Options - Long vs short, assignment, exercise & ‘moneyness’

Level: Beginner / Length: 7 minutes

In this module, you’ll learn the difference between being long and being short on an options contract. And, in addition, we’ll explain the process of assignment and exercise and also look at the ‘moneyness’ in an option contract.

An options value is comprised of two elements: Intrinsic and extrinsic value. We’ll show you how this is calculated and what it means to your trading.

And depending whether you bought or sold a contract, the ‘time value’ could work to your disadvantage or advantage. We’ll explain why.

- What does it mean to be long or short?

- The process of alerting your broker to your intent – ‘exercise’

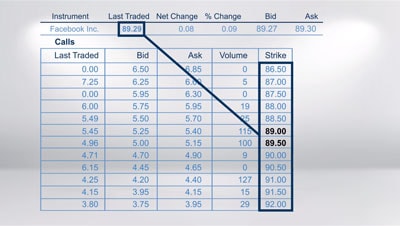

- What is the difference between intrinsic and extrinsic value?

- The differences between ‘in’, ‘out’ and ‘at’ the money