Outrageous Predictions

Executive Summary: Outrageous Predictions 2026

Saxo Group

Global Head of Macro Strategy

EM currencies remain in a bit of a funk as global risk appetite remains defensive on balance. As well a recent bout of USD strength and fears that newly minted Fed chairman Jay Powell has dramatically lowered the price of the Fed put are weighing on EM currencies. This Wednesday being the first Federal Open Market Committee meeting under Powell, it looks like a pivotal week on all fronts as we await his style and intangibles more than any specific guidance.

The weekly wrap: EM performance turned south on strong USD and wobbly risk appetite

Last week saw the majority of EM currencies in defensive mode as risky assets turned back lower after faltering in attempts to make new highs. The strong US dollar of late was no help, as Fed rate hike expectations remain pegged near recent highs for the cycle, even as longer US yields pushed back a bit lower and away from what are widely considered structurally important levels – 3.00% in the US 10-year benchmark, for example. The weakness in EM was broad and involved most of the heavyweights among the most traded EM currencies, including MXN, RUB, TRY and ZAR. The Chinese renminbi remains (ominously) range-bound as we only have a negative drumbeat of rumoured moves from the US administration on new protectionist measures aimed at China without actual new developments, save for some drama in US President Trump’s reshuffling of his cabinet, one that would seem to raise the odds that a more hawkish stance on trade is on its way.

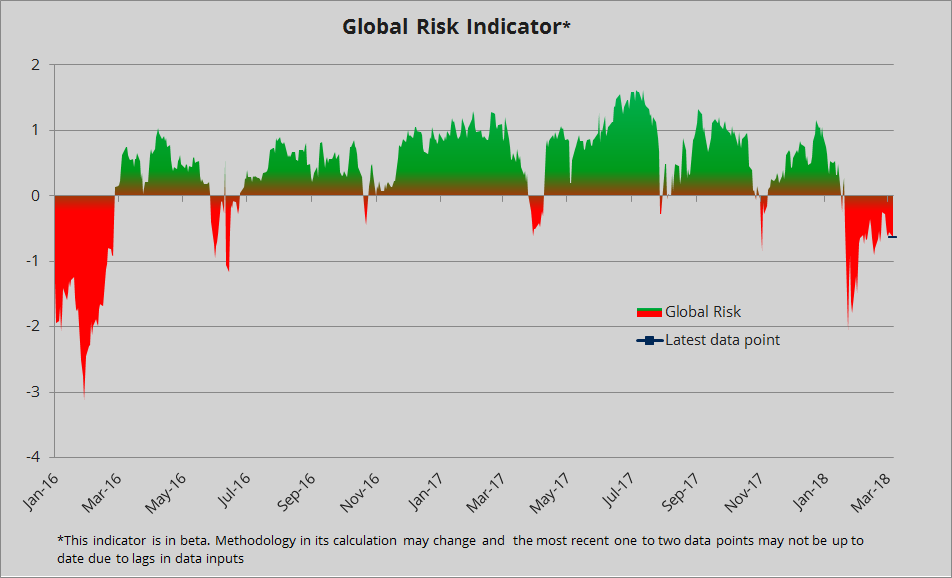

Chart: Global Risk Index – tilting back in the wrong direction

The chart below is our Global Risk indicator which offers a perspective on the short-term level of risk appetite relative to the longer-term backdrop. A persistent improvement is needed to take the risk indicator back to neutral. Over the last week, our global risk indicator has tilted back into a negative direction, helping to drive the weak performance across risk-sensitive EM currencies. No single factor was to blame and we continue to note that the majority of risk indices are fairly neutral relative to longer term ranges, it’s just that we have come off a period of very widespread complacency. Again, opportunities generally strike for EM when conditions are improving and positive, or when there has been an exceptional overshoot of negativity. For the latter, the latest bout of somewhat weak risk appetite does not qualify.

