Quarterly Outlook

Q4 Outlook for Investors: Diversify like it’s 2025 – don’t fall for déjà vu

Jacob Falkencrone

Global Head of Investment Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

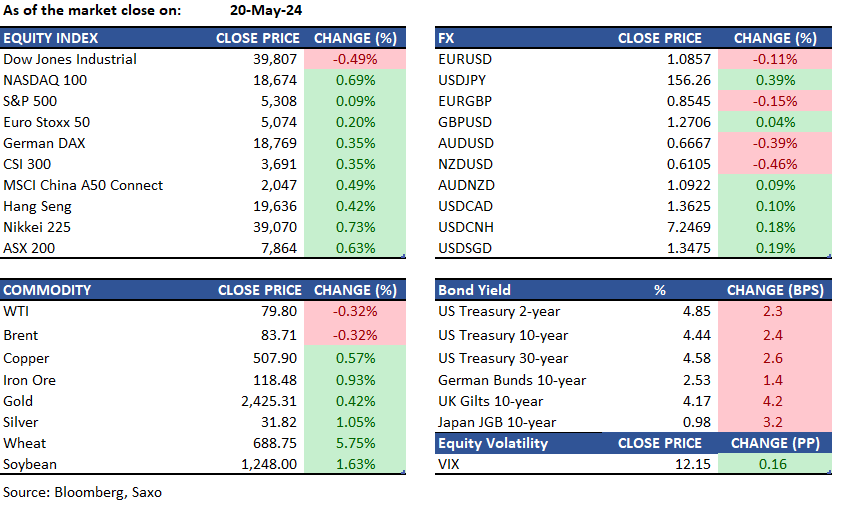

Equities: The S&P 500 inched up, buoyed by hopes for rate cuts and positive sentiment around Nvidia's upcoming earnings, stirring a risk-on mood. Nvidia's rise, echoed by other AI-focused firms like AMD and Intel, contributed to the Nasdaq 100's 0.7% rally, despite a tick up in the CBOE Volatility Index. Asian markets had a tepid start, with mixed futures as investors await Nvidia's report, the final of the "Magnificent Seven" tech giants to announce earnings, which could reinforce the strong demand for its AI chips. U.S. futures remained stable amid the anticipation. Microsoft has revealed new PCs featuring AI chips from Qualcomm. These new Surface PCs will be designed to meet Microsoft's Copilot+ standard for executing artificial intelligence models.

Jamie Dimon stated that JPMorgan would not engage in significant stock buybacks at current high prices, indicating a preference for repurchasing when the stock value drops. Following these remarks, the bank's shares, which had recently closed at a record high, declined by 4.5%. Despite the day's losses, the bank's shares have still risen 15% this year. Palo Alto Networks dropped 9% in post-market following the fourth-quarter guidance, which was less optimistic than anticipated at the midpoint of its projections.

FX: The U.S. dollar strengthened on Monday, echoing an uptick in Treasury yields as Federal Reserve officials reiterated a commitment to maintaining a tight monetary policy. The Bloomberg Dollar Spot Index saw a modest increase of 0.1%, with the Mexican peso's gains helping to temper the index's rise. USDJPY climbed to 156.23, a 0.4% increase, driven by stop-loss actions and yen sales, with the May high of 156.74 in sight if the uptrend continues. The euro dipped against the dollar, with EURUSD down 0.1% at 1.0861, as ECB's Martins Kazaks commented on aligning rate cuts with the slowing inflation in the eurozone. GBPUSD remained relatively unchanged, with upcoming UK CPI data drawing attention. USDCAD held steady before Canadian CPI figures are released, while the Australian dollar weakened slightly alongside a retreat in copper prices and a decline in the offshore yuan. The New Zealand dollar underperformed, falling 0.4% as the market anticipates the upcoming RBNZ meeting.

Commodities: Gold prices reached record highs, settling at $2,438.50 an ounce, driven by safe-haven demand. Copper prices surged, with three-month copper on the London Metal Exchange rising 2% to $10,897 per metric ton, peaking at $11,104.5. Bitcoin prices rose by 2.5% to above $68,650 and Ethereum soared 18% amid new speculation that spot Ether ETF could be approved this week, boosting other cryptocurrencies and related stocks. Brent Crude futures settled at $83.71/bbl, while U.S. WTI crude oil futures settled at $79.80/bbl. Natural gas futures settled at $2.751/mmBtu, reach 4-month highs, driven by early season heat in Texas.

Fixed income: Treasuries experienced a third consecutive day of decline, offsetting the previous week's bond rally due to indications of reduced inflationary pressures in the US. The 10-year yield remained around 4.43% at 2:45 p.m. in New York, with a surge in futures market selling contributing to an early session slump. Although losses were partially reversed throughout the day, yields for all maturities were still elevated by approximately 1 basis point

Macro:

Macro events: Australia May Westpac consumer confidence, Canada April CPI

Earnings: XPeng, James Hardie, Kingfisher, Lowe’s, Macy’s, Toll Brothers

News:

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.