Outrageous Predictions

Executive Summary: Outrageous Predictions 2026

Saxo Group

Global Head of Macro Strategy

Emerging market currencies continue to show wide divergences in behaviour, as some commodity-linked currencies rallied as trade war worries both rose and later fell dramatically over the last couple of weeks, while elsewhere, individual EM’s like the ruble and the Turkish lira were shaken by specific developments not linked to broader risk appetite developments.

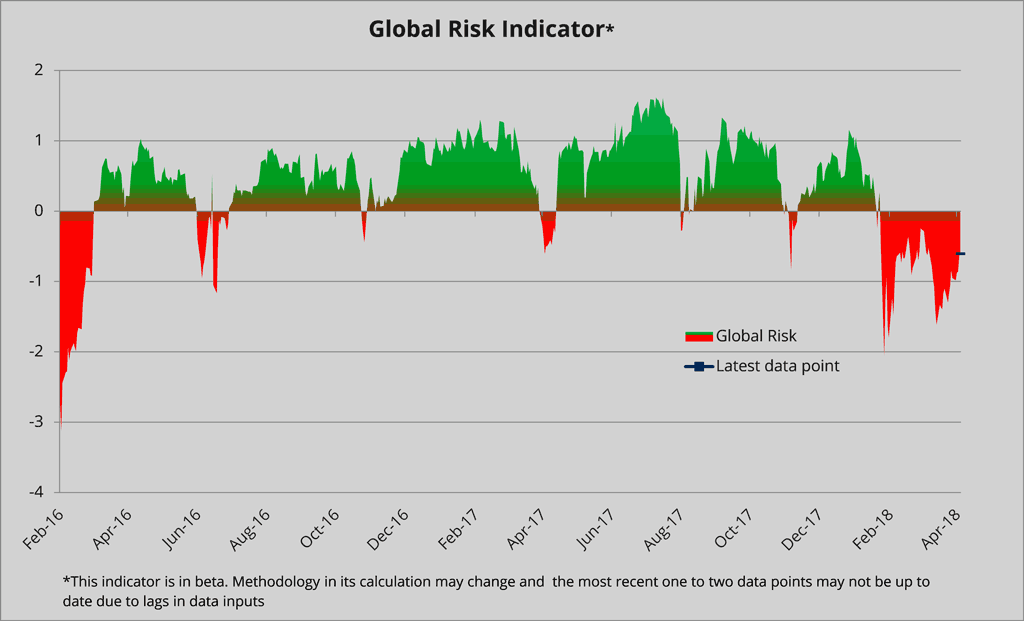

Our global risk indicators has shown some improvement as general market volatility has settled, but we’ll take some more convincing before considering the environment generally friendly for broad EM exposure.

The weekly wrap: diverging individual developments worth highlighting.

This week, rather than discussing the EM currency performance in aggregate, we would rather highlight a few specific developments for individual currencies as the performance divergence has been perhaps the most pronounced in the short history of this publication as specific currencies are following their own drivers. The only broad observation we can make is that China doesn’t seem interested in anything save for signalling stability, which spells very low volatility for the currencies of the most China-linked exporting economies like Thailand, Malaysia, and South Korea.

RUB: the most dramatic currency fluctuations this week were in the Russian ruble as fresh sanctions aimed at key Putin ally and oligarch Deripaska saw a downdraft in nearly all Russian assets, from the companies associated with Deripaska all the way to USD-denominated Russian sovereign debt. While the move was cut in half by the end of this week, the severity of this new threat that could be compounded by any aggressive Russian response could put a discount on Russian assets for quite some time. A new high in oil prices offers some offsetting support for the ruble.

TRY: the Turkish lira has been gutted by fresh concerns that President Erdogan will continue to interfere with interest rate policy and pursue growth at all costs with funds that the Turkish government can’t afford to spend. Turkish finances are highly dependent on foreign capital and the situation has taken an ominous turn that could end up in a self-fulfilling spiral of loss of confidence in the worst instance – leading even ultimately to default as Turkey’s external debt load grows with every tick lower in the lira’s value.

Chart: EURTRY

EURTRY has been no successful carry trade, with shorts returning approximately -12.7% over the last 12 months despite a massive, approximately 14% carry differential. The spot rate has risen from below 4 to above 5 over the same period.

MXN: the Mexican peso has been a strong perfomer, managing to trade near its recent highs versus the US dollar as the Trump trade tantrums have decreased in intensity in terms of Mexican implications. Importantly as well, the front-running candidate for the July presidential election, the somewhat left-populist Obrador, has made surprisingly market-friendly noises on the need to slim down Pemex and may not end foreign involvement in Mexico’s oil and gas industry according to some, which many have raised as a key concern.

