Outrageous Predictions

Executive Summary: Outrageous Predictions 2026

Saxo Group

Head of Commodity Strategy

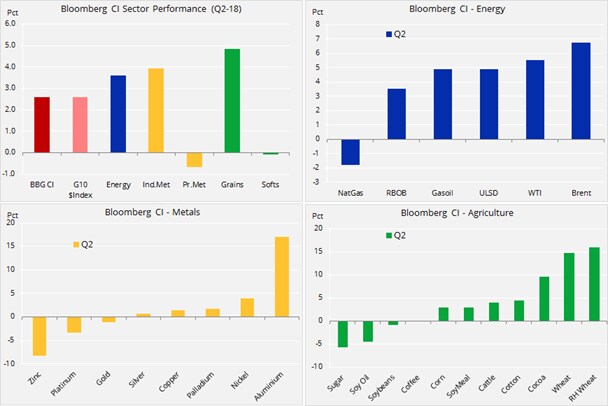

The performance across key commodities remains solid so far this quarter. Trade and geopolitical tensions, together with a stronger dollar, have nevertheless helped create a challenging market through which to navigate. As an overall factor we have seen the rising dollar create some headwind, not least for precious metals. The combination of an elevated speculative dollar short and euro longs helped trigger renewed buying of the dollar in recent weeks. The short-covering rally, which to a certain extent has been driven by rising yield differentials to other currencies, has seen the greenback recover most of its 2018 losses.

The energy sector, especially crude oil, has, on top of the support from the Opec/Russia production cap and robust demand, benefited from increased geopolitical risks related to Trump's May 12 decision on whether to step away from the Iran nuclear deal. The outcome could see crude oil either extend its current run of gains or trigger a deflation of the risk premium which has built up in recent weeks.

Industrial metals have been caught up in the trade tensions between the US and China given the potential risk to global growth and demand from a full blown trade war. The risk of supply disruption has lifted aluminium, and to a lesser extent nickel, after the US sanctioned several Russian oligarchs, one of them holding a major stake in the biggest aluminium producer outside China.

The focus on dry weather has seen the grains and soybean sectors find support. The record high stock levels left over from previous years, which until recently was making a negative impact, are currently being more than offset by an uncertain production outlook. A rising weather premium has emerged in recent months due to developments in both the northern and the southern hemisphere. Speculative traders, such as hedge funds, have as a result turned the most bullish on the three major crops for this time of year since 2014.

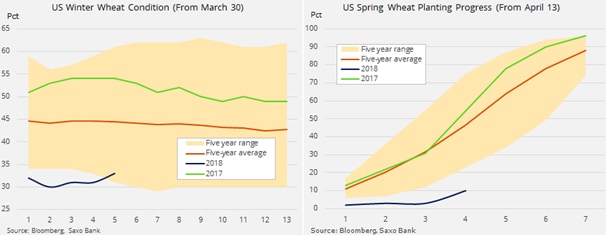

Wheat prices have benefited from dry weather conditions across the U.S. central plains. The current winter crop remains in poor condition while the planting of spring wheat remains well behind schedule.

The potential biggest event since the December 2016 Opec/Russia agreement to curb oil production in order to support the price awaits the market in a few days. US president Donald Trump has until May 12 to make a call on Iran. At stake is the June 14, 2015 deal between Tehran and six world powers that lifted sanctions against the Islamic Republic in exchange for limits on the Iranian nuclear programme.

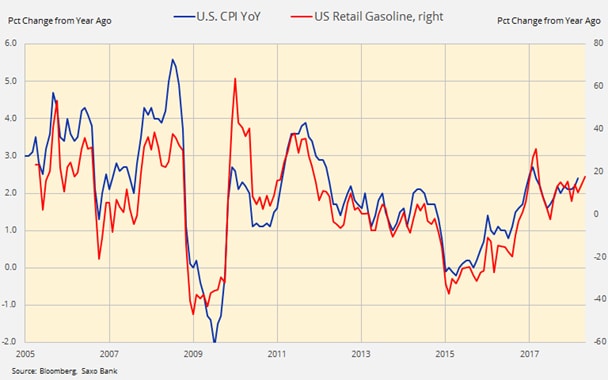

If Trump abandons the deal, he risks a spike in global oil prices that could end up being counterproductive given the impact on global growth and inflation. While the other members of the deal remain in favour of its continuation, the reintroduction of US sanctions would hurt Iran's ability to transact in dollars. Even though Iran does not export any oil to the US, it could on that basis reduce or potentially completely remove or at best reduce demand from US allies in Europe, Japan and South Korea – just like we saw between 2012 and 2015, when Iran was sanctioned.

The US, Israel, and Saudi Arabia view the deal as flawed as it allows Iran to build nuclear weapons following a 10-year moratorium while at the same time giving Tehran the economic power to fund terrorist organisations in Syria, Lebanon and Yemen.

