Quarterly Outlook

Q4 Outlook for Investors: Diversify like it’s 2025 – don’t fall for déjà vu

Jacob Falkencrone

Global Head of Investment Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

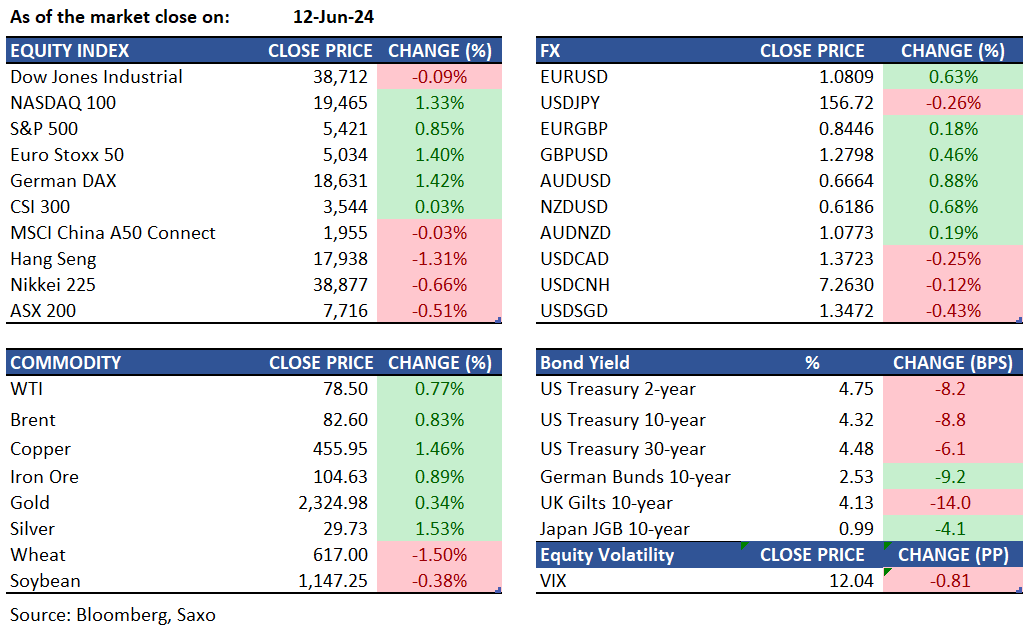

Macro: US CPI was cooler-than-expected across the board, sending a relief signal to markets. Core CPI M/M rose 0.2% (unrounded 0.163%), shy of the expected, and prior, +0.3% (prev. unrounded 0.292%) with the Y/Y +3.4% (prev. 3.5%, exp. 3.6%). Headline metrics were also light with M/M at 0.0% (exp. 0.1%, prev. 0.3%) and Y/Y at 3.3% (exp. 3.4%, prev. 3.4%). Supercore inflation turned negative at -0.04% MoM for the first time since September 2021. However, the Fed’s dot plot took some of the cheer away from the softer inflation print for a second consecutive month, as it shifted hawkish with median dot showing only one rate cut for 2024 from three in March. Looking ahead, the 2025 median dot plot is at 4.1%, up from 3.9% in March (signaling 100bps of rate cuts up from 75bps in March), while the 2026 dot was unchanged at 3.1%, but the longer run rate ticked up again to 2.8% from 2.6%. Chair Powell’s conference added little new information, preaching data-dependence even as he welcomed the May inflation report and said he would like to see more of that, repeating inflation is still too high and they need more data to gain confidence. China’s CPI rose 0.3% from a year earlier last month while factory prices dropped for the 20th months in a row, fueling concerns over persistently weak demand. Core inflation, which strips out volatile food and energy prices, rose 0.6%. The producer price index slid 1.4% in May from a year earlier after a 2.5% decline in April, largely due to rises in commodity prices.

Macro events: G7 summit, Australian Jobs Report (May), EZ Industrial Production (Apr), US PPI (May)

Earnings: Chow Tai Fook, Virgin Money, Wise, Signet Jewelers, Adobe

Equities: US markets were up, led by Apple (new all-time highs) after its WWDC events. Oracle also traded at all-time highs after earnings/ guidance. The rise in stocks was due to the lower-than-expected headline and core CPI readings for May and increased market expectations for rate cuts. Broadcom earnings topped expectations and surged 12% after hours. The company also upgraded its revenue guidance and announced a 10 for 1 stock split.

Fixed income: Australian and New Zealand government bonds strengthened as US inflation data trailed expectations, prompting a surge in global debt markets. Following the softer inflation report, US Treasury yields continued to retreat, with the two-year note halving its earlier yield decline to just eight basis points. Despite this, market swaps are pricing in potential rate cuts for November and December. In contrast, Treasury note futures saw a decline in early trading in Asia. Federal Reserve officials have indicated a likelihood of only one rate cut this year, a reduction from the three cuts projected earlier in March.

In response, the yield on Australia's 3-year bonds dropped by 6 basis points to 3.88%, while their 10-year counterparts saw yields fall by 7 basis points to 4.21%. Meanwhile, yields on Japanese 10-year government bonds decreased by 3.5 basis points to 0.985% on Wednesday. In the backdrop of these movements, Japan's Ministry of Finance is set to auction ¥500 billion in long-term debt, ranging from 15.5 to 39 years in maturity.

Commodities: Gold held steady at $2,330 per ounce, while silver rose over 1% to around $30 per ounce after the Federal Reserve kept its funds rate unchanged as expected. Oil prices rose due to an unexpected increase in US crude stocks, with inventories rising by 3.73 million barrels last week, contrary to market expectations for a draw. UK natural gas futures surged by more than 5% to reach 85 pence a therm, in line with the increase in European prices following a legal case where Germany's Uniper SE secured €13 billion ($14 billion) in damages from Gazprom PJSC for failing to meet gas delivery obligations.

FX: The dollar weakened earlier in the overnight session as softer US inflation cheered markets and fueled risk-on, but a hawkish shift at the FOMC announcement despite the cooling in inflation prompted a slight recovery into the close for the DXY index to close above the 200-day moving average. EURUSD pushed back above 1.08 but eased from the post-CPI highs of 1.0852, but focus remains on French election concerns. USDJPY made a round-trip to lows of 155.72 but ended the day back above 156.50 as focus turns to BOJ meeting announcement due tomorrow. AUDUSD also reversed from 0.67 handle with eyes on Australia’s jobs report today, and NZDUSD was back below 0.62. EM FX is under pressure, and both COP and MXN were down 1% yesterday despite dollar weakness, suggesting risks of a carry unwind in emerging markets.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.