Source: Saxo Bank

EM currency outlook: FOMC on tap – USD direction important for EM

The recent strength in the US dollar has been one of the key factors in pressuring EM currencies recently, probably more than slightly weaker risk appetite, and EM risk spreads are largely flat over the last couple of weeks. This week’s FOMC meeting is likely to prove pivotal for at least the near-term USD direction and thus also pivotal for the near-term outlook for EM currencies, given USD sensitivities. A more hawkish message than expected and the need to price in a total of four hikes this year is a negative EM risk (one hike at each press conference FOMC meeting for the rest of the year). On the other hand, a surge at the longer end of the US yield curve could inflict even more damage than a further flattening of the US yield curve via higher short rates.

Something tells us that Powell might dislike excessive certainty in the timing of forward rate moves as opposed to wanting to signal anything explicit on the number of hikes. Currently, the market sees three or fewer hikes as more likely. Regardless, any aggravated uncertainty that the Fed could hike more than expected could risk a further bout of volatility and weakness in EM assets. The best outcome for EM would be an indifferent Fed, flat to lower US yields and a return of risk appetite.

The worst aspect of the current market environment and attempt to assess the outlook for EM currencies is that the greatest source of potential risk in the near term is from policy announcements, whether on Trump’s next potential protectionist move or on the response from China and other major US trading partners. For now we maintain a fairly defensive posture on EM outlook, particularly for the riskiest currencies like the Turkish lira (our spotlight currency this week – see below). If risk appetite suffers a disorderly decline and risk assets suffer a broader and deeper correction than was the case in early February, this might have us on the lookout for mean reversion/buying the dip/fading the panic opportunities, but the current market environment is still a bit thin on reward for the risk, given the risk appetite backdrop merely having mean reverted from extreme complacency and what we see as the pronounced headline risks.

We underline again this week the widening Libor-OIS spread, a measure of USD funding tightness that may be driven by the US repatriation flows (taking offshore dollars back on-shore as US companies take advantage of the next tax regime in the US) among other factors. Regardless of the source of the funding squeeze, further aggravation of this spread, which has widened aggressively over the last week risks further extending the broad weakness in EM, particularly those EM countries with larger USD debt exposures, like Turkey, Brazil and South Africa.

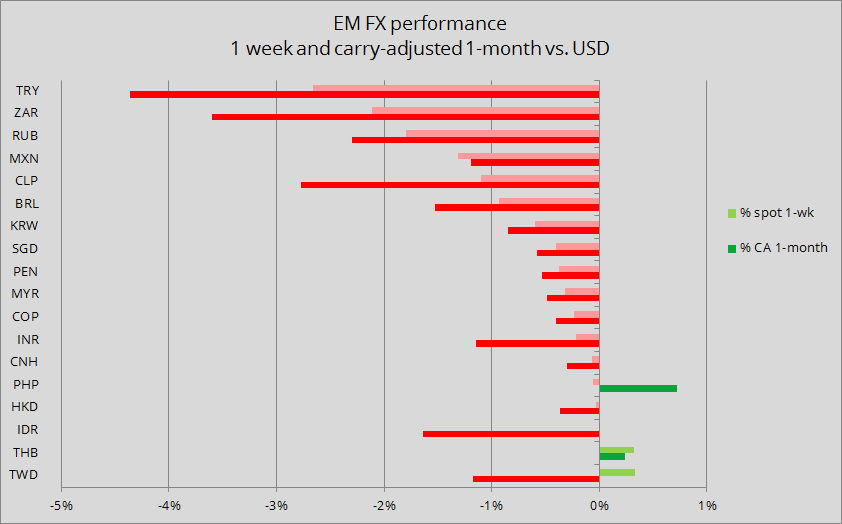

EM currency performance: Recent and longer-term, carry adjusted

Chart: the weekly spot and 1-month carry-adjusted EM FX returns vs. USD. The red is everywhere on this week’s short-term performance chart of our universe of EM currencies. Weakest have been our spotlight currency of the month, the Turkish lira, followed by a rapidly consolidating ZAR after its former strength, and a Russian ruble that has been on the defensive after the assassination attempt on former spy Sergei Skripal on UK territory and the UK and its allies’ response and threat of sanctions. Curiously, only the Thai baht has managed a positive performance for both the week and the month as the country possibly continues to avoid the risk of being accused of manipulating its currency.