BRL: the Brazilian real has been whipsawed by the political situation, first attempting a rally on the jailing of former president and leading presidential candidate Lula as he was seen as dangerously populist by capital markets. That rally lasted all of less than a day and since then USDBRL has jumped to new highs for the cycle. Lula enjoyed widespread popular support and his jailing could energize the sense of uncertainty ahead of the October election, with an ongoing ruinous Brazilian fiscal backdrop continuing to apply the pressure as the needed pension reform has yet to happen. Recent efforts at more fiscal discipline have also failed, keeping up the pressure on the real.

HKD: not an EM currency, strictly speaking, but plenty of drama here as the popularity of running a USDHKD carry trade due to the rate differential has seen the pair bumping up against the top of its trading band, requiring the Hong Kong Monetary Authority to intervene, both by hiking rates and buying HKD. The HKMA has plenty of firepower to defend the currency and has sent signals that it remains willing to do so, but say tuned.

IDR: This Friday the 13th, Moody’s raised the rating for the country’s long-term, foreign currency sovereign debt to Baa2 with a stable outlook, taking it to the second-lowest rung of investment grade rating. Moody’s based the upgrade on the country’s fiscal and monetary policies and the rise in the country’s foreign reserve holdings. For its part, IDR hardly reacted to the news and the USDIDR rate looks almost managed, virtually unchanged for more than a month. In our spotlight focus on IDR back in March, we argued that it was precisely this interest in the central bank’s reserve building that could continue to lead to lacklustre performance and explained past sluggish performance despite other promising developments over the last year.

Chart: Global Risk Index – not getting worse, but can we scratch back to improvement?

As this week has wound down, we have noted some marginal improvement in our Global Risk Indicator, which continues to show some rather pointed divergences in the performance of its components, as credit and risk spreads remain a bit elevated but going nowhere, while market volatility measures are generally collapsing again – especially in FX, but the VIX is trying to close this week at a three-week low for its part.

EM currency outlook: tempted to get a bit more constructive, but waiting at least another week.

It is far too early to tell if market conditions can continue to calm and provide a consistent tailwind for risky assets around the world. The MSCI EM equity index is almost unchanged from its level of two weeks ago in USD terms and is not providing any impulse of note, though its 200-day moving average remains intact (that MA is rising fast and not far below recent lows, it should be noted).

Trump’s wildly erratic pronouncements on trade appear to be ending the week on a positive note for risk, though the directional resolution of equity markets remains an open question (unprecedented intraday volatility for recent years, that oddly leads nowhere) and Trump’s focus and policy broadsides can come out of nowhere.

As well, we appear to be set to end the week on a two-week high note for US Treasury yields. While bond market volatility has rapidly collapsed in recent weeks after the prior significant pickup, it could be that the apparent calm risks quickly yielding to more volatility if the US 10-year benchmark, for example, approaches 3.00% again as it threatened to do in February, possibly the key factor kicking off intermarket volatility.

Inflation and earnings data from the US could once again act as a broad market destabiliser on any large surprises.

To boot, next week features a calendar rich with Federal Open Market Committee voters members out speaking, so we may get more input on whether the Fed is leaning more to three more hikes this year versus the mere two hikes that represent the consensus scenario. This is in addition to that 3.00% level for the benchmark. Given how well the market survived the recent bout of equity volatility, we’re far more concerned about the return of bond market volatility.

