In April of this year one of the most anticipated IPOs took place as Spotify was listed on the NYSE in a big blow to Europe. Again, a European technology giant chose the US as its gateway to financial markets, underscoring a theme we have been arguing lately that European equities are becoming uninteresting due to a weak technology sector.

Spotify’s share price is up 42% from the IPO price and up 13% from the first secondary market price (the open price on April 3, 2018). For years, the music industry was under pressure with falling revenue and rampant piracy by consumers. With Spotify and the music streaming revolution, things have changed; 2015 was the first year that saw total music revenue grow again since the mid ‘90s according to Spotify’s Investor Day slides.

Spotify is one of our high-conviction equity ideas over the coming years as monetisation enters a new and interesting phase.

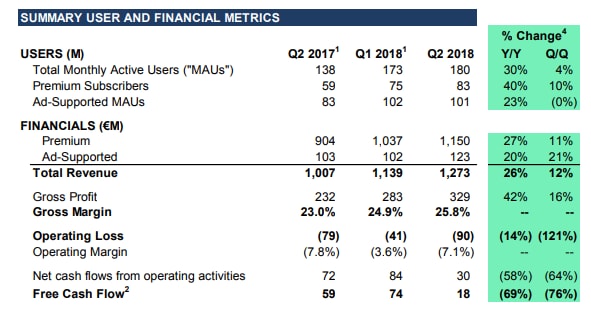

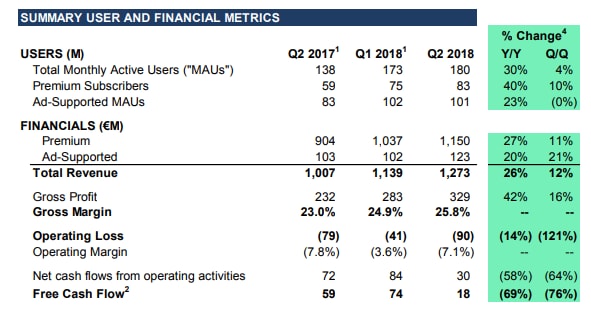

Source: Spotify Q2 earnings release

Below are some our key views on Spotify:

• It will not create its own record label (except for low-penetration background music used for commercials, restaurants etc.)

• It will not go into video content (except maybe for selected live concerts)

• Strong profitability will come but it will take five years

• The firm will move into direct communication (fans-to-artists) – think Instagram

• In-platform advertising (used by record labels for album promotion) will likely become a big profit engine in the future

• Record labels will likely not allow high attractive profit margins on music content

• Spotify will win the music streaming war and remain industry leader as consumers want choice instead of concentration with Amazon and Apple

Spotify has a 42% global music streaming market share which means the company dominates the industry. The company offers music through a mobile app and web application on desktops with two subscription types: Ad-supported and Premium. Monthly active users (MAU) have grown from 91 million in 2015 to 157m in 2017. In Q2 the number of Premium subscribers rose to 83m, up 40% y/y driven by family subscription plans.

Spotify is continuously modifying and expanding its offerings with in-platform ads the most likely focus over the coming years. The recent Drake album ad campaign was a clear indication of the future. Spotify wants to enable record labels to activity users to listen to new albums to drive revenue generation and increasing the fan base. With heavy use of data, ad campaigns might be used intelligently to increase awareness and penetration for musicians. In Norway, the company has experimented with hiking prices although industry experts do not expect Spotify to generally increase the subscription price.

Advertising revenue in Q2 was €123mn, up 20% which is still a high-growth business but probably a bit below consensus estimates. Recent data policy changes may have affected the ads business, but that should have only temporary effects on the results. Overall we believe the advertising business remains Spotify's key weapon to increase the gross margin as Spotify does not have significant bargaining power over record labels in negotiating revenue splits.

In addition, music's lifespan is different from video content so Spotify has to acquire streaming rights for old music. Nobody wants a music subscription if they cannot listen to The Beatles or Taylor Swift.