Source: Saxo Bank

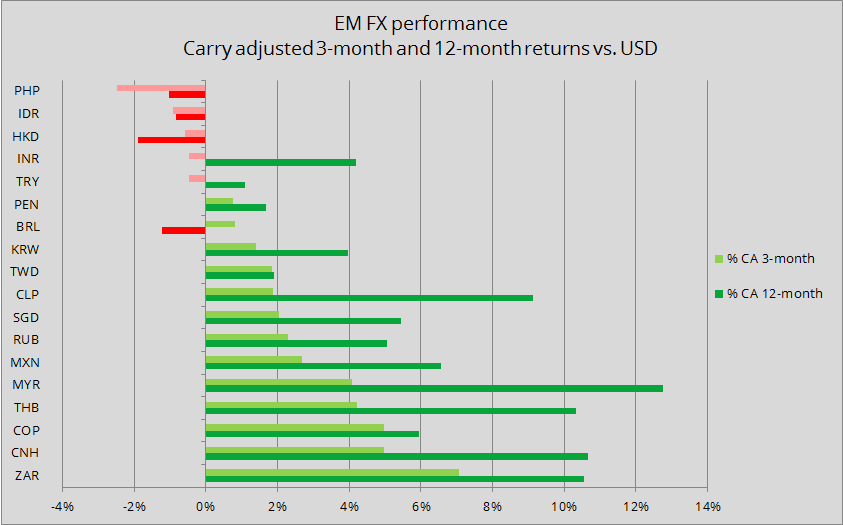

Chart: 3-month and 12-month carry-adjusted EM FX returns vs. USD. The longer-term performance of EM currencies remains positive, though the recent weak performance has eaten into a large portion of the three- and twelve-month returns.

Source: Saxo Bank

Spotlight currency this week: TRY (Turish lira) – Very cheap for very good reasons

Our spotlight currency of the week is the Turkish lira, which posted the weakest performance in our EM universe over the last week and last month. The lira has been weighed down by the general risk appetite wobbles we have discussed, almost since our inaugural edition of the EM FX Weekly in early February, but recently, more specific developments are driving its weakness. Over the last week, the escalation of Turkey’s military involvement in Syria is raising concerns that Turkey will find itself in geopolitical hot water that will send investors fleeing. And Turkey can ill-afford capital flight, as its sizeable current account deficit requires a constant inflow of capital to offset the deficit and makes Turkey one of the most susceptible emerging market economies to the whims of international investor appetite.

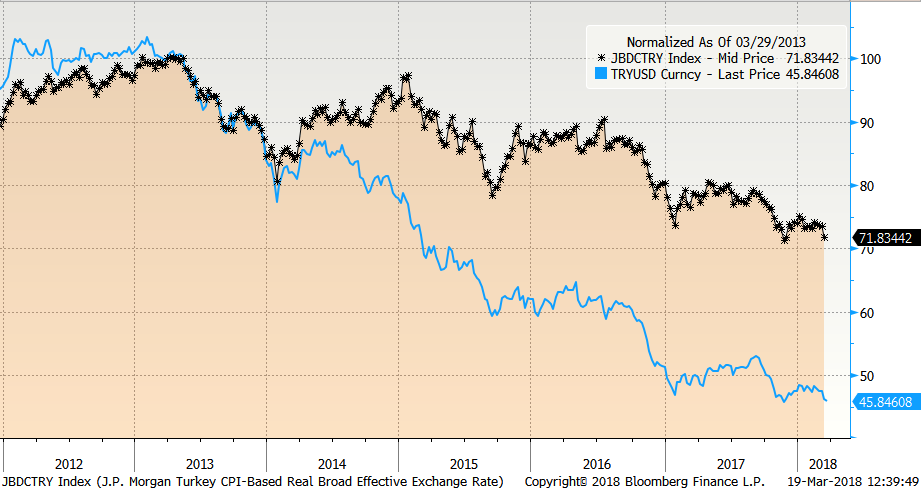

Chart: Turkish lira – CPI adjusted REER vs. USDTRY spot exchange rate

In the chart below, we can see that on a CPI-adjusted real effective exchange rate basis (black line), the lira looks weak relative to its multi-year history. Meanwhile, as usual, the development in the TRYUSD spot exchange rate (blue line) does a poor job over the long run of offering perspective on the strength or weakness of the currency due to the high level of carry for TRY.