EM currency performance: Recent and longer term, carry-adjusted

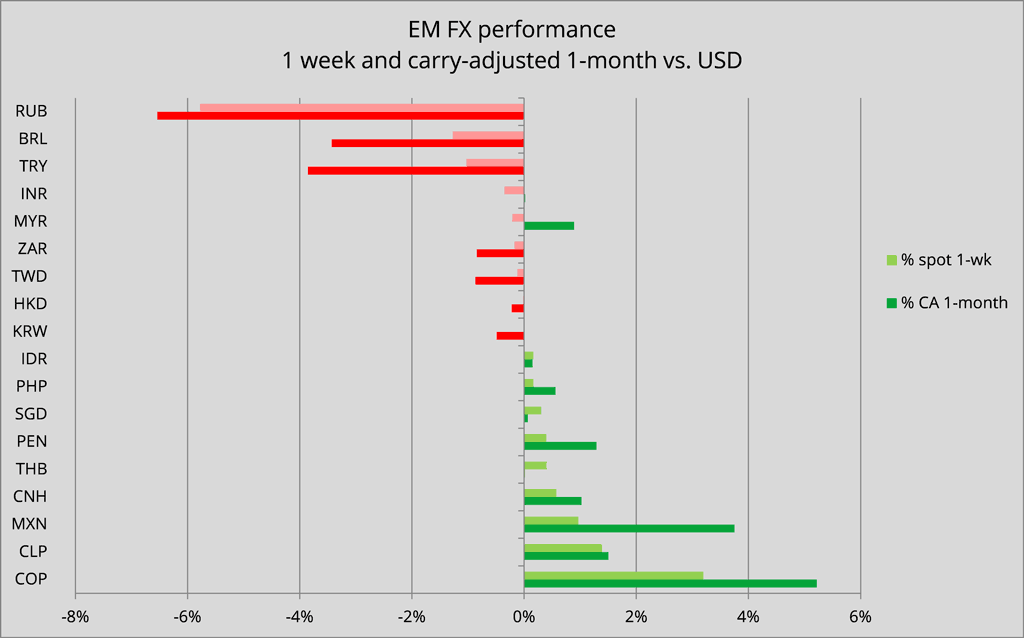

Chart: the weekly spot and 1-month carry-adjusted EM FX returns vs. USD: The three bottom dwellers this week are RUB, TRY, and BRL, which have also done very poorly on a one-month basis. We discuss the drivers of their weak performance above. The rest of our universe has mostly seen lacklustre performance as neither the USD nor the CNY have provided much drama over the last week of action.

COP is the outperformer this week on the strong performance of oil, which is Colombia’s dominant export product.

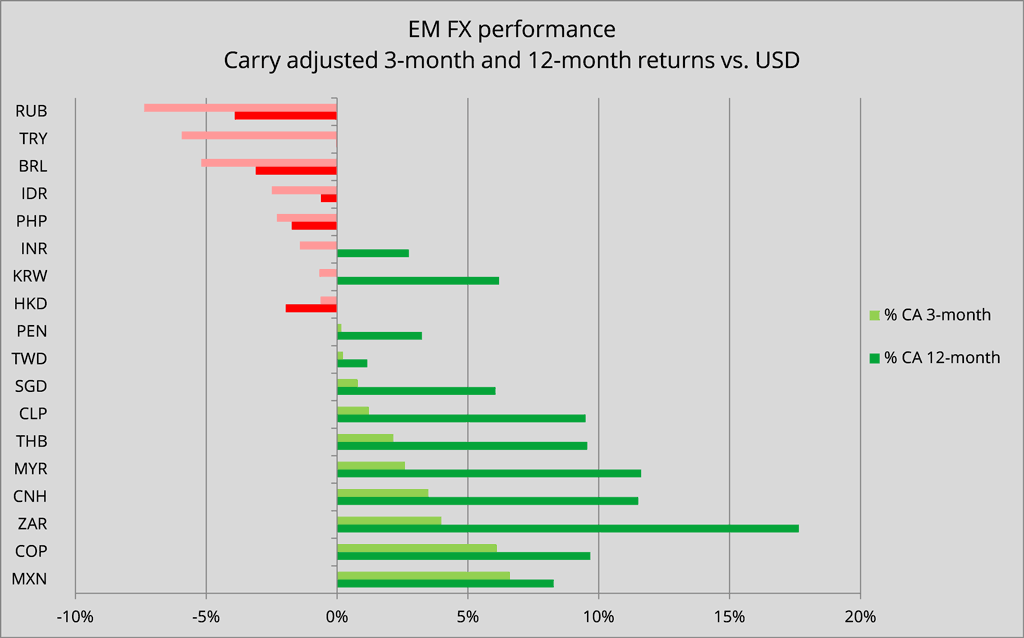

Chart: three- and 12-month carry-adjusted EM FX returns versus USD: The longer and shorter term performances are beginning to show consistency except for the South African rand, which is still digesting the very sharp move higher from late last year and hasn’t done notably well in the nearer term, though the long term carry-adjusted performance offers perspective on how far it has come over the last year.

Note the Turkish lira now up 0% year-on-year versus a rather weak US dollar despite a very strong carry differential. In EUR terms, the TRY is down over 12.5% on a carry-adjusted basis. The Mexican peso has enjoyed recent strength as the market continues to discount the threat of trade policy from an erratic Trump administration, though the threat remains, as does some residual (if now lower) uncertainty centred on Mexico’s July presidential election.