Outrageous Predictions

Executive Summary: Outrageous Predictions 2026

Saxo Group

Head of Commodity Strategy

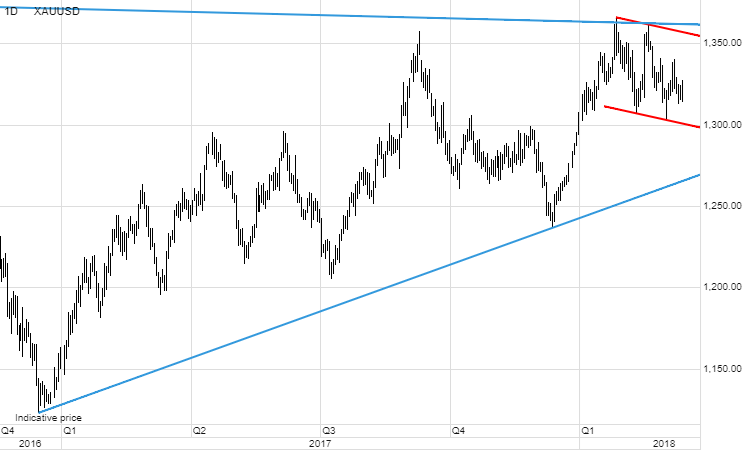

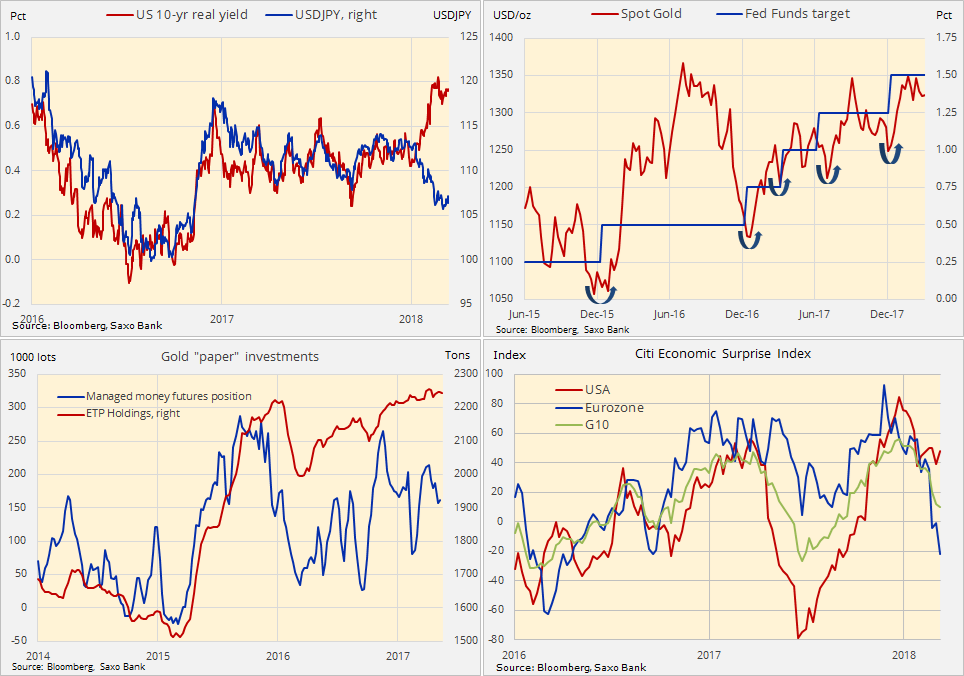

Gold has settled into a $40 range ahead of a near-certain sixth rate hike from the Federal Open Market Committee on March 21. A repeat post-FOMC rally depends on the forward guidance and whether economic data, as seen recently, continues to weaken relative to expectations. Opposite movements in real yields and the dollar during this quarter have also added to the current stalemate.

The probability of sixth rate hike in this cycle next week has been put at 100%. The key in order to determine the impact on gold will be the forward guidance, which could signal a change from three to four rate hikes in 2018. The latter is currently being priced with a 26% probability following a couple of months where expectations have been raised on a regular basis.

The five rate hikes seen so far in this current cycle all resulted in the same behaviour with gold selling off ahead only to rally strongly once the announcement was made. All of these hikes were characterized as being dovish hikes hence the potential impact this time round should Jerome Powell, the new Federal Reserve chair, strike a more hawkish note.

Economic data have shown a weakening trend relative to expectations this year and this may accelerate should a global trade war erupt.

An emerging divergence between the dollar and US 10-year real yields – not least against the Japanese yen – has been another reason for gold's recent lack of direction. With 10-year nominal bond yields approaching 3% and inflation expectations anchored around 2%, the real yields have seen a steady increase this year. Countering this move has been the renewed strength of the yen against the dollar.

A constant source of support for precious metals during the past year has been provided by President Trump and his often controversial twitter habits. Trump's behavior remains unpredictable with geopolitical risk indicators having increased since he took office.

We maintain a bullish outlook for gold and it would take a break below $1,285/oz for that view to be altered. The last couple of weeks ahead US rate hikes have proven in the past to be a good buying opportunity.