Note: This is marketing material.

Key points:

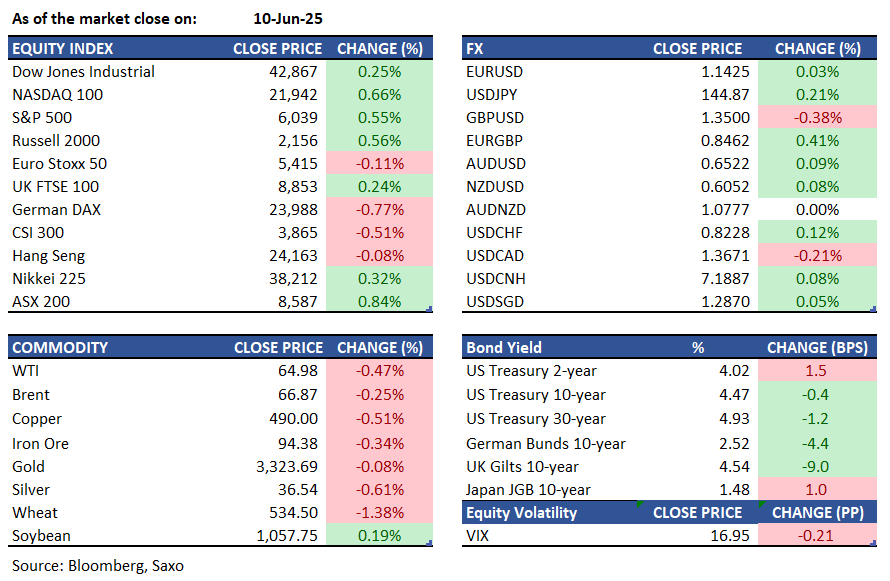

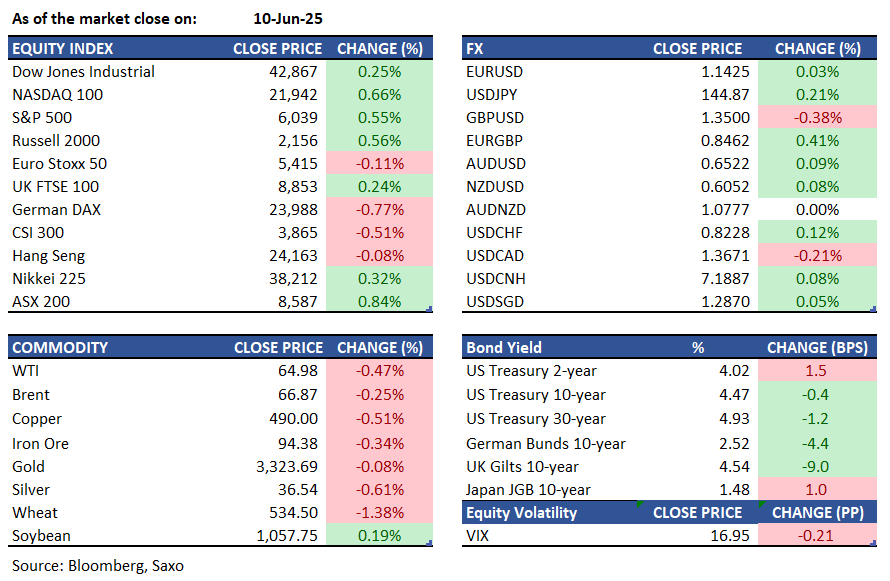

- Macro: US-China preliminary deal on rare earths awaits leader approval for implementation

- Equities:US futures dip; UBS shares fall 7% on Swiss capital concerns

- FX: GBP fell after UK jobs report showed payrolls and earnings decline

- Commodities: Spot gold remains above $3,300

- Fixed income: Treasuries gained from a rally in gilts, driven by weak UK labour data

------------------------------------------------------------------

Disclaimer: Past performance does not indicate future performance.

Macro:

- US and China reached a preliminary agreement on implementing the Geneva consensus, with negotiators confident that rare earth minerals and magnets issues will be resolved. Delegations will present the proposal to their leaders for approval and subsequent implementation. The London talks aimed to solidify China's pledge to ease rare earth shipments, made during last month's Geneva discussions.

- UK's unemployment rate increased to 4.6% in the three months to April 2025, the highest since August 2021, due to slowed wage growth after payroll tax hikes and a rise in the national minimum wage.

