Outrageous Predictions

Executive Summary: Outrageous Predictions 2026

Saxo Group

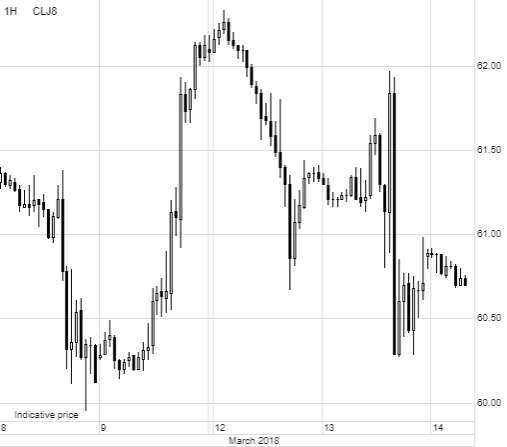

Crude oil spiked Tuesdayday on the surprise sacking of the US secretary of state, but the lift was only temporary as the technical outlook weakened and the rally turned into a scramble to get out, says Ole Hansen, Saxo Bank head of commodity strategy, in Saxo's daily morning markets call.

"Prices jumped because Mike Pompeo, who is replacing Rex Tillerson as secretary of state, is a major hawk on Iran, just like Trump," he says. "However, the risk of renewed geopolitical risks and supply disruptions are likely to keep the downside risk capped, with $58/barrel being key on WTI and $60.5 on Brent."

Gold, too, received a boost from "Rexit" as well as another bout of US protectionism concerns arising from reports that President Trump is seeking tariffs on up to $60 billion of Chinese imports. Gold is likely to remain range-bound between $1,300 and $1,340/oz ahead of the almost certain rate hike on March 21. Still, the myriad geopolitical tensions now at play means that Hansen maintains a bullish outlook for the yellow metal "as long as it stays above $1,285/oz".

The threatened Trump trade war is causing waves in forex markets too, especially for the Canadian dollar after the country's prime minister, Justin Trudeau, admitted that he may have to introduce his own sanctions to prevent dumping into the US via Canada, says John Hardy, Saxo's head of forex strategy. "We saw a considerable CAD move to the downside on this," Hardy says.

Elsewhere, the US dollar is a bit weaker after yesterday's CPI release which "doesn't really shift interest rate expectations going into next week".

On the data front, today's US February retail sales warrant attention because, Hardy explains, they're "the last important data print before next week's Federal Open Market Committee outing".