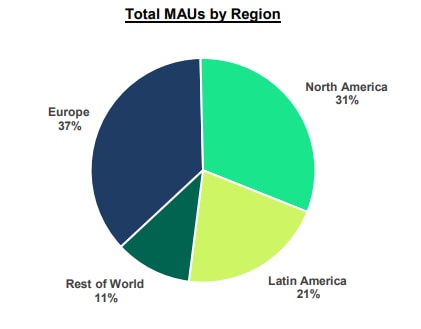

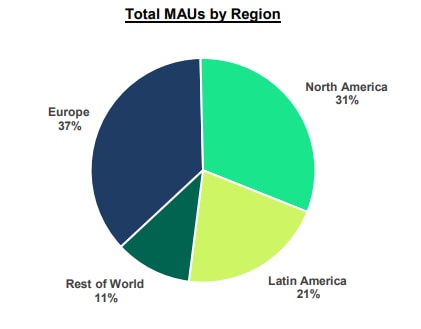

Even more compelling for the investment theme is the fact that 42% of Spotify’s monthly active users are under 25. This is critical as it represents adoption among the young population that will ensure a large sticky customer base in the future. But the most compelling statistic is that on average, MAU spend 32 hours per week listening to music, according to Spotify. This compares with roughly below seven hours for Instagram and Facebook. The major point here is that music can be consumed passively while doing other tasks, whereas social media and video streaming is for the most part a singular activity. Music streaming is probably one of the most time-consuming activities in the world today. Besides large penetration in the young population segment, the company has also a good MAU diversification across many geographies with no region being overly dominant (see pie chart below).

Source: Spotify Q2 earnings release

A key path to a higher market value is Spotify’s ability to lift its gross margin (currently at around 26%). CFO Barry McCarthy has stated that Spotify’s goal is a gross margin around 35% which would bring Spotify closer to other technology platforms and physical distributors’ usual cut. Apple is currently running its old 70:30 model with 30% going to Apple, although both Android (Google’s mobile operating system) and Microsoft have lowered their cuts. Apple has recently switched to a new pricing model of an 85:15 split after one year if the app is sold as a subscription. These pricing pressures on other technology platforms with revenue sharing between platforms and content providers suggest that Spotify has probably hit an upper limit with its 25% cut from record labels. The gross margin expansion has to come from other revenue sources such as advertising or its own copyrighted music (secondary music for commercials and such).

The main reason for our buy recommendation is margin expansion through the new monetisation phase as the business is hitting economies of scale. Free cash flow generation will likely surprise many analysts and investors as the business ramps up. In addition to (and because of) the margin expansion, we believe Spotify’s valuation multiples will expand.

Valuation As of Q2'18, Spotify generated $4.59bn in 12-month trailing revenue. The current enterprise value is $27.3bn, translating into an EV/sales multiple of 5.95. This multiple is less than other platform companies such as Netflix (11.7x), Facebook (9.3x), iQIYI (6.1x), Tencent (9.9x), Sirius XM (6.9x), Etsy (11.6x), Alibaba (10.4x), Twitter (8.7x). Only eBay with an EV/sales ratio of 3.4x is less than Spotify.

Compared against these other dominant platform companies, it suggests that there is a valuation gap that can be filled. In our view the EV/sales should be closer to around 9 given the firm's margin expansion trajectory, sales growth of 26% y/y, and rising free cash flow generation.

Sell-side analysts have consensus revenue at $10.4bn in FY21 which at a EV/sales multiple of 9x suggests an enterprise value of almost $100bn. Excluding cash generation, this implies a potential 200% upside over the coming three to four years. However, the future is very unpredictable so we stay with a one-year price forecast of $300/share, or around a 60% upside from yesterday’s close.

The free cash flow is expected to be around $200m in FY18 which is a free cash flow yield (versuss enterprise value) of 0.7% – low, but this also reflects the upside potential from growth and new revenue sources. Amazon, by way of comparison, is valued at a free cash flow yield of 1.8% based on expected free cash flow in FY'18 of $18.7bn against an enterprise value of $1.01 trillion.