- Regular pay in the UK rose by 5.2% year-on-year to GBP 674 per week in the three months to April 2025, the smallest increase in seven months, below the forecast of 5.4%. This follows payroll tax hikes and a 6.7% rise in the national minimum wage.

- World Bank cut its 2025 global growth forecast to 2.3%, the weakest in 17 years outside of recessions, and 2026 to 2.4%. Growth is hindered by trade barriers and uncertain policies. Halving tariffs by May 2025 could boost growth by 0.2 percentage points in 2025 and 2026.

- US and Mexico are negotiating to reduce or eliminate Trump's 50% steel tariffs on imports. A likely outcome is a quota allowing a certain volume from Mexico to enter duty-free or at a reduced rate, with excess imports facing the full tariff.

Equities:

- US - Stock futures dipped on Wednesday ahead of the Consumer Price Index report and US-China trade talks. Commerce Secretary Lutnick said discussions were going well and might extend into Wednesday. On Tuesday, the S&P 500, Nasdaq, and Dow rose, led by energy, consumer discretionary, healthcare, and tech stocks like Tesla (+5.7%), Meta (+1.2%), and Alphabet (+1.3%). Meta plans a $14 billion investment in Scale AI and is launching a "superintelligence" research lab. Alexandr Wang and other Scale AI employees will join, with Meta offering large compensation packages to attract top AI researchers.

- EU - The STOXX 50 fell 0.4% and the STOXX 600 dropped 0.3% as investors awaited updates on US-China trade talks, which continued into a second day with US officials expressing optimism despite no major breakthroughs. UBS shares plummeted nearly 7% due to concerns over Swiss government proposals requiring an additional $26 billion in capital. Other banks, including Societe Generale (-1.2%), BNP Paribas (-1.1%), and Banco Santander (-0.9%), also saw declines. Conversely, Novo Nordisk shares rose over 2% following news that Parvus Asset Management is building a stake in the company.

- HK - HSI closed slightly lower at 24,163 on Tuesday, reversing early gains due to declines in tech and consumer sectors. Mainland stocks fell ahead of U.S.-China trade talks, despite a 90-day tariff easing agreement, as trade flows weakened with significant drops in exports and imports. EV stocks declined amid competition, with Geely and Great Wall Motor criticising BYD's price cuts. Li Auto fell 3.4%, Geely Auto 0.6%, and other major decliners included Mixue Group (-5.9%), Meituan (-2.8%), Xiaomi Corp. (-1.5%), Kuaishou Tech (-1.4%), and Tencent Holdings (-1.0%).

Earnings this week:

- Wednesday: Chewy, Oracle

- Thursday: Adobe

FX:

- USD remained stable with minimal news and a quiet US calendar ahead of Wednesday's CPI release. DXY traded slightly above 99 level.

- EUR returned to its initial level near 1.1430 after recovering early losses, as ECB's Rehn indicated decisions will be made on a meeting-by-meeting basis.

- GBP weakened to 1.3500 following the UK jobs report, which showed a significant drop in HMRC Payrolls Change, slowed earnings growth, and a rise in the unemployment rate, as anticipated.

- JPY softened due to positive risk sentiment, though USDJPY retreated from its peak after briefly reaching the 145 level.

- Economic data – UK Spending Review, US Inflation Rate, US CPI, US MBA 30-year Mortgage Rate

Commodities:

- Oil prices fell with WTI near $65. US crude output is expected to decline next year, contrary to Trump's energy goals. OPEC forecasts demand rising to 120 million barrels per day by 2050.

- Gold rose slightly even as the US and China agreed to ease trade tensions in London talks. Bullion traded near $3,330 an ounce, with a modest weekly gain. Officials said they reached a preliminary framework agreement from Geneva.

- An aluminium spread moved into backwardation, signalling a potential squeeze on the LME as the June contract expires. Mercuria's position might not be bound to lend at "flat" levels. The LME may limit large positions, with stocks at 360,000 tonnes.

Fixed income:

- Treasuries saw little change for a second session as markets awaited May CPI data and the 10-year note auction. A lacklustre 3-year note sale had minimal impact. Treasuries were bolstered by a rally in gilts due to weak UK labour data. Gilts outperformed as traders anticipated deeper Bank of England rate cuts, with UK 10-year yields ending 9 basis points lower.

For a global look at markets – go to Inspiration.