Key points:

- Nvidia’s blockbuster results couldn’t clear sky-high expectations, triggering a sell-the-news reaction.

- Slowing revenue growth and China export risks spotlight the potential for multiple compression in AI leaders, especially given crowded positioning.

- Markets are now balancing the long-term AI narrative with a tilt toward defensives and broader diversification.

Why Nvidia underwhelmed

Nvidia’s latest results once again smashed through consensus numbers—revenue rose 56% YoY to $46.7B, and Q3 guidance of around $54B topped estimates. Yet markets sold off. Why?

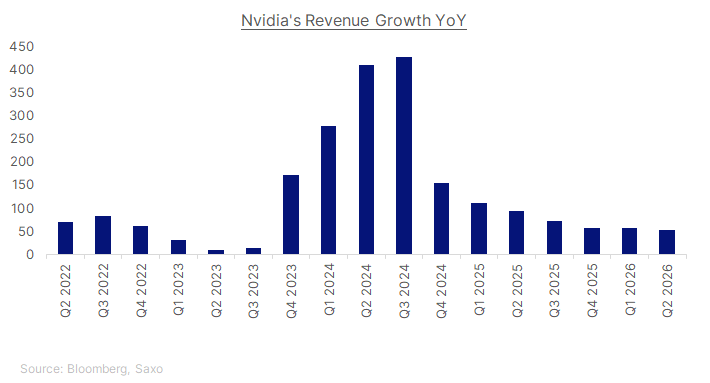

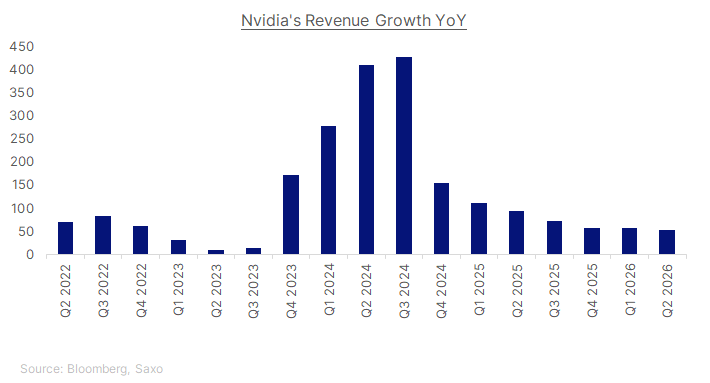

- The growth curve is flattening: The company’s extraordinary triple-digit growth from 2023–24 is decelerating. Investors now worry that slower revenue expansion means earnings multiples could compress, even if absolute profits remain stellar.

- Data-center line underwhelmed: This segment has been the growth engine of Nvidia’s AI dominance. While still strong, results fell short of “whisper” expectations on Wall Street—enough to cool the AI frenzy.

- Policy overhangs persist: Nvidia reported zero sales of its H20 AI chip to China during the quarter. With U.S.–China tech tensions simmering, export restrictions remain a key risk to future growth.

- Crowded positioning: Nvidia had run up sharply into earnings, carrying outsized weight in indices. After the S&P 500 closed at a record, investors took the chance to lock in profits.

The result: a sell-the-news wobble rather than an AI funeral.

How to position now

The bigger question for investors is not whether AI is over—it’s how to adjust exposures in this next phase.

Trim concentration risk

Nvidia remains a cornerstone of the AI trade, but extreme concentration in one name makes portfolios fragile.

- Upstream: Diversify beyond Nvidia into broad semiconductor ETFs (SOXX, SMH).

- Midstream: Add exposure to cloud and infrastructure names powering AI adoption (V9N – Data Centers & Digital Infrastructure UCITS).

- Downstream: Robotics and automation ETFs (BOTZ) provide exposure to AI applications beyond chips.

Watch global chipmakers

- Korea and Taiwan semis: Expect short-term drag as these names are most correlated with Nvidia’s cycle.

- China chipmakers: Policy tailwinds could turn this dip into opportunity. Companies like Cambricon have just reported record profits on surging domestic demand, reinforcing Beijing’s drive to localize AI hardware.

Balance growth with defensives

- With Fed rate cuts likely in sight, investors may want to balance AI exposure with income strategies (dividend stocks, REITs, investment-grade bonds).

- Sectors like utilities, consumer staples, and healthcare can provide ballast if tech multiples compress.

Risks to watch

- Fed policy: The next two weeks bring PCE inflation and jobs data—both crucial for shaping the “Fed pivot” narrative.

- Geopolitics: Any escalation in U.S.–China semiconductor restrictions could cap AI valuations.

- Peak cycle fears: If the market concludes Nvidia’s Q3 guidance signals peak demand, multiples could compress more broadly across AI leaders.

Bottom line

Nvidia’s results highlight an important turning point: AI remains a transformative theme, but the market is no longer in hyper-exuberant discovery mode. From here, the trade requires more selectivity, diversification, and tactical income strategies.

Investors should resist the urge to chase every dip blindly, but equally avoid calling the end of the AI cycle too early. The winners of AI 2.0 will still create significant long-term value—but the path will be choppier.