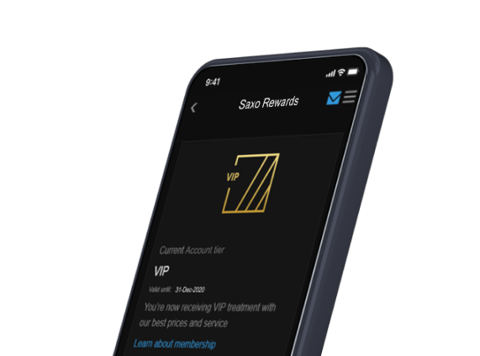

Saxo Rewards

Trade more, pay less and receive better service with our new loyalty programme.

| Product | Volume* | Points |

|---|---|---|

| USD 10,000 | 40 | |

| USD 10,000 | 200 | |

| 1 | 70 | |

| 1 | 70 | |

| USD 10,000 | 256 | |

| 1 | 40 | |

| 1 | 70 |

You don’t need to do anything. As you’re already a Saxo client, you’ll automatically join our loyalty programme, for no extra charge.

The number of points you will earn will depend on the product(s) you trade, and the size of your trade(s). Certain products will earn you more points than others, and the more you trade - in value or lots, for example – the more points you will earn.

When Saxo Rewards launched, existing clients remained in the same tier they were in immediately prior to the launch. If you're a new client, your initial deposit will determine your account tier. Initial funding of USD 2,000 will secure entry to the Classic tier, USD 200,000 to the Platinum tier, and USD 1,000,000 to the VIP tier. The upgrade will be effective two working days after the balance in your Saxo account reaches the qualifying level (e.g. USD 1,000,000 to attain VIP status).

To qualify for an upgrade, you’ll need to earn a specific number of reward points, defined by the tier you want to join. We base qualification to a tier on the number of points you’ve earned this month, and in the three previous months.

For example, any points earned in January will not be included in the points total from 1 May.

When you qualify for an account tier, you’ll receive a rolling 12-month membership. That means if you continue to meet the rolling points criteria of your tier, your 12-month membership will roll over as well. If you ever drop below the qualifying points criteria, you’ll have a 12-month grace period before we’ll move you to a lower tier, giving you time to build up your reward points again.

There are two ways you can earn reward points by funding your account.

1. First 30 days net funding

As a new Saxo client, you’ll receive reward points based on your net funding during the first 30 days from your first funding of your Saxo account.

You will earn 0.5 points on every USD deposited, or on its equivalent in your account's currency.

As an example, if you were to deposit USD 200,000, you will earn more than 120,000 points and therefore will qualify for the Platinum account tier.

Following the same principle, if you were to fund USD 1,000,000 to your account, you will earn 500,000 reward points and therefore will qualify for the VIP account tier.

If you withdraw funds, your points balance will reduce accordingly.

We’ll recalculate your points balance at the end of each day, and deduct points on a daily basis if you withdraw funds, so you can monitor your points on a regular basis. Any upgrade will be effective two working days after the balance in your Saxo account reaches the qualifying level.

Please note that total AuM (apart from your net funding and securities transfers) will not be taken into consideration for the purposes of calculating points during this initial, 30-day period.

2. First 30 days securities transfers

As a new Saxo client, you’ll receive reward points based on your net securities transfers into your account during your first 30 days with us.

Transferring securities will yield the same amount of points as a cash funding would. The amount of points will be based on the value of the transferred position.

You will earn USD points on every Euro transferred, or on its equivalent in your account's currency.

As an example, if you were to transfer USD 200,000, you will earn more than 120,000 points and therefore will qualify for the Platinum account tier.

Following the same principle, if you were to transfer USD 1,000,000 to your account, you will earn 500,000 reward points and therefore will qualify for the VIP account tier.

If you withdraw funds or transfer securities out of your account, your point balance will reduce accordingly.

We’ll recalculate your points balance at the end of each day, and deduct points on a daily basis if you withdraw funds or transfer securities out of your account, so you can monitor your points on a regular basis. Any upgrade will be effective two working days after the balance in your Saxo account reaches the qualifying level.

Please note that total AuM (apart from your net funding and securities transfers) will not be taken into consideration for the purposes of calculating points during this initial, 30-day period.

3. Funds and AuM over time

After your account has been open for 30 days, you’ll continue to receive points for the funds you hold with us, but as these funds may have converted from cash to positions the points you receive will be based on the total average assets under management (AuM) of your account, rather than the cash balance. This refers to the total value of your account, including any deposits and open positions.

Your reward points are calculated based on the monthly average AuM, and you’ll receive your points two trading days before the end of each month.

You will earn 0.025 points on every Euro AuM, or on its equivalent in your account's currency. An average AuM of USD 10,000 for example, earn you 250 Reward points every month.

Please note that we will not include AuM in our calculations during the first 30 days of your account being open. Rather, during this period we will consider net funding and securities transfers into the account, as outlined above.

If you don’t meet the points criteria of your tier, we won’t move you to a lower tier immediately. Instead, you’ll enter a 12-month grace period. This means you can continue to enjoy all the benefits of your current account tier for at least another 12 months.

This should give you time to collect enough reward points to qualify for your current tier again. If you do, your rolling 12-month membership will start anew. We will only consider moving you to a lower tier if you’re unable to meet the points criteria of your tier at any time during the grace period.