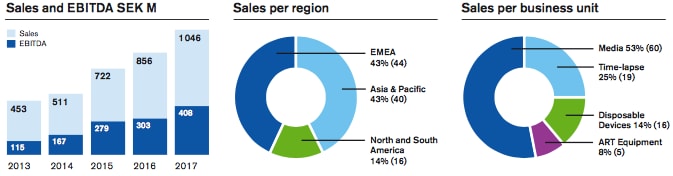

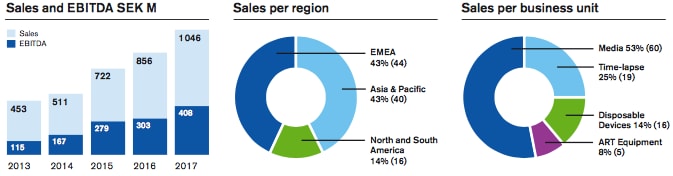

2017 was yet another successful year for Vitrolife. Growth during the year amounted to 22% in local currencies, of which 19% was organic growth. All market regions and business units contributed to this growth. During the year, Vitrolife also passed sales of SEK 1 billion on a rolling 12-month basis for the first time, a milestone in the history of the company. This growth has been achieved without sacrificing profitability. EBITDA strengthened during the year to 39%.

Vitrolife

Vitrolife In 2017, Vitrolife’s sales were SEK 1,046.2m, a 22% increase in SEK from the year before. Organic growth throughout all regions totalled 19% in local currencies. In monetary terms, global growth in the IVF market was estimated to be between 5–10%, which means Vitrolife also gained market share in 2017. Vitrolife has gained market share through continued expansion of its sales organisation globally and increasing its product portfolio. This trend is expected to continue as Vitrolife maintains a strong capital base to grow organically and through acquisitions, but also as the company continues to develop market-leading products internally.

In 2017 the EBITDA margin increased to 38% from 35% in 2016 and sell side analysts estimate this margin expansion will continue in the coming years to 41% in 2020. Margin expansion is driven by increasing economies of scale, Timelapse product growth, and removal of one-time expenses incurred in 2016.

The current Enterprise Value is SEK 13,737.5m, translating to a trailing 12-month EV/EBITDA multiple of 32.8x compared to 11.7x for global equities. Although Vitrolife is a quality company with exposure to a long-term structural growth thematic, the investment comes at a price and the company is expensive relative to global equities.

Vitrolife is also expensive relative to equities listed on the Stockholm Exchange (average EV/EBITDA 11.6x) and to other Swedish biotech companies like Karo Pharma, Swedish Orphan Biovitrum, and BioGaia, whose average trailing 12-month EV/EBITDA multiple is 21.5x.

Despite being expensive on a fundamental valuation basis, Vitrolife is a high-quality company with exposure to a growing industry. The company has consistently lived up to it- reputation and market leading position, and continues to grow organically and take market share.

Vitrolife operates at the cutting edge of research and product development in collaboration with leading scientists in the ART field. Continuous research is performed to create new products and to enhance existing products, which we expect to drive existing sales growth and market share over and above the organic growth of 5-10% per annum expected from the ART industry.

Based on a terminal EBITDA estimate of SEK 726m in 2023 and a discount rate of 9.9%, a 26% upside move remains tenable for Vitrolife – the calculation can be seen in the table at the end of this article.