Outrageous Predictions

Carry trade unwind brings USD/JPY to 100 and Japan’s next asset bubble

Charu Chanana

Chief Investment Strategist

Director of European Marketing and Education, Options Industry Council

Using exchange-listed options as a positioning tool for IPO stocks

Markets trade on information. Initial public offerings, or IPOs, can be large events that are popular with investors. An IPO is when a new or existing company first issues stock to the public.

As well as raising capital for corporate development, IPOs are often used to reward the original, pre-IPO investors in the firm. Investors should note that as with any stock, IPOs can go up or down.

Listing new equity options

The decision to list a new stock on an exchange rests with the corporation itself and is subject to specific criteria that it must meet by the exchange. In the case of listing options on a new underlying equity, the procedure is different.

Each US equity option exchange has its own criteria for listing options, but they all follow a number of basic rules. These can be summarised as:

Once these general criteria are met, then individual US equity option exchanges can make a business decision on whether or not to list options on the specific underlying equity.

Why trade options on recently listed stocks?

Trading options on recently listed stocks offers the same potential advantages as trading options on any other stock, specifically to:

Readers unfamiliar with these concepts are referred to the Getting Started page on The Option Industry Council website.

Investors should also remember an important difference between established stocks and IPO stocks. IPO stocks do not have an established track record, making it harder for investors to make informed investment decisions. IPOs tend to generate a lot of press coverage and hype, but that is not the same as a track record. As stated before, IPO stocks can go up or down. They can be very volatile. IPO prospectuses can be of some assistance in investor research, as can other third-party research.

Investors establishing a position by buying options can define their maximum risk – the premium that they have paid. This may be useful for volatile underlying instruments like IPO stocks. Remember, though, that there is a time lag between an IPO stock starting to trade and when an option on it could be listed.

If options traders are correct on their directional view, the leverage delivered by an option may further enhance returns. Finally, an important component of options premium is volatility. Rapid changes in volatility will impact the options price, on both the upside and the downside.

Some bullish strategies

If investors are bullish and believe that the IPO stock will increase in price, then they could buy a call. If correct, they will benefit from the appreciation in the stock price. Bear in mind that there are many influences on an option’s price, of which the price of the underlying is only one. It is possible that while the price of the underlying rises, volatility might fall, offsetting the impact of the rise in the stock.

Volatility is not the trend of a stock’s price, but the divergence from that trend. See here for more information.

Another way to achieve a similar market positioning is to buy an out-of-the-money call (i.e. with an exercise price above the current market price for the underlying stock). The extent to which the option is out of the money will make the option cheaper, but the stock will have to move higher, above the exercise price, before the position becomes profitable.

Another options strategy might be a bull call spread, which involves buying a call at a lower strike, and then selling a call at a higher strike. This can reduce the cost of the strategy, by giving up any upside gains above the higher strike price. See here for details on a bull call spread.

Some bearish strategies

Possible bearish positions are the exact opposite of the ones listed above, namely buy a put (either at the money or out of the money; see here); or buy a bear put spread (see here).

Strategies that expect little price movement

IPOs can be volatile but if an investor thinks that the stock isn’t going to move much in price, then writing a straddle or a strangle are possible strategies. Of course, establishing a net short position can be expensive if the market moves the wrong way and the investor has to pay out more than he received to close out the position at a loss.

To establish a short straddle, both a put and a call are sold, at the same at-the-money exercise price. If the underlying stock doesn’t move, then the seller will retain the premium received. If the stock rises the call will lose money for the seller. If the stock declines then the short put will lose money. See here for details of the strategy.

Establishing a short strangle works in a similar way, but two exercise prices either side of the money are used. Having two exercise prices provides a greater possibility of positive outcomes, but the premium received will also be lower because both options are out of the money. See here for details.

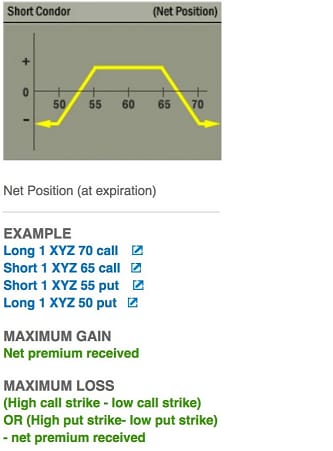

One final strategy is the short condor, also known as the iron condor, which can be seen as selling a strangle and simultaneously buying an even wider strangle.

To construct a short condor, the investor sells one call while buying another call with a higher strike and sells one put while buying another put with a lower strike. Typically, the call strikes are above and the put strikes below the current level of underlying stock, and the distance between the call strikes equals the distance between the put strikes. All the options must be of the same expiration.

The investor is hoping for the underlying stock to trade in a narrow range during the life of the options. The strategy profits if the underlying stock is inside the inner wings at expiration. Assignment risk – the risk that an option will be exercised by the option buyer and thereby disrupting the strategy – should not be ignored.

In the above example the short options – the "shoulders" in the graph – are subject to exercise at any time. Increased volatility will also have a negative impact on the profitability of the strategy. For more information see here.

Conclusion

IPO stocks have particular characteristics: they can be volatile, have no track record to guide investors, have prospectuses, and they also often attract strong media interest. But they are still stocks. If specific criteria are met, then they may become eligible for having options listed on them. The specific characteristics of options (defined risk for option buyers, leverage, importance of volatility in pricing), mean that they can be well suited for use with IPO stocks.

Saxo Bank’s educational initiatives can be found here.