Outrageous Predictions

Executive Summary: Outrageous Predictions 2026

Saxo Group

Head of Commodity Strategy

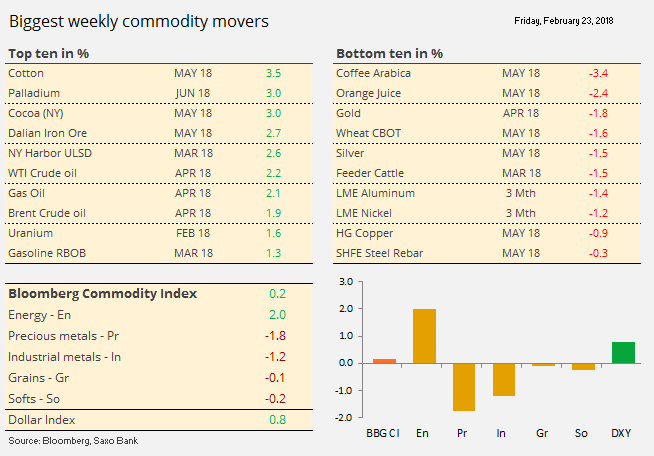

Commodities traded flat on the week with the Bloomberg Commodity Index showing gains in energy offset by losses across both industrial and precious metals. The agriculture sector was also flat following a month of strong gains, particularly among key crops.

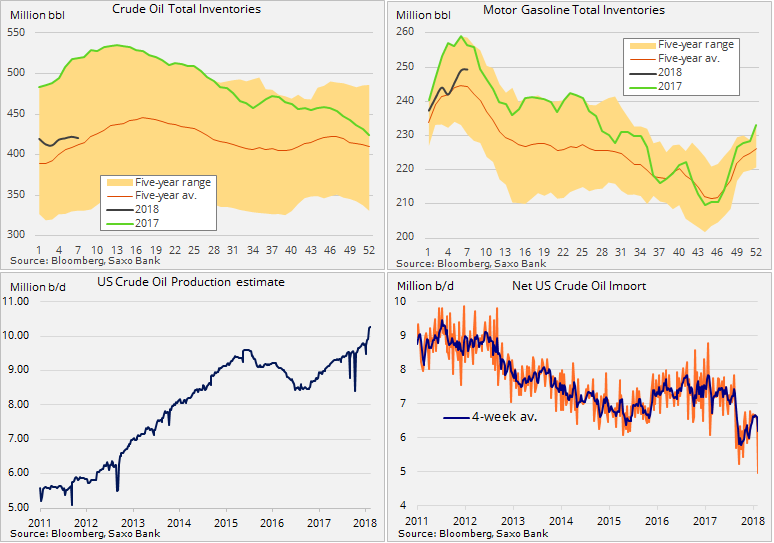

The latest weekly report from the US Energy Information Administration delivered a triple dose of bullish news with WTI surging to resistance at $63.15/barrel. This followed a surprise counter-seasonal drop in stocks driven by surging exports while production was flat following a recent jump.

Gold, meanwhile, endured its worst week since early December on the back of a stronger USD, a hawkish Federal Open Market Committee, and the US 10-year government bond yield approaching 3% – a level not been seen since it was rejected back in December 2013.

The fifth consecutive failure (since 2014) in breaking higher has also helped raised short-term concerns about a deeper correction.

Geopolitics

The motto of this year’s annual Munich Security Conference, held last week, was "To the Brink – and Back". All indications unfortunately pointed towards further conflicts as the conference laid bare the major lack of trust among world powers.

It highlighted multiple geopolitical risks ranging from US versus Russia, The West versus North Korea, Europe versus Turkey, and a messy Middle East where Russia and Iran are up against Israel and the US in Syria.

Other threats being discussed and worried over were cyber threats and not least the rise in global trade tensions, especially between the US and China. The US Commerce Department recently released its recommendations for restricting imports of steel and aluminium. The proposal, which now awaits a response and approval from President Trump, could potentially slap punitive tariffs on imports from five major suppliers, including China and Russia.

From a global perspective the impact is likely to be limited with the biggest being the risk of tit-for-tat retaliation on US imports, not only from China but also from other countries singled out by the proposal. The stock prices of US steel and aluminium producers are likely to receive a boost while US manufacturers making products from the two metals could suffer a competitive disadvantage given the impact of higher prices for domestically produced steel and aluminium.

Industrial metals in general traded lower as Chinese investors returned from their New Year holiday. The weakness was driven by a recovering dollar, increased expectations for further FOMC rate hikes, and China's quest to deleverage in order to achieve a more sustainable growth trajectory.

