Quarterly Outlook

Q3 Investor Outlook: Beyond American shores – why diversification is your strongest ally

Jacob Falkencrone

Global Head of Investment Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: Chinese Industrial Profit (Jun), US Dallas Fed Manufacturing Business Index

Earnings: McDonald’s, Onsemi, Philips, Tilray, Sprouts Farmers

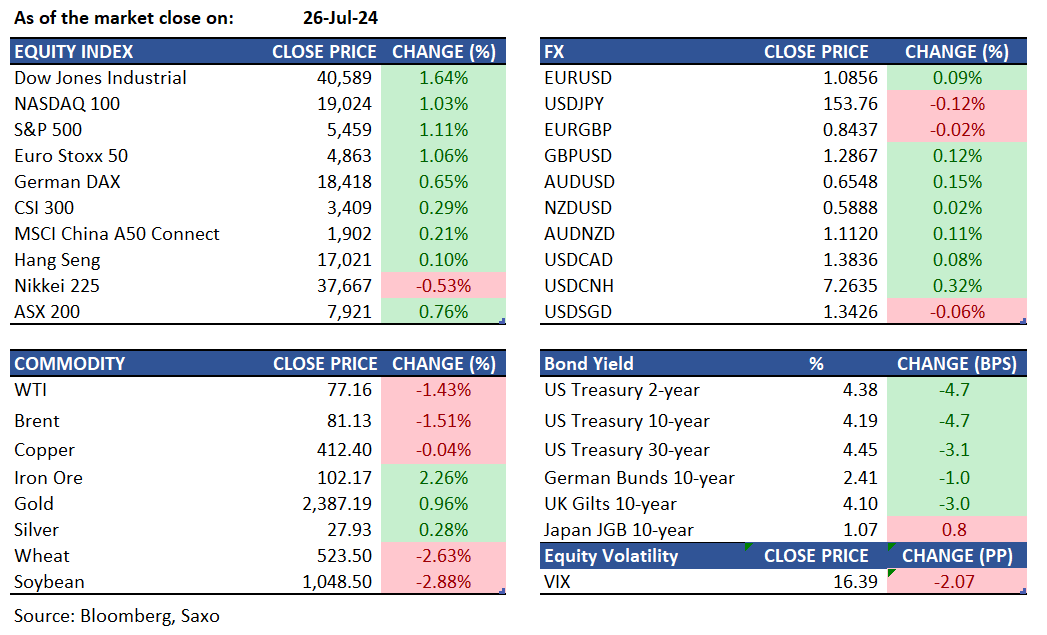

Equities: US markets experienced an upbeat session on Friday as the S&P 500 rose by 1.1%, the Nasdaq 100 was up 1%, and the Dow climbed 654 points. Investor sentiment was lifted by data showing potential signs of easing inflation, raising the possibility of an interest rate cut in September. The PCE, the Federal Reserve's preferred inflation metric, matched expectations, with the core rate rising slightly by 0.2% against a forecast of 0.2%. All sectors saw gains, led by industrials, notably 3M, which soared 23.1%, reaching a milestone not seen since 1972. Conversely, DexCom plummeted 40% after cutting its sales forecast for the year. Apple, Amazon, Microsoft, and Meta are set to report quarterly results this week, alongside McDonald's, Starbucks, Boeing, Exxon Mobil, and Chevron. Markets are also awaiting the Federal Reserve's policy decision on Wednesday.

Fixed income: Treasuries ended Friday with lower yields and a slightly steeper curve, as benign June PCE price index data reinforced expectations for Fed rate hikes starting in September. Gains were supported by favorable short-term technical factors, including no auctions until August 6 and next week’s month-end index rebalancing. The Bank of Japan will conduct its final bond-purchase operation before announcing a policy decision later this week. On Friday, the implied volatility of Japanese 10-year note futures surged to its highest level since late October. Additionally, Singapore and Australia are set to auction bonds. The Monetary Authority of Singapore will auction S$1.7 billion of July 2039 bonds, while the Australian Office of Financial Management will auction A$900 million of November 2028 notes on Monday.

Commodities: Gold prices rose by 0.96% to $2,387 an ounce, recovering some losses after a 2.5% drop on Thursday due to a non-alarming PCE inflation report. Gold is down 4.5% from its record high of $2,483.60 on July 17, amid optimism for a Federal Reserve rate cut in September. WTI crude oil futures fell 1.43% to $77.16 per barrel, and Brent crude dropped 1.51% to $81.13 per barrel. Nymex natural gas futures declined 5.73% for the week to $2.006, marking a four-session fall and a 13.87% drop over the past two weeks.

FX: The US dollar trades mixed at the start of a pivotal week with three key central bank meetings ahead from the Federal Reserve to Bank of Japan and Bank of England along with key Mag 7 earnings as well. This is pushing down the low-yielding currencies such as the Japanese yen and the Swiss franc which were the outperformers last week. The Japanese yen faced carry unwinding risks last week, which could be prolonged if the Fed signals a rate cut this week, however BOJ’s inaction could bring back yen weakness. On the flip side, the Australian dollar and New Zealand dollar are in gains, and Australia’s quarterly inflation report will also be one to watch this week. Sterling is unchanged after ending last week lower, with economists expecting the Bank of England to cut rates this week.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.