Outrageous Predictions

Carry trade unwind brings USD/JPY to 100 and Japan’s next asset bubble

Charu Chanana

Chief Investment Strategist

Global Market Quick Take: Asia – July 23, 2025

Key points:

------------------------------------------------------------------

Disclaimer: Past performance does not indicate future performance.

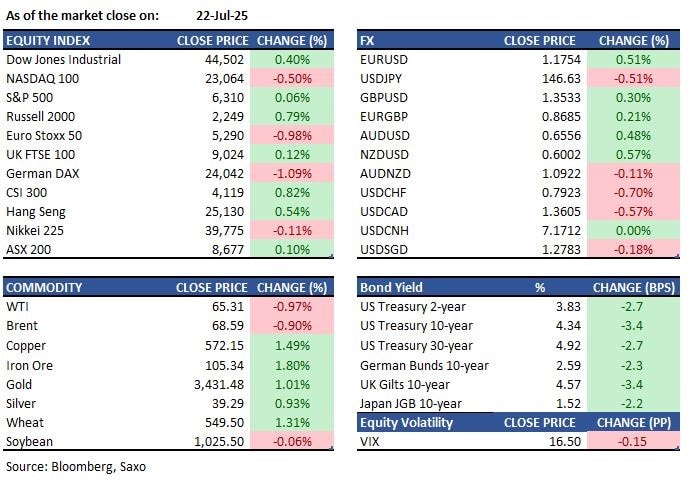

Macro:

Equities:

Earnings this week:

FX:

Economic calendar: Singapore June CPI data, Japan June Machine Tool Orders, Taiwan June Industrial Production, US June Existing Home Sales.

Commodities:

Fixed income:

For a global look at markets – go to Inspiration.