While investors await an expected post holiday pick-up in Chinese demand, the downside risk for now seems limited with HG Copper currently trading within a $3 to $3.3/lb range.

Food commodities going it alone

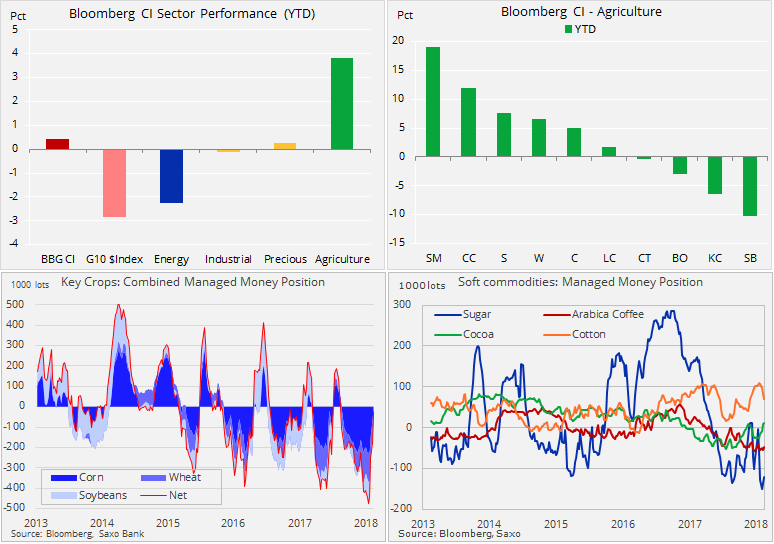

Overall the agriculture sector led by grains seems to have woken up from a multi-year snooze with record high stock levels increasingly being challenged by an uncertain production outlook. During the past month, a rising weather premium has emerged after extreme heat in the Southern Hemisphere and extreme cold across the Northern hemisphere impacted a variety of food commodities from soybeans to wheat and cocoa.

Additional support has come from the weaker dollar, strong demand, and rising energy prices as well as short covering from hedge funds who have been reducing a record grain short back to neutral during the past four weeks.

The recent rally in key crops led by soybeans due to lower output from Argentina may now pause ahead of the crucially important month of March. This is when the size of the Latin American harvest will become known while the US planting season begins, and with that news about what and how much US farmers intend to plant.

IP Week delegates focused on dwindling stocks, rising non-Opec production

During the past week, oil and gas operators as well as traders and ministers descended on London for the biggest annual gathering of oil executives at the IP Week. While the consensus was for higher prices due the successful and ongoing production cuts from Opec and friends, some uncertainty with regard to surging non-Opec production was also seen.

This was highlighted by the International Energy Agency which is forecasting that global demand growth in 2018 and 2019 can be met by rising non-Opec production.

Houston, we may have a problem... your oil is too light

One concern that has started to receive some attention is the actual usefulness of shale oil given its super-light quality, which is limiting the use for refiners. All of the current growth in US oil production comes from wells producing very light crude oil which during the refinery process yields less in the way of middle distillates such as diesel and jet fuel – two major growth areas when it comes to future demand.

Over the past few decades the US refinery system has geared itself towards processing heavier fuels from countries like Venezuela, Canada, and the Middle East. The US is therefore increasingly in need of foreign buyers for its light crude, hence the current rise in exports.

Crude oil receives a boost from US data

The latest weekly report from the US Energy Information Administration delivered a triple dose of bullish news with WTI surging to resistance at $63.15/barrel. This following a surprise and counter-seasonal drop in stocks driven by surging exports while production was flat following the recent jump.

This brought the price of WTI crude oil to the 61.8% retracement of the January-February selloff. A break through this level would be a strong indication of the market having established a bottom following the recent correction. Overall, traders maintain a bullish outlook with the recent weakness only triggering a minor reduction in what a month ago was a record bullish bets on crude oil and products.

April WTI surged higher to reach resistance at $63.15/barrel, the 61.8% retracement of the January-February selloff. A break above would signal that a short-term low has been established with potential outside drivers being movements in stocks and the dollar.

As noted above, gold prices are presently being reined in by bond yields, the strong dollar, and the hawkish FOMC. We, however, maintain a positive outlook in the belief that inflation and geopolitical concerns – of which there are currently plenty – along with the potential risk that another stock market setback and weaker-than-expected economic data will continue to attract demand from investors seeking tail-end protection.

Gold is testing trendline support from the December low with a break signalling further losses towards $1,300/oz, a key technical and psychological area of support. Above the multi-year line of resistance currently at $1,365/oz sits a key barrier that stands in the way of a potential major upside extension.

Saxo Bank head of commodity strategy Ole Hansen publishes the Weekly Commodity Update every Friday.