Outrageous Predictions

Executive Summary: Outrageous Predictions 2026

Saxo Group

FX Trader, Loonieviews.net

The Canadian dollar suffered along with the rest of the G10 currencies during this week’s US dollar resurgence. Domestic data rubbed salt into the wound as well, with Canadian Retail Sales having dropped 0.8% in December, well below the forecasts and erasing the November gains.

Part of the issue may have been weather-related, but traders didn’t care. USDCAD roared higher, smashed through resistance levels and hung a target on the 2018 peak of 1.2915. The February 23 inflation report should have given the loonie a reprieve; CPI rose 0.7% in January, well above the forecast for a 0.4% rise (although the Ontario minimum wage increase may have impacted the results).

The USDCAD selloff, however, did not last, and prices are near pre-release levels.

The short-term technical picture is bullish. The break of key resistance at 1.2665 and the 200 day-moving average at 1.2704 suggests a revisit to the 2018 peak of 1.2915.

Mulling over the minutes

The Federal Open Market Committee minutes caused a bit of a stir on February 21, but most of that stirring was in the afternoon US market. The dollar sank then soared when traders concluded the minutes were hawkish.

It should not have surprised anyone that the minutes were hawkish. The January 31 FOMC statement was deemed “hawkish” because of a “tweak” in the wording about inflation.

If the FOMC statement was hawkish, it stands to reason that the minutes would be hawkish as well. Nevertheless, market pundits wrote that Fed rate increase expectations for 2018 rose to four hikes from three...

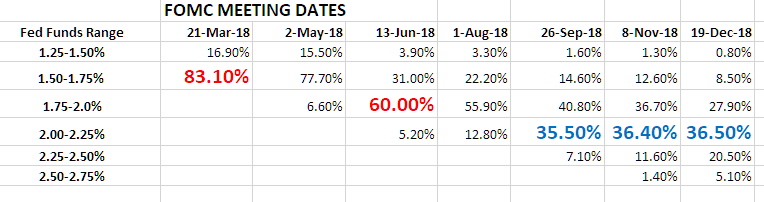

Maybe so, but according to the CME FEDWatch tool, the market only has two FOMC meetings where the probability of a rate increase is higher than 50%.

The week ahead

Data, data everywhere and testimony by the new Fed chair... what’s not to like?

Monday: This will be the quiet day of the week.

Tuesday: New Zealand Trade data (forecast flat) could renew the focus on NZDUSD downside. Eurozone economic confidence, business confidence and German HiCP Inflation reports are due. The US January Durable Goods Orders report (forecasted at -2.0% versus December's 2.9%) will be the main event followed by the S&P Case Shiller Home Price Index (forecasted at 6.2%)

Canada Federal Budget is tabled (and may include a costume allowance for Prime Minister Trudeau).

Wednesday: Fed chair Powell’s testimony to Congress overshadows a data-filled session, and managing expectations may be the order of the day. He won’t be able to ignore the recent spate of upbeat data and uptick in inflation, so like his predecessor, may emphasis caution.

Data includes US Q4 GDP (forecasted at 2.5%), Chicago PMI (forecasted at 64), and Japan Industrial Production and Retail Trade (forecasted at 2.1%, y/y). We also have a China NBS Manufacturing PMI print, Eurozone “flash” HICP inflation, and UK Gfi consumer confidence and Nationwide House Prices.

Thursday: Australia kicks things off with Q4 Private Capex (forecasted at 1.0%), then we see PMIs from China, the UK and the Eurozone ahead of day two of Powell's Congressional address.

Friday: A Japanese employment report, Eurozone PPP and German Retail Sales, UK PMI Construction, and Canadian GDP.

The week that was

The week was expected to get off to a slow start. It did. On Monday, Chinese New Year’s, US President’s Day, and Canada Family Day sucked a lot of liquidity out of markets. Brexit issues undermined sterling while a narrowing of the Eurozone trade surplus did the same to EURUSD. USDJPY drifted higher with traders looking ahead to Wednesday’s FOMC minutes. The commodity currency bloc slipped on broad US dollar strength.

On Tuesday, China was still closed. USDJPY traded steadily higher until the New York close, rising from 106.60 to 107.34 on concerns that the FOMC minutes would be hawkish. AUDUSD got a boost after the Reserve Bank of Australia minutes, but the gains were erased in a steady decline that continued until New York closed.

The kiwi mirrored the AUDUSD moves while report from the Eurozone suggesting preferred access for the UK was ignored, and GBPUSD slumped. EURUSD’s downward move was exacerbated by a mixed German ZEW survey. Wednesday’s pending FOMC minutes overshadowed trading in New York and the greenback drifted modestly higher. Wall Street finished in the red.

On Wednesday, China was closed and USDJPY rallied. This time the rally was short-circuited in Europe, and the move was largely reversed. Weak wage price data hurt AUDUSD. UK employment data and a letter suggesting discord among Theresa May’s back-benchers pushed GBPUSD down. Weak Eurozone flash PMI data pressured EURUSD. FX markets were rangebound until the FOMC minutes were released. Trading was choppy immediately afterwards but settled into US dollar demand on fears the Fed would raise interest rates at least four times in 2018. The dollar closed with gains all around, and Wall Street slumped.

China was open for business Thursday and USDCNY fixed at 6.3530. Aussie and kiwi traders didn’t seem to be bothered with the FOMC minutes; those currencies were bought and they opened in New York at or near pre-FOMC levels.

USDJPY was the outlier as initial gains turned into losses on minor risk aversion selling which continued until New York closed. GBPUSD was hurt when Q4 GDP missed forecasts. EURUSD shrugged off a mixed German ZEW survey. New York sold US dollars across the board except against the Canadian dollar; the loonie underperformed because of a weak Retail Sales report.

Wall Street finished mixed, the Nasdaq lost a tad while the other two had small gains.

Finally, we saw a quiet FX session Friday but the US dollar managed to eke out further gains while Brexit stories kept GBPUSD traders on their toes.