Israel joined the debate this week when prime minister Benjamin Netanyahu said Iran was lying "big time" after presenting documents which he said proved that Iran ran a programme between 1999 and 2003 to build atomic bombs. The market impact, however, proved temporary as he failed to present any evidence that Iran was currently violating the terms of the agreement. However, the timing was seen as a counter to European leaders who, led by France's Emmanuel Macron and Germany's Angela Merkel, have stepped up their attempts persuade Trump to agree to an amendment instead of abandoning the nuclear deal.

The lifting of sanctions at the beginning of 2016 helped trigger a one million barrels/day increase in Iranian oil production to 3.8 million b/d. A reintroduction of sanctions without seeing other Opec members increase production could remove an estimated 300-500,000 barrels/day of Iranian barrels.

Brent crude, the global benchmark, has benefited greatly from ongoing geopolitical risks, with the US-versus-Iran standoff as well as an ongoing collapse in Venezuelan production attracting most of the attention.

On top of this, global demand was strong during the first quarter and, combined with Opec and Russia's continued discipline in keeping production capped while talking up the price towards $80/b, has helped support a strong build up in speculative bets on higher prices. The net-long in the market is by historical standards now very stretched, not least in Brent crude where only one short exists per 20 longs.

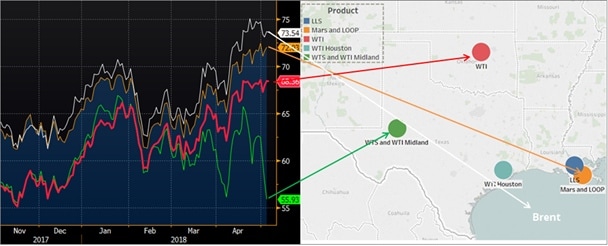

Rising US shale oil production, pipeline constraints and distance to the Gulf of Mexico export terminals are currently creating some major price discrepancies within the US market.

Source: Bloomberg and CME

US oil production continues to surge and with that we are seeing bottlenecks starting to emerge. Pipelines increasingly running close to capacity have dislocated the price of oil produced in the Permian region in West Texas from the rest of the US. The chart above shows the wide discrepancies between Permian shale oil priced at Midland compared with WTI crude oil at Cushing. The price of oil at the major oil export hubs on the Mexican Gulf Coast, not least the Louisiana Offshore Oil Port (LOOP), reflects a price much closer to that of Brent crude, the global benchmark.

Brent crude has currently got a technical upside target just below $82/b, the 61.8% retracement of the 2014 to 2016 sell-off. But this depends on its ability to hold onto the current non-fundamental risk premium, estimated to be somewhere between $5 and $10.

Source: Saxo Bank

Gold's recent slide paused after the Federal Open Market Committee at its latest meeting was seen sticking to its gradual tightening policy, while the China/US trade war and US/Iran sanctions and Israel/Iran military concerns provided some underlying support. The weakness seen during the past three weeks has primarily been driven by a recovering dollar.

The US jobs report for April saw the dollar strengthen further on a strong headline number but with no signs of wage pressure picking up ,bonds were allowed to run a tad higher, thereby providing gold with an offset against the dollar strength.

Speculative data using IMM currency futures show how in recent months a record euro long and a dollar short at a seven-year peak had increased the risk of a counter move. With more than 80% of the dollar short being against the euro, recent developments – such as a rising yield spread and disappointing economic data from the euro area – helped weaken the euro and left USD, at least in the short term, exposed to additional gains and subsequent headwind for commodities, not least gold and silver.

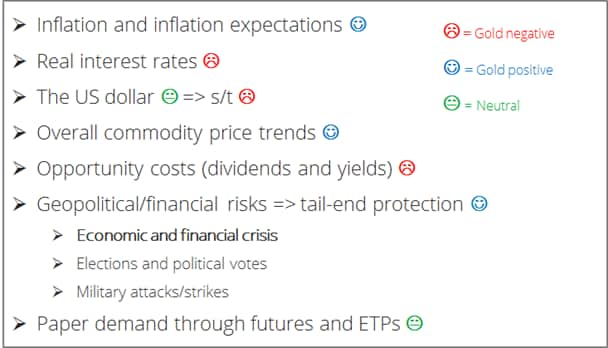

An overview of the drivers that tend to set the direction for gold shows how we are seeing no clear direction at this stage. Rising inflation expectations, an overall bullish commodity trend (late-cycle preference for commodities), geopolitical and financial risks are being offset by a rising dollar and rising real rates.

Source: Saxo Bank

A brick wall of resistance continues to cap the upside and multiple failures since 2016 in breaking above an area between $1,365 and $1,375/oz has left the market nervous with the focus once again on finding support.

Having retraced half of the December to January rally, gold has found support ahead of key technical and psychological support at $1300/oz. The potential success of holding above is mostly in the hands of the dollar and its short-term trajectory, together with news on Iran sanctions from the US with the May 12 deadline looming. A move back above $1322/oz is needed to signal a return to relative safety.

Source: Saxo Bank