Source: Bloomberg

The most significant source of the current account deficit is the budget deficit, which has widened to the worst among EM peers at 4.5% of GDP as President Erdogan has indulged in pro-growth outlays to keep the economy humming. So GDP looks good, as does the employment level, while the external balances have deteriorated. The strong economy and weak currency have also driven high inflation levels, though with the very high policy rate, real yields are still barely positive (the so-called late liquidity window rate is the policy focus, and stands at 12.75%, while the implied forward carry vary versus the USD is above 11.00% annualised in FX forward terms). Inflation needs to slow soon for investors to find Turkey’s high yields relevant, however, with the core CPI recently having risen above 12% year-on-year in December of last year before declining very slightly to start the year.

Another factor signaling the ongoing risk of outbound capital flows was Moody’s downgrade of Turkey’s sovereign debt to two steps below investment grade, while taking the outlook to stable from neutral. The ratings agency noted the external and geopolitical vulnerabilities we cite above, but also used that rather harsh phrase of “faltering institutional strength” in expressing concerns that Turkey’s institutions are not aligned to protect investors’ interests, including the ongoing state of emergency after the failed coup attempt of late 2016, a weakened court system and potential overreach by the executive branch due to Turkey’s recent institutional reforms that have excessively empowered the post of president. Moody’s also noted inadequate FX reserves, which have been drawn down somewhat over the last few years as the central bank has intervened on occasion to defend the currency. The reserves can only cover about four and a half months of imports, placing Turkey near the bottom of the EM class.

From here, despite the noted cheapness of the currency in the longer term perspective, we would steer clear of TRY as long as our Global Risk indicators remain weak. An excessive selloff driven by investor panic in the near to medium term could eventually take the currency into such undervalued territory that the discount is sufficiently large to justify some risk exposure to Turkey. Until then, we’d like to see real steps taken by the Erdogan government and central bank that are more reassuring to global investor capital, as well as a general improvement in the global investment environment.

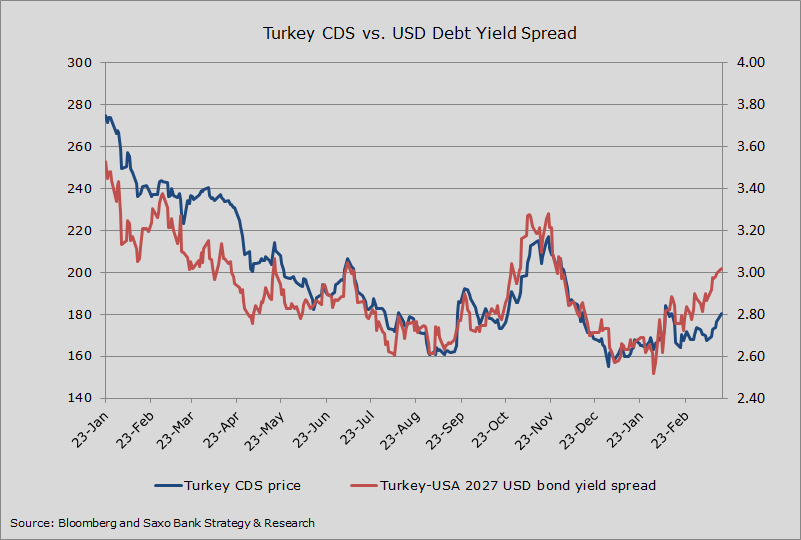

Chart: Turkey CDS prices versus USD bond spread. The widening of the yield between Turkish USD-denominated sovereign bonds and US treasuries of similar maturity (the two bonds used to create this spread expire within a month in 2027) show the markets deteriorating confidence in holding Turkish debt, with Turkish USD-denominated yields for 2027 maturity closing in on 6.0%, about a 300 basis point spread to US treasuries of similar maturity. The lack of responsiveness of the CDS price somewhat calls into question the usefulness of the CDS prices as an accurate measure of sovereign risk.