Quarterly Outlook

Q3 Investor Outlook: Beyond American shores – why diversification is your strongest ally

Jacob Falkencrone

Global Head of Investment Strategy

Key points:

-----------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: RBA Announcement, EIA Short-term Energy Outlook, EZ Retail Sales (Jun), New Zealand Jobs (Q2)

Earnings: Uber, SMCI, Rivian, Airbnb, Cat, Reddit

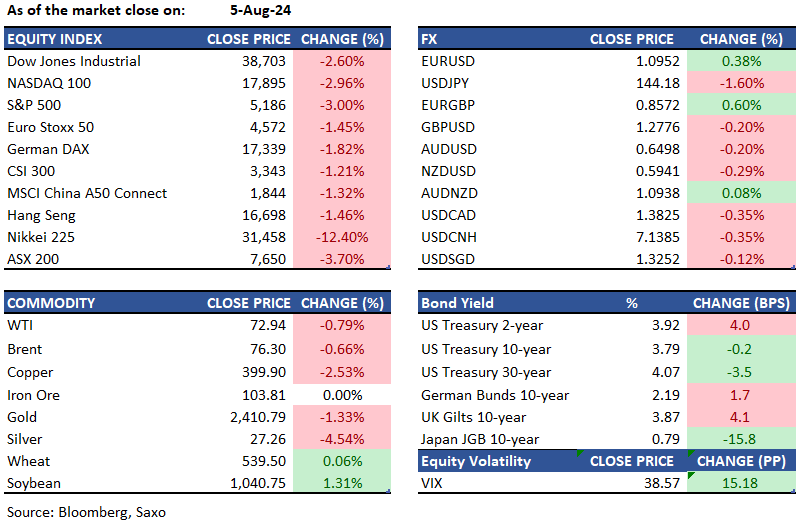

Equities: US stocks faced a severe sell-off on Monday as recession fears intensified. Partly contributing to the volatility was a sharp drop in Japan’s stock market, which fell 12.4% yesterday, the worst since Black Monday in 1987. S&P 500 dropped 3%, while the Dow Jones plummeted by 1,033 points. The Nasdaq 100 fell 2.96%, extending its decline after steep losses on Friday. Wall Street's fear gauge, the CBOE Volatility Index, surged to its highest level of 65 since October 2020. Nvidia’s shares fell 7.1% after dropping as much as 15%, while other major tech stocks also saw significant declines, including Microsoft (-3.3%), Apple (-5%), Amazon (-4.4%), Meta (-2.5%), and Alphabet (-4.5%). Meanwhile, Palantir Technologies surged 12% in extended trading on strong quarterly results and a guidance upgrade.

Fixed income: Treasury 10-year yields increased to 3.8% after dipping to 3.67%, bolstered by a stronger-than-expected July ISM services report. The 2- and 10-year US Treasury yield curve briefly turned positive before falling back to -13bps. US overnight indexed swaps are pricing in nearly 50bps of rate cuts for the September decision and over 100bps by year-end. Japan will auction 10-year government bonds amid a global debt rally that has significantly lowered yields following last week's Bank of Japan rate hike. The Ministry of Finance will sell ¥2.6 trillion ($18 billion) of notes maturing in June 2034 at 12:35 p.m. On Monday, the 10-year yield fell by 20.5 basis points, marking the largest drop since 1999, despite the BOJ's second rate hike of the year on Wednesday. Australian sovereign bonds opened higher after a bank-holiday break, ahead of the Reserve Bank's policy rate decision and Statement on Monetary Policy. Out of 32 forecasters, 31 expect the central bank to hold the rate steady at 4.35%, with one predicting a hike.

Commodities: Commodities, including oil, natural gas, metals, and agricultural products, experienced a sell-off alongside global equities due to fears of a U.S. recession impacting demand. In volatile trading, crude oil dropped 0.8% to $72.94 per barrel, with a high of $74.46 and a low of $71.67. Copper prices fell over 3% to a 4.5-month low due to weakening demand in China. Gold decreased by 1.33% to $2,410 per ounce, and silver plunged 4.54% to $27.26 per ounce, marking its lowest level in three months.

FX: The US dollar was slightly lower at the start of the week as market drawdowns escalated and called for the Federal Reserve to cut rates. However, some calm was seen returning early on Tuesday as the Japanese yen weakened again after sharp gains of 4.6% since July 30 on the back of Bank of Japan’s hawkish pivot. This helped the activity currencies to recover, and the Australian dollar led the gains. The Reserve Bank of Australia’s meeting will be key today, especially if a hawkish hold come together with market calm sustaining that could be a potential positive for activity currencies in general. The euro touched a key level of 1.10 against the US dollar and geopolitical developments remain on the radar. For more on our FX view, go to the Weekly FX Chartbook.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.