Asia Market Quick Take – 12February, 2026

Key points:

- Macro: US payrolls reported at 130k, smashing forecasts of 70k

- Equities: Zillow down 16% after Q1 forecast miss; US stocks ended flat

- FX: USD weak despite strong jobs report; JPY and AUD outperform

- Commodities: US crude inventories rose 8.5m bbl to the highest since JuneFixed income: US Treasuries bear‑flattened as Fed rate‑cut bets were pared

------------------------------------------------------------------

Disclaimer: Past performance does not indicate future performance.

Macro:

- US added 130K payrolls in January 2026, far exceeding December's revised 48K and the 70K forecast. Health care added 82K jobs, social assistance 42K, and construction 33K. Manufacturing grew by 5K jobs. Federal jobs fell by 34K and financial activities by 22K. Other sectors showed little change. BLS revisions reduced nonfarm payrolls by 862k as of March 2025, exceeding the 825k expected but less than the initial 911k. This indicates a weaker labor market and raises doubts about January's job growth sustainability.

- China's annual inflation fell to 0.2% in January 2026 from 0.8% in December, below the 0.4% forecast. Food prices dropped 0.7%, non-food inflation slowed to 0.4%, and core inflation rose 0.8%, the weakest in six months. Monthly CPI held at 0.2%, under the 0.3% expectation.

- US January private nonfarm payrolls saw average hourly earnings rise by 15 cents (0.4%) to $37.17, exceeding the 0.3% forecast. Production and nonsupervisory employees' earnings grew by 12 cents (0.4%) to $31.95. Annually, earnings increased by 3.7%, surpassing the 3.6% forecast.

- Japan’s producer prices rose 2.3% year-on-year, the slowest since May 2024, easing from 2.4% in December and matching expectations. Costs moderated in several sectors, while prices for chemicals and metals remained weak. Monthly inflation edged up to 0.2%.

- Trump is mulling an exit from the North American trade pact, raising uncertainty during US, Canada, and Mexico talks. He asked aides about withdrawing but hasn't confirmed any plans; a White House official calls the speculation baseless.

Equities:

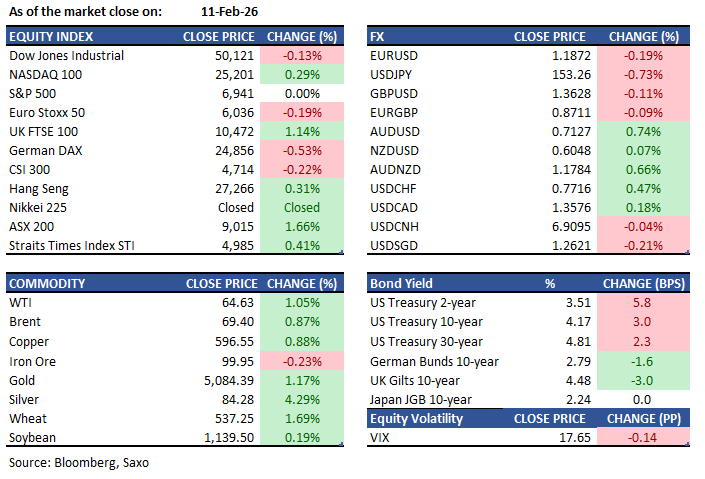

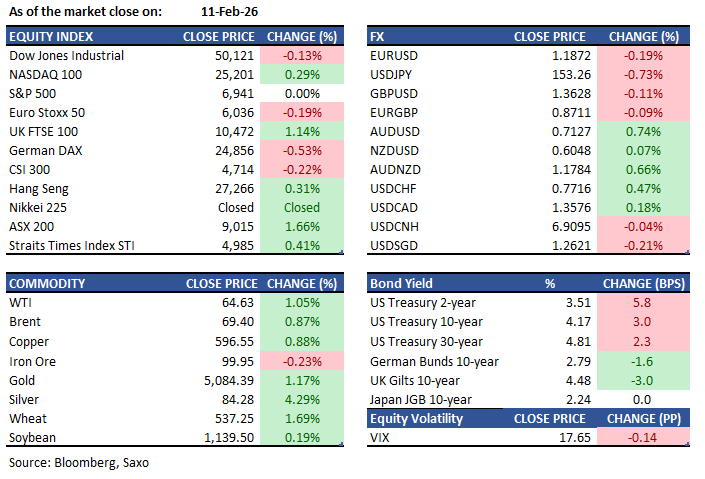

- US - S&P 500 rose 0.1% on Wednesday, while the Dow slipped 0.1% from record highs and the Nasdaq gained 0.3%. Nonfarm payrolls increased 130,000 versus the 55,000 forecast, and unemployment fell to 4.3%, though gains were concentrated in health care and prior months were revised lower. AI hardware outperformed, while software lagged, and Zillow tumbled 16.5% after earnings.Shopify was also down 6.7% after missing earnings but approved $2b in buybacks. In after hours, Cisco fell 7% after reporting poorer gross margins due to memory chips price increase. Kraft flat after reporting mixed results with revenue declining 3.4% and pausing business separation plans. McDonald's earnings of $3.12 per share beat estimates; revenue at $7.01 billion.

- EU - European stocks were little changed Wednesday, as mixed corporate earnings and a stronger U.S. jobs report kept markets steady while pushing EU borrowing costs higher. The STOXX 50 slipped 0.2% to 6,040, while the STOXX 600 rose 0.2% to another record at 622. Siemens Energy jumped 8.5% after reporting a near‑tripling of net profit, and Ferrari gained over 4%, extending its strong rally on upbeat guidance. Ahold Delhaize surged more than 10% on better‑than‑expected U.S. performance. In contrast, financials softened, and SAP fell 4% amid renewed concerns that AI automation could pressure software‑sector revenues.

- HK - Hang Seng gained 82 points, or 0.3%, to 27,266 on Wednesday, rising for a third session as most sectors advanced. Sentiment was supported by the PBoC’s renewed pledge to boost domestic demand and January data showing softer consumer inflation and continued producer‑price deflation, reinforcing expectations of further policy support. Hesai Group and SenseTime rose after joining the MSCI China Index, while WuXi Biologics and Minth Group rallied on strong catalysts. SMIC fell 2.7% after warning of panic over AI‑driven memory‑chip shortages.

Earnings this week:

- Thursday - Brookfield, Pinterest, Arista, Rivian, Crocs, Coinbase, JFrog, Melco, Howmet Aerospace, Nebius, Softbank Group

- Friday - Moderna, Enbridge, Cameco, Advance Auto Parts, Wendy’s

FX:

- USDweakened for a fourth straight session as traders looked past an unexpectedly strong US jobs report and pared expectations for rate cuts, leaving G‑10 FX mixed: the JPY and AUD outperformed, while most European currencies fell.

- USDJPY dropped as much as 1.2% to 152.56 before trimming losses, marking a third straight decline — the longest losing streak since 27 Jan — as front‑end yen vol skew was repriced 15–20bps bullishly

- EURUSD fell 0.2% to 1.1870 for a second day, GBPUSD slipped less than 0.2% to 1.3619, and AUDUSD rose 0.71% to 0.7125 after RBA Deputy Governor Andrew Hauser said inflation remains too high.

Commodities:

- Gold eased as strong US jobs data tempered expectations of swift Fed rate cuts, falling as much as 0.6% Thursday after a 1.2% gain Wednesday. January payrolls rose the most in over a year and unemployment unexpectedly fell, signalling a stabilising labour market; platinum down 1%, palladium down 1.5%.

- Oil held gains as US–Iran tensions overshadow swelling supply, with WTI near $65 after a >1% rise and Brent above $69, while traders remain wary despite Trump signalling a deal with Tehran; US crude inventories rose 8.5 million barrels to the highest since June, per the EIA.

Fixed income:

- US Treasuries bear‑flattened after a stronger‑than‑expected jobs report with unemployment down to 4.3%, prices pared losses but OIS stayed hawkish, and selling deepened after a $42bn 10‑year auction tailed, denting sentiment ahead of Thursday’s 30‑year sale. Two‑year yields jumped as much as 9.5bp to 3.55% before easing to 3.50% by Wednesday’s close, while 10‑year yields rose 3bp to 4.17% as traders pared Fed cut expectations.

For a global look at markets – go to Inspiration.

This content is marketing content and should not be considered investment advice. Trading financial instruments carries risks and historic performance is not a guarantee for future performance.

The instrument(s) mentioned in this content may be issued by a partner, from which Saxo receives promotion, payment or retrocessions. While Saxo receives compensation from these partnerships, all content is conducted with the intention of providing clients with valuable options and information.